Buy Bharat Petroleum Ltd For Target Rs. 390 By Yes Securities Ltd

In line core performance while inventory and adventitious losses surprise

BPCL's Q3FY25 results exhibited a soft financial performance where the core integrated margins were in line with our expectations. The EBITDA and Adj. PAT, stood at Rs 75.8bn and Rs 46.5bn, respectively. The core GRM at USD6.5/bbl was strong while and the market share in diesel and motor spirits highlight the company's operational prowess. BPCL's strategic lower debt:equty amongst its peers, annual capex target of Rs164bn, and enhanced refining efficiency position it as a compelling investment, reflecting a positive outlook for sustained growth. We maintain our BUY rating with a 12-mth revised TP of Rs390/shr (earlier Rs 370).

Result Highlights

* EBITDA/Adj. PAT at Rs 75.8/46.5bn were up 22%/37% YoY and 67/94% each QoQ. This is lower than our estimates and the consensus due to absence of support from government on LPG subsidy burden so far and inventory/adventitious losses, although the core performance is close to our estimates on both refining and marketing segment. The integrated core EBITDA margin was USD6.2/bbl vs our est of 6.4 (USD4.6 the prior quarter, USD4.9 a year ago), close to our expectations on core refining and marketing performance.

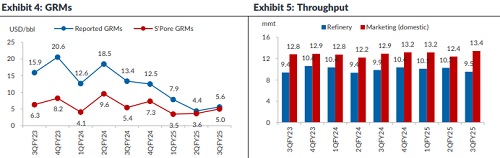

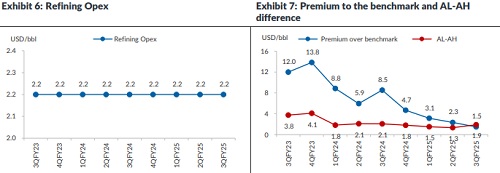

* The reported GRM was USD5.6/bbl (MR/KR/BR USD4.5/USD5.5/USD7.8) vs USD4.4/bbl the previous quarter (MR/KR/BR USD3.4/USD4.7/USD6.1) and USD13.4/bbl a year ago (MR/KR/BR USD7.9/USD14/USD20), while the Arab heavy-light difference was USD1.9/bbl (USD1.3 the quarter prior). As per our assumptions, the core GRM was USD6.5/bbl (USD5.96 the previous quarter, USD13.95 a year back), a USD1.5/bbl premium to the benchmark USD5, the best amongst Indian PSU refiners. The assumed refining inventory loss of USD0.9/bbl (loss of USD1.6 the prior quarter and USD0.6/bbl a year ago) on shutdowns and lower realizations. Refinery throughput was 9.54mmt (MR/KR/BR 3.6/3.9/2.1) at ~107.2% utilisation (116% the previous quarter, 111% a year ago). There was a shutdown for 25 days in Oct’24 at Kochi refinery, and 20 days in Nov’24 at Mumbai refinery which resulted in an impact on GRMs and refining throughput.

* The core marketing EBITDA (back-calculated) was Rs4/ltr (Rs2.8 in the prior quarter, negative Rs0.3 a year back) in line to our expectations. The domestic marketing throughput was 13.4mmt, up 3.9% YoY and 8.4% QoQ (vs. the industry’s growth of 4.8% YoY and 7.9% QoQ). MS sales were 2.7mmt, up 7.9% YoY and 2.6% QoQ, while diesel at 6mmt, up 2.9% YoY and 16.4% QoQ. Industry motor spirit and diesel sales were up 9.7%/4.8% YoY and 3.5%/18.9% QoQ. The reported marketing adventitious/inventory loss was at Rs7.22bn. BPCL lost marginal market share of high-speed diesel and motor spirits to 25.3% and 26.8% respectively. LPG Burden impact: The company has a negative buffer amounting to Rs 72.3bn as of end 9MFY25, and Rs 31.1bn in Q3FY25 pertaining to LPG subsidy. The Rs2.7bn forex loss marginally impacted to the quarter’s profitability.

* Capex was at Rs64.4bn for Q3FY25 (Rs119bn in 9MFY25). Debt at Rs196.2bn was up by Rs36.1bn YoY but down Rs19.1bn QoQ.

* 9MFY25 performance: EBITDA at Rs 177.8bn (vs Rs 349.4bn in 9MFY24) while PAT at Rs 100.6bn (vs Rs 224.5bn) and the reported GRM at USD5.95/bbl (vs USD14.7). The core integrated margins were at USD4.6/bbl vs USD8/bbl while the marketing EBITDA/ltr (Rs) was at 2.6, same as previous year.

Valuation

At CMP, the stock trades at 5.4x/5.7x/5.9x FY25e/26e/27e EV/EBITDA and 1.4x/1.3x/1.2x P/BV (excl. investments, trades at 4.3x/4.5x/4.8x FY25e/26e/27e EV/EBITDA and 1.1x/1x/0.9x P/BV). We maintain a BUY rating with a target price of Rs390 valuing it on a sum-of-parts basis (core business at 7x EV/EBITDA and investments at Rs61).

Compressed Biogas Joint Venture with Praj

BPCL has announced a 50:50 joint venture with Praj Industries Ltd. to set up Compressed Biogas (CBG) plants across India. The JV will focus on constructing, operating, and maintaining these plants, as well as selling CBG and its derivatives. This domestic initiative aligns with BPCL's strategy to meet CBG blending mandates and advance its energy transition and net-zero goals. Key details, including share capital and consideration will be finalized in a definitive agreement. The JV does not involve related-party transactions, and no shares are being issued at this stage.

Please refer disclaimer at https://yesinvest.in/privacy_policy_disclaimers

SEBI Registration number is INZ000185632