IIP Growth Slowed to 1.5% June 2025 by CareEdge Ratings

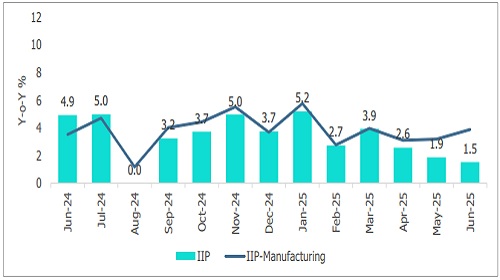

Growth in India’s industrial production eased to 1.5% in June, compared to an upwardly revised 1.9% in May. A slight improvement in manufacturing sector growth was outweighed by contractions in both the mining and electricity sector output. On the consumption front, the output of consumer non-durable goods continued to remain weak, while the output of consumer durable goods improved. IIP growth has remained relatively subdued in recent months, with Q1FY26 growth at 2%, lower than 5.4% seen in the same quarter last year.

Exhibit 1: Index of Industrial Production

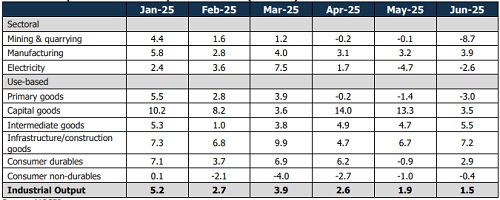

Manufacturing sector output rose by 3.9% in June, up from 3.2% in May. On a year-on-year basis, output increased in 14 out of the 23 manufacturing subcategories. Within the sector, basic metals (the largest component with a weight of 12.8%) posted a healthy growth of 9.6%, compared to 7.8% in the previous month. Among exportdriven categories, wearing apparel and textiles saw a rise of 4.2% (Vs 2.3% in May) and 1.2% (Vs -3% in May), respectively. In contrast, leather and related products remained in the negative territory. Meanwhile, electricity output contracted by 2.6% (Vs -4.7% in May) and mining output contracted by 8.7% (Vs -0.1% in May).

Based on use-based classification, infrastructure and construction goods registered a notable performance, with output rising by 7.2% in June, up from 6.7% in May. While private capex is yet to show a meaningful pickup, public capex continues to remain encouraging. Additionally, output of consumer non-durable goods declined by 0.4%, remaining in the contractionary zone for five consecutive months. At the same time, output of consumer durables recorded a growth of 2.9% (Vs -0.9% in May).

Table 1: Component-wise Breakup of IIP Growth (Y-o-Y %)

Way Forward

The recovery in demand continues to show mixed signals, with urban consumption still trailing. Uneven demand is having a bearing on the private investment scenario, which continues to remain weak. Persistent global uncertainties are further weighing on the investment sentiments. However, consistent easing of inflation, favourable monsoon, and the RBI’s policy rate cuts are expected to provide the much-needed impetus to the economy. Going forward, both consumption and investment trends warrant close observation.

Above views are of the author and not of the website kindly read disclaimer