WTI crude oil is likely to rise towards $63 level as long as it trades above $61.00 - ICICI Direct

Bullion Outlook

* Spot Gold is likely to rise further towards $3775 level on weakness in dollar and persistent demand for safe haven amid escalating geopolitical tensions in Eastern Europe and Middle East. Further, prices may move up on growing expectations of further rate cut by U.S Fed. As per CME FedWatch tool market is pricing in 90% probability of another 25bps cut at the central bank's October meeting. Additionally, demand for investment may increase on political uncertainty in France and Japan and concerns over U.S Fed independence. Moreover, precious metals prices may continue to receive support from fund buying. Meanwhile, all eyes will be on economic data from US and Fed Chair Powell speech to gauge economic health of the country and get more insight on rate trajectory

* MCX Gold Oct is expected to rise towards Rs.113,000 level as long as it stays above Rs.111,400 level

* MCX Silver Dec is expected to face stiff resistance near Rs.134,000 level and correct towards Rs.132,000 level.

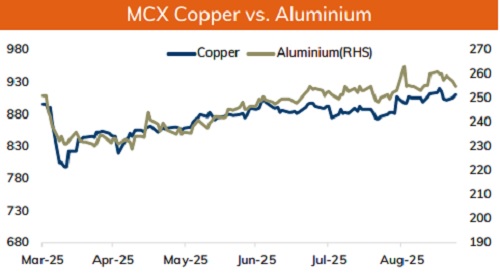

Base Metal Outlook

* Copper prices are expected to trade with a positive bias on weak dollar, rise in risk appetite in the global markets and signs of improving demand from China. Additionally, Yangshan copper premium a gauge of China's appetite for importing copper rose to $58 a ton. Furthermore, buyers in China will continue to restock metal ahead of the National Day holiday from October 1 to October 8. Moreover, prices may move up on supply concerns amid production suspension at Freeport Indonesia's Grasberg mine. Further, expectation of expansion in activity in manufacturing sector across major economies will be supportive for the prices

* MCX Copper Sep is expected to rise towards Rs.915 level as long as it stays above Rs.903 level. A break above Rs.915 level prices may rise further towards Rs.918 level

* MCX Aluminum Sep is expected to slip towards Rs.253 level as long as it stays below Rs.257 level. MCX Zinc Sep is likely to move south towards Rs.273 level as long as it stays below Rs.280 level.

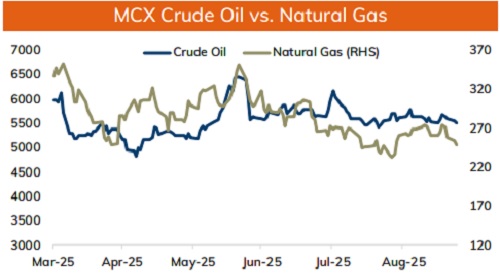

Energy Outlook

* Crude oil is likely to trade with positive bias and rise further towards $63 level amid weak dollar and rise in risk appetite in the global markets. Further, prices may move up on concerns over supply disruption as Ukraine has intensified drone strikes on Russia’s energy facilities in past few weeks. Moreover, prospect of additional EU sanctions against Russia and escalating geopolitical tension in Middle East would be supportive for the prices. Meanwhile, sharp upside may be capped as investors worries that trade tariffs would hurt global economic growth and dent demand for oil. Further, Iraq has increased oil exports under an OPEC+ agreement

* WTI crude oil is likely to rise towards $63 level as long as it trades above $61.00. MCX Crude oil Oct is likely to rise towards Rs.5600 level as long as it stays above Rs.5450 level.

* MCX Natural gas Oct is expected to dip towards Rs.265 level as long as it stays below Rs.285 level.

Please refer disclaimer at https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631