Weekly Wrap - 8th June 2025 by SBI Securities

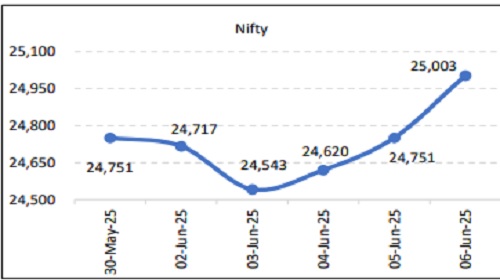

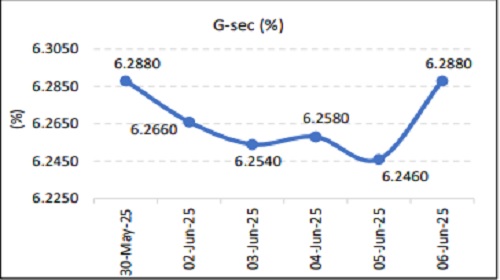

The benchmark indices during the week ended higher with Nifty gaining 1%. The highlight of the week was the surprise RBI MPC meeting outcome on Friday which took the Nifty above the 25,000 mark. The global cues were largely supportive during the week despite escalation of geopolitical tensions (Russia-Ukraine), FII selling and trade led uncertainties. The dollar index continues to linger below 100 mark as weak economic data (OECD cuts the US growth outlook, lower private payrolls addition, higher weekly jobless claims) is nullifying any safe haven demand for the greenback. RBI’s MPC announced a surprise 50 bps cut in repo rate and 100 bps in CRR to 5.5% and 3.0% respectively. The committee also lowered the inflation expectation for FY26 to 3.7% from earlier 4% while keeping the growth outlook intact. Nifty bank zoomed over 800 points to end at record highs as CRR cut is likely to infuse ~Rs 2.5 tn liquidity in the banking system which augurs well for growth in medium to long term. The change of stance from accommodative to neutral also implies that any incremental rate cut will not be very soon. ECB (European Central Bank) also reduced its deposit rate by 25 bps to 2% making it the 8th reduction since Jun’24.

The 4QFY25 result season ended on a decent note. BSE All Cap (1,076 companies excluding financials) have reported 6.8%/10.8%/26.6% YoY growth in Revenue/EBITDA/PAT to Rs 34.9 tn/ Rs 5.6 tn/ Rs 3.3 tn respectively (Source: ACE Equity). EBITDA margin improved 60 bps YoY. Strong growth in profit is supported by earnings rebound in telecom, metals, and refinery companies.

For the week, Nifty 50/Nifty MidCap/Nifty 500 were up by 1.0%/2.8%/1.6% WoW to settle at 25,003.0/59,010.3/23,165.1 levels respectively. During the week, BSE Realty/Metal/Auto/Healthcare/PSU ended with WoW gains of 9.6%/1.7%/1.5%/1.5%/1.2% respectively while BSE Capital goods/ IT closed with WoW losses of 0.4%/0.2% respectively. For the week, FIIs net sold Rs 12,077.4 cr while DIIs net bought Rs 16,171.0 cr (DIIs data is till 5th June).

Next week, as the earning season is now behind, we expect global cues along with domestic economic data flow (CPI and trade balance data) to act as a catalyst for the market. Monsoon in 2025 made the earliest onset in 16 years and hence further progress and spread will be keenly watched. Street is likely to remain constructive on rate sensitives like NBFCs, Banks (U shape margin trajectory with likely dip in 1QFY26 followed by strong exit during FY26 end), Real Estate, Auto, Consumption (especially credit linked), AMC’s (reduction in EMI burden may aid further inflows in MFs) etc. In US, May’25 CPI, PPI and Weekly initial jobless claim will also provide a hint on economic health and interest rate outlook. Going ahead, we believe the index is well poised to test 25200, followed by 25500 in the short term. On the downside, the zone of 24750–24700 is likely to act as a strong support in case of any immediate pullback.

CNX Nifty

10 year Government of India Bond Yield

Above views are of the author and not of the website kindly read disclaimer

.jpg)