The Nifty Pvt Bank index underperformed the benchmark and closed on a negative note and settled at 27346 , down by 1 .17 % - ICICI Direct

Nifty :24542

Technical Outlook

Day that was…

• Indian equity benchmark extends losses for third session as weak global cues weigh. The Nifty settled at 24542, down 0.70%. Market breadth was in favor of declines, with an A/D ratio of 1:1.40, as the broader market underperformed. Sectorally, barring Realty all sectors closed in red where Nifty Pvt Bank, Oil & Gas and Consumer durable were the laggards.

Technical Outlook:

• The index opened on a flat note and after an initial upmove it faced resistance near Friday’s high making lower-low-high, where intraday rallies were sold into. This led to the formation of a bearish engulfing candle indicating profit booking at higher levels.

• In todays sessions, index is likely to open on a positive note tracking firm global cues. Further, any positive outcome on the back of the India-US trade deal would boost the market sentiment. The rally from 7th April low to 15th May high witnessed shallow correction where the max correction was 650 points, and in current scenario such correction would mature around 24500 levels. Thereby, holding above 24500 (on a closing basis) would result into prolongation of consolidation in the broader range of 24500- 25100 levels. Only a breach below 24500 would result into extended correction, where strong support is placed at 24200. In the process bouts of volatility will be witnessed as all eyes will be on upcoming RBI’s Policy (to be released on coming Friday). Consequently, rate sensitives like financials, auto, realty would be in focus.

• Key thing to highlight is that, the index has staged a strong 15% rally from April lows. Post that, Nifty has been consolidating over past two weeks wherein it corrected 3%. The elongation of rallies followed by shallow retracement is a key ingredient of a structural bull market. Any decline should be used as buying opportunity.

• On the broader market front, the ratio chart of Nifty 500 / Nifty 100 has staged a strong rebound after finding support from multi years range breakout area. The rising ratio line highlights relative outperformance of the broader market compared to large caps. Meanwhile sector rotation underpinned by improvement in market breadth augurs well for durability of ongoing optimism in the midcap and small cap space.

• Key monitorable which would validate our positive bias going ahead:

• a) RBI's commentary on rate cut

• b) Further weakness in US Dollar index and Brent crude oil prices

• c) Bilateral Trade Agreement between India and US

• The index is consolidating between (25100-24200). We maintain our support base at 24200 as it is the gap zone support (24378- 24164) and 38.20% retracement of recent rally (21743-24944).

Nifty Bank : 55600

Technical Outlook

Day that was :

• The Bank Nifty, ended the four sessions up streak, amid weak global cues . The index settled at 55600 , down 0 .54 % . The Nifty Pvt Bank index underperformed the benchmark and closed on a negative note and settled at 27346 , down by 1 .17 % .

Technical Outlook :

• The index started the day on a flat note and after the initial upmove which helped Bank Nifty to make a fresh all -time (56161 ) . However, ahead of RBI monetary policy index witnessed profit booking from previous all -time high (56098), making lower -low -high throughout the session . The daily price action formed a bearish candle, signaling profit booking at higher levels .

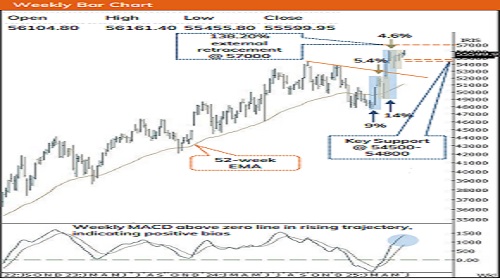

• Key point to highlight is that, after breaking out from contracting triangle index retested the breakout levels and defended previous session’s low indicating strength of the current upmove . Further, index is trading above 20 -day EMA since 12th may 2025 making higher -high -low formation indicating robust price structure . Going ahead, decisive close and sustenance above the all -time high level would open the door towards the 57 ,000 mark, as it is the external retracement of the fall from 56 ,098 –53 ,483 . Meanwhile, strong support is placed at 54 ,500 -54800 , which is the 61 .80 % retracement of the recent up -move (53 ,483 –55 ,903 ) and coincides with the gap area witnessed on 12th May (54 ,055 –54 ,442 ) . Hence, volatility would prevail ahead of RBI monetary policy and any decline from hereon would offer incremental buying opportunity .

• Structurally, the Bank Nifty is witnessing elongation of rallies followed by shallow retracements, which signifies a robust price structure . The recent up -move of 14 % is larger compared to the previous month’s 9 % rise . Additionally, the declines are getting shallower, with the recent one being 4 . 6 % versus 5 . 4 % in March 2025 . Furthermore, the index broke out of an eight -month falling trendline and surpassed its lifetime high, highlighting a robust structure .

• Mirroring the benchmark, the PSU Bank index witnessed profit booking and closed on a negative note . The index broke out from an eleven -month falling trendline on 19th May since then index is making higher -high -low indicating strong momentum on the upside . Bank Nifty is trading near all -time high whereas, PSU Bank index is still trading ~13 % below its all –time high, which presents a compelling case for a catch -up move . Meanwhile, immediate support on the downside is placed at 6700 , being 38 .20 % retracement of the rally from 7th April 25 to 3rd June 25 and 20 -day EMA .

Please refer disclaimer at https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631