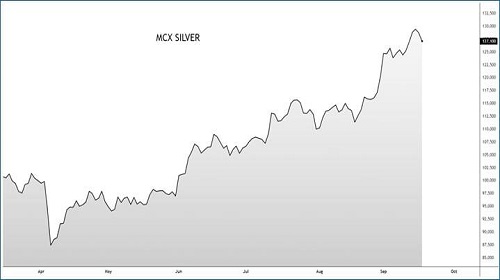

Silver Update As On 17th Sept 2025 by Amit Gupta, Kedia Advisory

Silver prices slipped today to around Rs.1,26,910, down by Rs.1,900 (-1.48%) on profit booking ahead of the U.S. Fed meeting, where the first 0.25% rate cut of 2025 is widely expected. After crossing the Rs.1,30,000 mark earlier this year, silver has already delivered close to 40% gains, prompting traders to lock in profits.

Despite the near-term correction, the long-term structure for silver remains strong, with potential to revisit the historic $50/oz mark last seen in 1980 and 2011. Demand remains robust from clean energy applications, ETFs, and industrial usage, while the falling gold-silver ratio suggests continued outperformance of silver.

Technically, the market looks slightly overbought, and a corrective dip of 10–12% from current levels cannot be ruled out. However, the broader uptrend remains firmly intact for $50 but price or time correction required.

Above views are of the author and not of the website kindly read disclaimer