Shriram Life Launches Flexi Shield: ‘Your Term Plan On Your Terms’

Shriram Life Insurance has launched Shriram Life Flexi Shield, a non-linked, non-participating term insurance plan designed to provide protection that adapts to every life stage. Built around the concept of “Your Term. On Your Terms.”, Flexi Shield gives policyholders the freedom to personalise their protection.

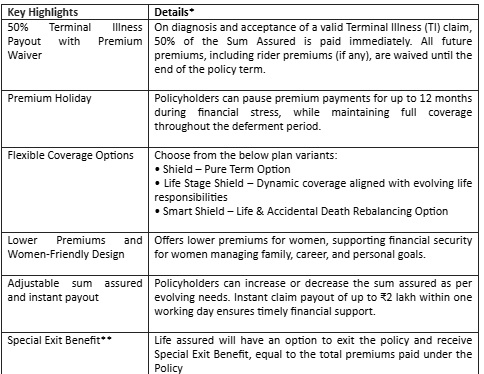

Key features of the plan include:

* 50% payout on terminal illness with premium waiver – Upon acceptance of a valid Terminal Illness claim, 50% of the Sum Assured is paid as a lump sum, and all future premiums, including rider premiums, are waived until maturity.

* Premium Holiday for up to 12 months – Policyholders can pause premium payments during periods of financial stress while maintaining full coverage.

* Lower premiums and tailored protection for women – The plan offers lower premiums and flexible coverage options to support women in managing evolving life responsibilities.

* Flexible coverage with instant support – Customers can choose any plan variant and adjust their Sum Assured as needed and may receive a quick claim support payout of up to Rs 2 lakh within one working day for eligible claims, subject to submission of required documents and verification.

Plan Variants

* Shield – Pure Term Option

* Life Stage Shield – Dynamic coverage aligned with evolving life responsibilities

* Smart Shield – Life and Accidental Death Rebalancing Option

Shriram Life Flexi Shield provides coverage for up to 100 years and allows policyholders to align their protection with long-term financial planning. It is ideal for retirement planning, children’s education, family protection, or creating a long-term financial safety net.

Consider a 30-year-old policyholder planning their long-term financial future. To protect loved ones from financial hardship, they choose the Shield variant with a Sum Assured of Rs 40?lakhs over a 30-year term. In the event of an untimely passing, the nominees receive the full Rs 40?lakhs, ensuring financial stability. If diagnosed with a terminal illness during the term, 50% of the Sum Assured is paid immediately, providing crucial financial support during a challenging period.

“With Shriram Life Flexi Shield, we are redefining term insurance to be more adaptive and empowering for our customers. The plan’s flexibility, coupled with unique benefits like Premium Holiday and early terminal illness payout, ensures that protection keeps pace with life’s changing needs,” said Casparus J.H. Kromhout, MD and CEO, Shriram Life Insurance.

Above views are of the author and not of the website kindly read disclaimer