Report on Gold Ore Processing: Unlocking the Golden Gateway by CareEdge Ratings

India's gold industry faces a significant supply-demand gap, relying heavily on imports to meet its domestic consumption needs. In CY24, it produced only 18% of gold for total consumption.

The country's gold mining sector remains underdeveloped due to, regulatory challenges, and infrastructure limitations. Despite being one of the world's largest gold consumers, India has a long way to go towards enhancing its domestic production.

Gold processing plays an important role in the whole supply chain from transforming raw gold materials to high purity form of gold. The global supply of gold ore increased from 1,788 million tonne (MT) in CY19 to 1,846 MT in CY23 out of which gold ore concentrates accounted for around 4% globally. India recorded only 29,400 tonnes of ore concentrates in CY23; and India’s refining capacity has expanded from less than 5 refineries in CY13 to 33 in CY21.

Recent government reforms, including amendments to the Mines and Minerals Act and the introduction of the National Mineral Policy, have opened the sector to private investment and exploration. These measures aim to encourage domestic production and also boosting private sector involvement in mining and processing.

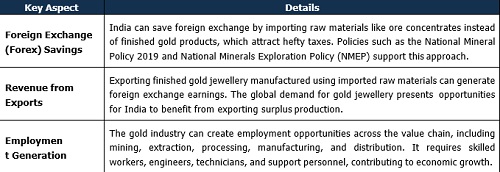

The gold processing industry has the potential to significantly benefit India's economy. By focusing on domestic manufacturing and reducing import dependency, India could save foreign exchange, boost exports, and create jobs across the value chain. The government can play a crucial role in fostering this growth by supporting the establishment of gold processing hubs and offering incentives to promote local processing and refining activities.

Demand and Supply of Gold

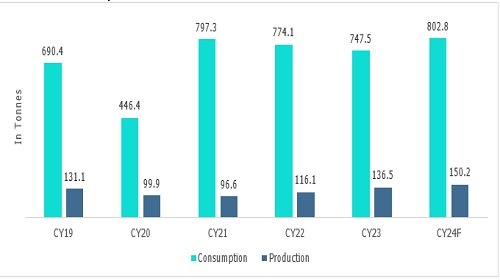

Indian gold consumption has been on the rise, reaching 747.5 tonnes in CY23, largely driven by healthy demand for jewellery, which made up 75.2% of the total usage. The World Gold Council reported that consumption increased by 5% to 802.8 tonnes in CY24, even with a 27% rise in prices, indicating a healthy domestic demand for gold. Although India had total reserves of 804 tonnes in CY23, it still relies heavily on imports due to very low domestic production, which was only 1 tonne in CY23, contributing a mere 0.02% to the world's total output.

The initiatives such as establishing gold manufacturing hubs in Special Economic Zones (SEZs) and implementing Production Linked Incentive (PLI) schemes for gold ore concentrates could enhance domestic production, lessen import reliance, and support India's self-reliance objectives under the Aatmanirbhar Bharat initiative.

Chart 1: Gold Consumption and Production

The gold trade in India is steered by policies that aim to balance domestic demand, reduce trade deficits, and develop the local gold industry. The government, in a major move, reduced customs duty on gold from 15% to 6% and on gold oré from 14.35% to 5.35% in July 2024. This was the sharpest cut in duty in over a decade and aimed at curbing smuggling and boosting the organized market.

On the export side, government policies have slowly liberalized to enhance India's global competitiveness. Duty drawback schemes and Special Economic Zones (SEZs) have been incentives for gold jewellery exporters. Exports are still low, and more needs to be done in terms of investment in advanced gold processing technologies, streamlined export procedures, and market diversification. Addressing these areas will help India reduce its dependence on imports, unlock the potential of its gold ecosystem, and strengthen its standing in the global market.

In contrast, exports from India constitute to a relatively small proportion of its production. The exports have drastically decreased in CY21 due to outbreak of covid-19. As a result, the domestic manufacturing was declined and the demand in key export markets was affected due to pandemic restrictions. After a continued decline until CY22, the demand picked up in CY23 on account of increased demand due to festive celebrations and wedding season, positive consumer sentiments in the market and the trade pact-Comprehensive Economic Partnership Agreement (CEPA) between India and United Arab Emirates (UAE). Other major export destinations include the USA, UK, Hong Kong, Canada, Singapore, and Turkey.

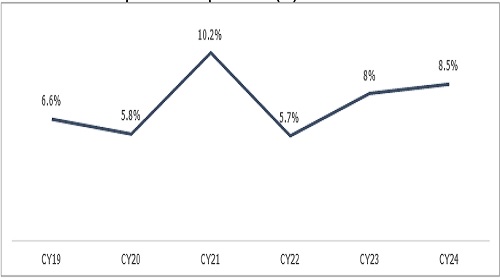

Gold imports have consistently accounted for at least 6% of India’s total merchandise imports over the past five years, peaking at around 10% in CY21. In CY24, gold imports represented approximately 8.5% of total merchandise imports by value, compared to 8% in CY23.

Chart 2: Share of Gold Imports to Total Imports in India (%)

Challenges faced by the Indian gold ore processing industry

• India's gold mining industry is struggling with outdated methods, insufficient investment, and a lack of supportive policies.

• Regulatory challenges make it difficult to transfer leases and hinder exploration efforts. The lengthy process for obtaining licenses, which can involve 10 to 15 approvals, leads to delays and increased costs.

• High import taxes and dependence on foreign equipment further drive-up project expenses.

• Inadequate infrastructure in remote areas rich in gold makes transporting materials difficult.

Potential for Gold Ore Processing Industry

In recent years, India has taken significant steps to revitalize and modernize its gold mining sector, recognizing the potential for domestic production to reduce reliance on gold imports. The government has introduced a series of key reforms aimed at attracting investment, increasing production, and fostering private sector participation in gold exploration and extraction. These measures represent a concerted effort to position India as a global player in the mining industry, particularly in gold processing.

To further encourage exploration and production, the government launched the National Minerals Exploration Policy (NMEP), which aimed to facilitate the discovery of new mineral resources, including gold. The National Mineral Policy (NMP) 2019 followed, with a focus on boosting mineral production, improving the ease of doing business, and attracting foreign and domestic investments. The NMP also introduced measures such as granting "industry" status to mining, which allowed for more streamlined regulatory processes and better access to financing for mining projects.

In 2020, the government took additional steps to stimulate private investment in the sector by announcing the auction of 500 mining blocks. This initiative opened new opportunities for large- and small-scale miners and was designed to address India's growing demand for minerals, including gold. By increasing the number of blocks available for auction, the government aimed to unlock untapped gold reserves and boost domestic production.

To ensure continued momentum, the Mines and Minerals (Development and Regulation) Act was further amended in 2021 to promote greater transparency in mining block auctions and simplify lease transfers. These changes were

aimed at making the bidding process more transparent and efficient, thereby attracting more private investment and ensuring that mining operations are conducted with greater accountability.

Together, these reforms represent a comprehensive strategy to boost India's gold mining sector, addressing key challenges such as regulatory complexity, limited private sector participation, and underexplored mineral resources. By creating a more investor-friendly environment and fostering competition, India is positioning itself to capitalize on its gold resources, reduce its dependence on imports, and build a self-sufficient and competitive gold processing industry.

Key Benefits of gold processing industry in the economy

Way Forward

To fully realize the potential of its gold industry, India needs to focus on its development as a key driver of economic growth. By establishing gold manufacturing hubs in Special Economic Zones (SEZs), akin to the diamond industry in Surat, the country can enhance gold processing, draw in investments, and generate employment opportunities. Nitu Singh, Associate Director at CareEdge Research, notes, "India’s gold import is estimated to be ~866 tonnes in CY24 which would be more than 8% of total merchandise imports. By localizing gold ore refining industry, the country would save a substantial amount of forex, would generate employment opportunities and the tax collection for the government.”

Above views are of the author and not of the website kindly read disclaimer