RBI Monetary Policy Update A prelude to Rate Cut ? by SBI Capital Markets

Repo rate stays put even as a changed dynamic opens the door for rate cuts

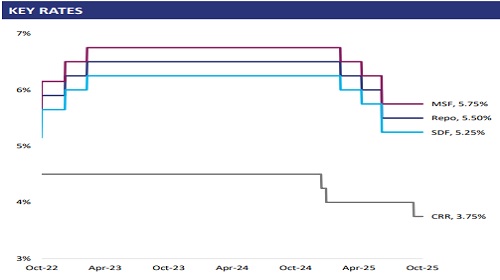

Repo rate was kept at 5.50% by a unanimous decision. The policy stance has been retained at “Neutral”, though two members wanted it be to changed to “Accommodative”. Confidence on curbing inflation remains high, helped by bounteous monsoons, though Core inflation and fuel prices should be in the line of sight. Growth projections were adjusted upwards, though the downward sloping trajectory as FY26 ends was steepened. We anticipate another ~25bps rate cut in the current cycle, with the timing depending on growth figures in H2

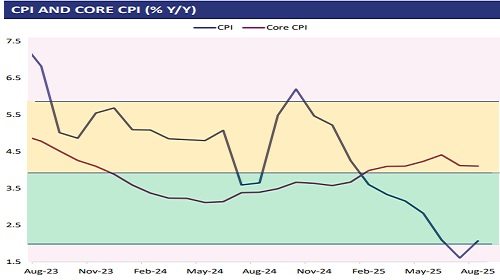

.Inflationary concerns now in the background leading to sharp cut in projections

Projection for consumer inflation was dragged down sharply to 2.6% y/y for FY26, a full 50bps below Aug’25 figure. The benign food inflation seen in 5MFY26 is expected to continue for the remainder of the fiscal based on excellent food production expected on good monsoons and GST rate rationalisation driving down prices. Inflation concerns have clearly receded, but volatility remains at the forefront, highlighted by the sharp change in RBI’s projections in a matter of months. With Core staying stiff on precious metal prices and crude prices prey to geopolitical tussles, inflation will remain a monitorable

Growth outlook pulled up for FY26 on a stellar H1 and hope for consumption boost in H2

Even as the real GDP growth for FY26 was pushed up 30bps to 6.8% y/y, much of the hike hinges on what precipitated in H1FY26. The outlook for H2 downward sloping, with projection for Q3 being slashed to 6.4% from 6.6% and for Q4 cut to 6.2% from 6.3%. The Governor admitted that fiscal measures such as GST rate changes will only partially offset the hit to exports from tariffs. In any case, with borrowing for the Union in FY26 likely to be Rs. 100 bn below BE, there is ample headroom to deliver booster shots as needed, and its alacrity on capex has been seen in 5M. On balance, we retain our nominal GDP forecast at 8.5% y/y

External front in check, foreign investor interest could improve going ahead

CAD is likely to be manageable for FY26, and import cover is at a comfortable 11 months based on generous forex buffers, balancing out concerns generated by a fall in INR (vs. USD) to all-time low. The soundness of this conclusion is evidenced by the fact that net FDI flows increased by more than 200% y/y in 4MFY26 to USD 10.8 bn, with Jul’25 recording a 38-month high.

Rate disparity between bond markets and banks reduces as rate transmission is efficient, yields to remain anchored near current levels

Transmission of ~100 bps of repo rate cuts since Feb’25 has been remarkably efficient, with it being complete to fresh deposits. Transmission to outstanding deposit rates has been much slower vs. lending rates. Further, Union G-sec yields are likely to remain anchored near current levels (6.50% ± 0.25%), keeping spreads between MCLR and benchmark bond yields low. The steepness in the yield curve is due to demand-supply dynamics and evolving liquidity.

STATUS QUO ON KEY POLICY PARAMETERS

CPI PROJECTIONS SLASHED, WELL WITHIN TARGET RANGE NOW

Above views are of the author and not of the website kindly read disclaimer