RBI Monetary Policy - As clear as it goes by ASK Private Wealth

RBI cuts rates, alters stance and provides liquidity

Growth, Inflation estimate cut by 20 bps

Yield curve lower and steeper resulting in increased spread

Future guidance and clarifications from RBI Governor:

? Stance: Today’s change in stance from ‘neutral’ to ‘accommodative’ means that going forward, absent any shocks, the MPC is considering only two options – status quo or a rate cut.

? Liquidity: The Reserve Bank is committed to provide sufficient system liquidity.

? Growth inflation risk: Clear bias towards growth, more sanguine on inflation

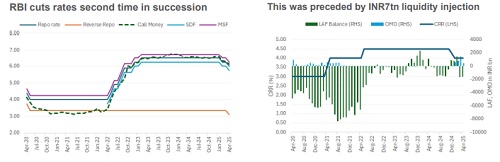

Rate, stance, liquidity: As clear as it goes

Assessment:

? RBI has clearly switched gear in favour of an accommodative stance. The second successive rate cut comes after a liquidity injection of INR 7 tn. RBI appears keen to do whatever it takes to take the interest rates down from the current level.

? From various pronouncements made; it is clear that RBI is more worried about domestic and global growth prospects and built comfort on the domestic inflation front and noted the evenly poised inflation outlook in the global context; underplaying the role of ongoing trade and tariff war.

Investment Ideas:

? Long bond: Given the view on rates, which can come down further over next 6-12 months, we believe risk reward is favourable investing in 20-30 year which can provide reasonable capital gains on our base case panning out.

? InvITs: An alternative mode of playing long duration is through InvITs, which have long term cash flows and can benefit with lower rates.

Above views are of the author and not of the website kindly read disclaimer