Pharma Sector Update : Pharma Firms Steady Amid Tariff Turmoil Choice Broking Ltd

Pharmaceutical companies under our coverage are expected to report healthy revenue growth, averaging 13.1% YoY, driven by volume expansion and price increases in the domestic market— enabling continued outperformance vs the IPM, new product launches in the US as well as sustained growth in the EU (Europe) and Emerging Markets. EBITDA growth is also expected to remain strong, with an average growth of 20.4% YoY, supported by a favorable product mix and improved operational efficiencies across most companies.

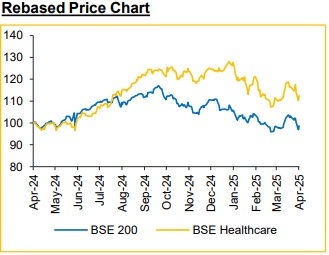

Pharma Firms Steady Amid Tariff Turmoil

While the pharmaceutical industry has been spared for now, our discussions with company management suggest they are wellequipped to navigate the challenges ahead. Most companies consider it more efficient to retain existing manufacturing setups, choosing to absorb part of the additional cost while passing on the majority to end customers.See page 2 for further details.

Segment-Wise Outlook

Generics and Branded Generics

* India: Therapies such as Antidiabetic, Cardiac, and Oncology are expected to outpace therapy IPM growth. Notable drivers include Dr. Reddy’s growing Nutraceuticals segment, as well as new launches such as Glenmark’s Glempa (for type 2 diabetes) and Zydus’s IBYRA (oncology).

* United States: US revenues are expected to grow in the mid-to-high single digits. While challenges around gRevlimid persist, the impact is anticipated to be partially offset by new product introductions (e.g., Valsartan by Lupin, Nilotinib by Cipla) and a moderation in price erosion.

* EU & Emerging Markets: Growth is likely to remain steady as companies continue to gain market share through cost-competitive generics, strong distribution networks, and product innovation, including integration of such as NRT by Dr. Reddy’s in European markets.

APIs

The API segment remains under pressure due to price erosion, particularly in the US, where erosion remains in the high single digits. However, increased focus on high-value oncology APIs by companies such as Lupin and Dr. Reddy’s is expected to support revenue in the medium term.

CDMO

The CDMO space continues to see strong demand visibility, aided by an uptick in RFPs and long-term contractual engagements. Key players including Piramal Pharma, Divis Labs, Concord Biotech, and Laurus Labs are undertaking capacity expansions to cater to rising global outsourcing demand.

Biosimilars

Companies are stepping up their presence in the Biosimilars through strategic collaborations, dedicated R&D, and a focus on affordable biologics.

* Alkem is advancing multiple monoclonal antibody, including Trastuzumab.

* Glenmark’s Liraglutide is the first Biosimilars in the anti-diabetic category.

* Zydus has received approval to market Bhava™ in oncology.

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131