Perspective on Breaking down the FYTD surge in Centre`s capex by Ms. Madhavi Arora, Chief Economist, Emkay Global Financial Services

Below the Perspective on Breaking down the FYTD surge in Centre`s capex by Ms. Madhavi Arora, Chief Economist, Emkay Global Financial Services

Breaking down the FYTD surge in

Centre’s capex

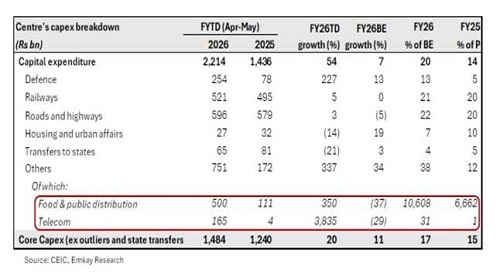

* The Centre’s May-25 fiscal data shows capex at Rs2.2trn for FY26TD – reflecting staggering growth of 54% YoY!

While prima facie, this indicates heavy frontloading of capex by the Centre in FY26 (vs the election-led slower capex in 1HFY25), a deeper dive into the numbers shows that there are a few outliers driving this growth

* The two outliers are – Telecom and Food & Public Distribution. Telecom capex for FY26TD is ~Rs165bn, nearly ~4000% higher than last year* – on account of BSNL recapitalization and spending on the BharatNet program*.

As for Food & Public Distribution, the capex number was also high in Apr'24, before tapering significantly during the year (even turning negative in a number of months) – this particular ministry is often used as a placeholder for funds which have not yet been allocated to specific ministries/projects.

Thus we expect a similar trend for this specific head in FY26 as well

* Ex of these outliers (and the Centre’s capex loans to states), core capex has grown at a healthy 20% so far in FY26 (vs 11% budgeted).

Of the major categories, Defence (Rs254bn, 227% YTD growth) has been the major driver, with a sharp pick-up in May partly amidst the Indo-Pak conflict.

Other major sectors have seen more modest growth – Railways (5% YTD growth) and Roads (3% YTD growth)

* It is also imp. to note that given the extremely slow pace of the Centre’s capex until Dec last year (a usual election year phenomenon), capex growth for most of FY26 will optically look quite strong, due to this favourable base effect

* After having done a massive catch-up on capex in 4QFY25 (33% YoY growth in 4Q), the healthy core capex growth for FY26TD (and 6MCY’25) reflects the Centre’s efforts to frontload capex spending after extremely lagged capex until Dec’24.

With strong capex for the first five months of CY26, the fiscal capex impulse on growth is likely to remain strong in 1Q and beyond.

Above views are of the author and not of the website kindly read disclaimer