Peer Company research report of UGRO Capital against SBFC Finance Limited by ULJK

Follow us Now on Telegram ! Get daily 10 - 12 important updates on Business, Finance and Investment. Join our Telegram Channel

Comparative Highlights of Peer Analysis Report: SBFC Finance and UGRO Capital

- Asset Under Management (AUM): ? SBFC Finance: Demonstrating consistent growth in AUM, the company's assets under management increased from 22 billion in FY21 to 49 billion in FY23, exemplifying successful expansion and presenting a noteworthy 2-year compound annual growth rate (CAGR) of 49%. ? UGRO Capital: On a comparative note, UGRO achieved much better AUM growth, boasting a 2-year CAGR of 116%. The company's AUM surged from 13 billion in FY21 to 61 billion in FY23, indicating a robust market presence and effective customer engagement. Total AUM as on Q1FY24 is 67.77 bn. ? SBFC's AUM mix emphasizes secured lending to MSMEs and collateral- based gold loans, showcasing risk mitigation. On the other hand, UGRO Capital's diverse mix encompasses various lending segments, targeting prime borrowers, micro-enterprises, supply chains, machinery loans, and strategic partnerships.

- Yield on Advances: ? As of March 31, 2023, SBFC's average yield on the Gross Loan Book reached 15.91%. Notably, Secured MSME Loans and Loans against Gold contributed 15.89% and 15.64% respectively to this yield composition. Since its inception in 2017, SBFC has exhibited rapid expansion, showcasing its ability to grow and capture market share effectively. ? UGRO Capital, on the other hand, maintains a Portfolio yield of 17.3%, which has exhibited a slight yet consistent increase over recent quarters. This augmentation is attributed to the company's strategic focus on high-yield products and efforts to enhance the yield on existing products.

- Cost of Borrowings and NIMs: ? SBFC Finance's growth has been supported by its ability to access diversified funding sources. The company intends to further diversify its funding channels, explore new sources of capital, and implement ALM policies to optimize borrowing costs and expand its NIM. The average cost of borrowing for SBFC Finance stood at 8.11%, 7.65%, and 8.22% for FY21, FY22, and FY23, respectively, with an Incremental Cost of Borrowings at approximately 8.76% for FY23. ? UGRO Capitalís management previously indicated that the spread income on the Off Book portion is slightly higher than the On-Book spreads, contributing to the top-line growth of the company. Additionally, there was a marginal increase of 8 bps in borrowing costs, influenced by macroeconomic factors. Term loans from banks and financial institutions remain the primary source of On-Book liabilities, accounting for 72% of the total, while the company has also diversified its funding sources through NCDs, CPs, and DFIs. The average cost of borrowing stood at 10.3%,10.7% and 10.6% for FY21,FY22 and FY23 respectively.

- A U M Mix: 1. SBFC Finance: The loan portfolio of SBFC is primarily composed of three key product segments : Secured MSME Loans, Loans against Gold, Other Loans, which encompass personal loans, business loans, and professional loans. Secured MSME Loans category, SBFC offers a diverse range of financial solutions tailored to assist entrepreneurs and MSMEs in meeting their increasing credit requirements. The typical loan amount in this segment averages at 90 k, with an average contractual tenure of 9.84 years, as of March 31, 2023. Repayments for Secured MSME Loans are structured in installments. Disbursement of secured msme loan stood at 22,768 mn with a GNPA of 2.55% Gold Loan :The average loan size within the Loans against Gold segment is approximately 0.09 million, with an average loan tenure of 11 months. SBFC operates its secured Loans against Gold portfolio across 16 states and two union territories throughout India, effectively serving 59,437 borrowers as of March 31, 2023. AUM for Loans against Gold amounted 8,641.02 million in FY23, GNPA for gold loan 1.21% in FY23.Personal Loans: These loans are tailored for salaried individuals. The average loan size for personal loans is approximately 0.69 million, with an average contractual tenure of 4.83 years. AUM for other loan 1,587.18 mn. UGRO Capital UGROís portfolio is spread out across various geographic regions and industry sectors, ensuring that no individual sector comprises more than 25% of its overall exposure. 100% MSME focused, Prime loans consist of both Secured MSME as well as Unsecured MSME loans. Disbursement stood at 19,860 mn, Prime unsecured disbursement stood at 21,090 mn with a GNPA of 3.0%, micro enterprise loan stood at 5,480 mn with a GNPA of 1.1% ,supply chain disbursement stood at 5,850 mn with GNPA of 2.6%,machinery loan disbursement stood at 7,980 mn with GNPA of 0.6%,partnership loans stood at 7,500 mn. Overall UGRO has a broader MSME-focused loan portfolio covering various yield bands and ticket sizes ranging from INR 1 lakh to 5 crore.

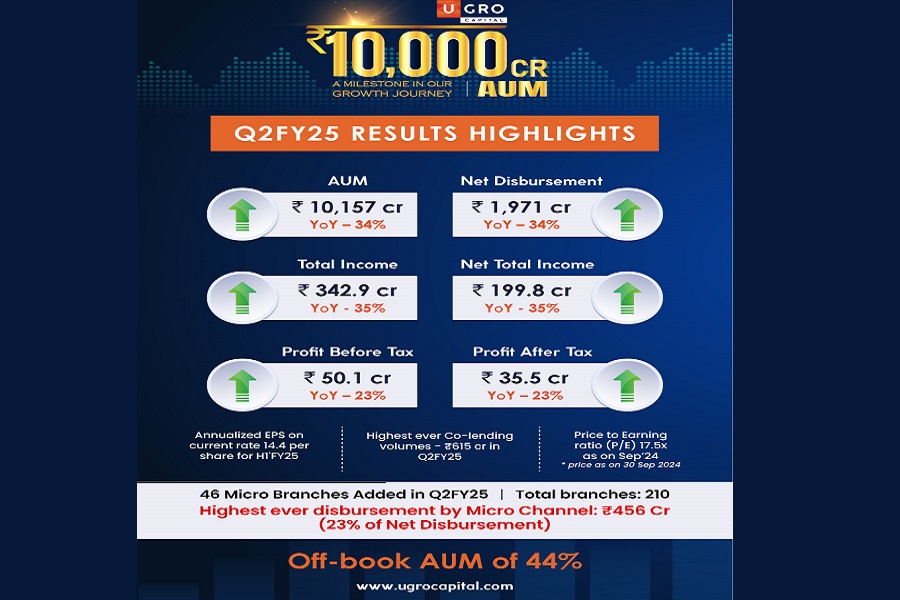

Additional Boost to UGROís Growth story: Fund Raise: UGRO Capital raised INR 340 Crore in April 2023, comprising INR 240 Crore from Danish Government Backed DFI, IFU through its Danish Sustainable Development Goals Investment Fund K/S, and INR 100 Crore from marquee Domestic Institutions including SBI Life, SBI General, and Go Digit. This fund raise is pivotal in maintaining the company's AUM growth trajectory. It provides sufficient capital to reach an AUM target of INR 10,000 Crore by the end of FY24. The infusion of capital enhances the company's ability to extend loans and expand its portfolio, which is critical for AUM growth. Distribution Strength: UGRO Capital has strategically built a diverse distribution network comprising four channels: Prime Business, Micro Business, Ecosystem, and Partnerships & Alliances. This extensive infrastructure includes 98 branches, 850+ GRO partners, 120+ Anchor/OEM partners, and 910+ sales employees. The emphasis here is on the existing distribution channels' capability to meet the AUM guidance for FY24.

More News

HCLSoftware's Startup SYNC Announces First-Ever Startup Cohort Program Focused on Retail and...