Ugro Capital has reached a total aum of INR 10,200+ cr milestone in Q2 FY25, growing from INR 2,970 crore in March 2022

UGRO Capital, a leading DataTech NBFC focused on MSME lending, today announcedits robust performance for the quarter ended September 30, 2024 (Q2 FY25), marking significant milestones in its journey towards becoming a leading MSME-focused lender. The company has reached a total AUM of INR 10,200+ crore, growing from INR 2,970 crore in March 2022, underscoring its accelerated growth trajectory and investment in DataTech infrastructure.

During Q2 FY25, UGRO Capital achieved several lifetime highs in key performance metrics:

Record Loan Originations: UGRO recorded its highest-ever quarterly net loan originations of INR 1,970+ crore, a remarkable 72% increase compared to INR 1,146 crore in Q1 FY25.

Micro Enterprises Lending Surge: UGRO’s Micro Enterprises Loan vertical saw origination of INR 450 crore, more than doubling from INR 209 crore in the previous quarter. This growth reflects the company’s expanded branch network, now at 210 branches, including 46 new micro-branches added during the quarter.

Co-Lending Milestones: UGRO achieved its highest quarterly co-lending volume of INR 600+ crore, up from INR 337 crore in Q1 FY25, with its co-lending partnerships expanding to 9 banks and 7 NBFCs. The company’s off-book AUM now stands at approximately 44%.

Strengthened Borrowing Profile: The company also mobilized its highest-ever borrowings, raising over INR 1,100 crore in Q2 FY25, up from INR 375 crore in Q1 FY25, ensuring a well-diversified liability profile.

Commenting on these achievements, Mr. Shachindra Nath, Founder and Managing Director of UGRO Capital, said,“Our performance in Q2 FY25 marks a significant leap forward, driven by our unwavering commitment to providing innovative, data-driven financial solutions for MSMEs across India. Since our inception, we have raised over INR 900 crore in 2018, INR 340 crore in 2023, and INR 1,265 crore in 2024. With a robust network of 210 branches and a dedicated workforce of around 3,500 employees, we are poised to accelerate our efforts, particularly in the Micro Enterprises Loan segment. As we continue to grow, our focus remains on empowering MSMEs, encapsulated in our core belief – MSME Accha Hai – to unlock even greater opportunities for growth and development across the sector.”

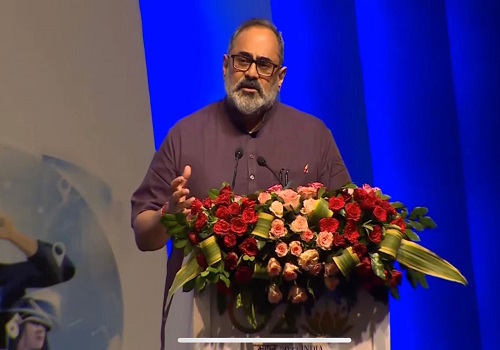

In addition to its financial achievements, UGRO Capital received a ratings upgrade from India Ratings to ‘IND A+/Stable’ (long-term) and ‘IND A1+’ (short-term), further solidifying its position in the market. The company was also honored with the 'Best Fintech Lender of the Year' award at Financial Express India’s Best Banks Awards, presented to Mr. Shachindra Nath by Hon’ble Union Minister of Finance & Corporate Affairs, Ms. Nirmala Sitharaman.

The business updates reflect UGRO Capital’s ongoing commitment to transforming MSME credit in India through technological innovation and strategic partnerships. These updates are subject to management review and have not yet undergone a limited review by the auditors.

Above views are of the author and not of the website kindly read disclaimer