Oil and Gas Sector Update : Crude Compass - Weekly Oil Market Dossier by Choice Institutional Equities

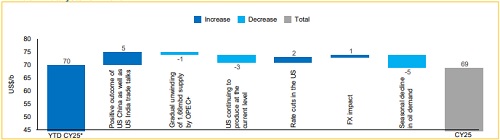

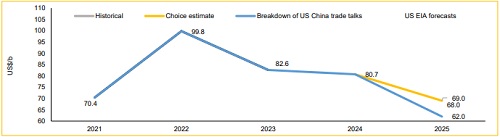

We maintain our estimate for Brent at US$69.0/b for the Calendar Year 2025 (as published on June 13, 2025) compared to YTD average of US$69.7/b.

In our view, following aspects will lead to volatility in oil price over the short-term:

* Geopolitical tension: According to market reports, following Ukraine's strikes, Russia's downstream industry is processing around 7% less oil than its traditional throughput of 5.4 mbd.

* Trade policies: Oil and gas importers are either strengthening ties with the US or reducing reliance on Russia.

This week, the US President called on NATO members to stop buying Russian energy, while nothing that India and China remain key contributors to Russia’s funding flows. He also highlighted that ongoing imports by NATO members continue to fuel the situation. Meanwhile, Commerce Minister Piyush Goyal said that India is willing to expand its energy trade with the US. During his meetings with his counterpart in Washington, this is considered as one of the aspects to be discussed in relation to US tariffs on Indian goods.

Our view: Over the past decade, the US has sought to increase its share of global oil and gas trade, while OPEC+ has attempted to limit it. Following the Russia-Ukraine war, tariffs on Russian oil and subsequent discussions may lend support to the US in increasing its market share in the global oil and gas supply. Nonetheless, Brent crude is likely to remain range-bound between US $60 and $75/b in absence any significant geopolitical escalation. Below US$60/b, marginal US supply becomes uneconomical, while above US$75/b, demand elasticity is expected to increasingly moderate prices in the current macroeconomic climate.

Exhibit 1: Catalysts for Brent

Source: FactSet for Historical data, Choice Institutional Equities

*Note: YTD CY25 price as of Sept 25, 2025

Exhibit 2: Brent estimates

Source: FactSet for Historical data, Choice Institutional Equities

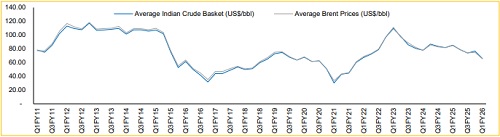

Exhibit 3: Average Indian Crude Basket (US$/bbl) against Average Brent Prices (US$/bbl)

For Detailed Report With Disclaimer Visit. https://choicebroking.in/disclaimer

SEBI Registration no.: INZ 000160131

More News

IT Services Sector Update : Midcaps to outperform By Elara Capital