Neutral Central Depository Services Ltd for the Target Rs. 1,150 by Motilal Oswal Financial Services Ltd

Weak operating performance

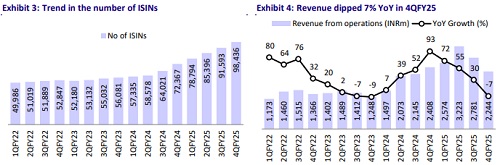

* CDSL’s operating revenue declined 7% YoY and 19% QoQ to INR2.2b (7% miss), primarily due to a 36%/29% YoY decline in transaction revenue/online data charges. For FY25, the company’s revenue grew 33% YoY to INR10.8b.

* EBITDA declined 26% YoY and 32% QoQ to INR1.1b (10% miss), resulting in an EBITDA margin of 48.7% (vs. 61.4% in 4QFY24 and 57.8% in 3QFY25). For FY25, its EBITDA grew 28% YoY to INR6.2b. Operating expenses jumped 24% YoY to INR1.2b due to a 14%/28% YoY increase in employee costs/other expenses.

* PAT for the quarter declined 22% YoY and 23% QoQ to INR1b (10% beat). For FY25, it grew 25% YoY to INR5.3b. PAT margin came in at 44.8% vs. 53.8% in 4QFY24 and 46.7% in 3QFY25.

* As a market infrastructure company, CDSL will continue to invest in four key areas—hardware, infrastructure, application, and security—while keeping technology expenses at a steady proportion of revenue.

* We cut our earnings estimates by 15%/13% for FY26/FY27 to factor in slower account openings, a weak cash volume trajectory, a reduction in IPO actions, and continued investments in tech and human resources. We expect CDSL to post a revenue/EBITDA/PAT CAGR of 12%/13%/13% over FY25-27. We reiterate our Neutral rating on the stock with a one-year TP of INR1,150 (premised on a P/E multiple of 35x on FY27E earnings)

Continued investments in technology and human resources

* On the revenue front, transaction revenue declined 36%/17% YoY/QoQ to INR490m on account of lower cash delivery volumes during the quarter.

* Annual issuer charges increased 34%/7% YoY/QoQ to INR870m, of which INR359.5m came from unlisted companies. The growth was primarily fueled by an increase in the number of issuers (35.9k in 4QFY25 from 23.1k in 4QFY24) contributing to the rise in recurring issuer income.

* IPO/Corporate Action charges declined 7%/57% YoY/QoQ to INR250m on account of a fewer number of IPO listings during the quarter.

* During FY25, the total income of its subsidiary, CVL, rose 35% YoY to INR2.5b, while total expenses grew 42% YoY to INR1.1b. PAT rose 28% YoY to INR1.09b.

* Total expenses jumped 24% YoY to INR1.2b, led by a 14%/67%/11% YoY increase in employee/IT/admin and other expenses.

* Other income was up 18%/57% YoY/QoQ to INR313m, primarily due to mark-to-market gains on debt investments.

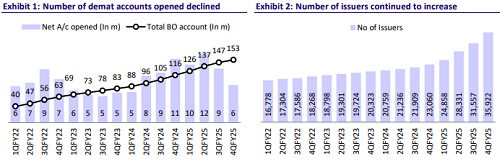

* Demat account additions during the quarter reduced sequentially to 6.4m from 10.9m in 4QFY24 and 9.2m in 3QFY25.

Key takeaways from the management commentary

* Management maintained a stable dividend payout ratio, targeting 60% on a standalone basis; for FY25, the actual payout was 61.3%.

* The dip in KYC revenue during 4QFY25 was attributed to subdued growth in market delivery volumes, demat account openings, mutual fund inflows, and IPO activities.

Valuation and view

* Lower market activity and fewer IPO listings led to a reduction in revenue, and continued investments in human resources and technology for future growth could restrict gains from operating leverage, but we still expect EBITDA margins to expand to ~58.2% in FY27E from 57.7% in FY24.

* We cut our earnings estimates by 15%/13% for FY26/FY27 to factor in slower account openings leading to subdued transaction revenue, a weak cash volume trajectory, a reduction in IPO actions, and continued investments in tech and human resources.

* We expect CDSL to post a revenue/EBITDA/PAT CAGR of 12%/13%/13% over FY25-27. We reiterate our Neutral rating on the stock with a one-year TP of INR1,150 (premised on a P/E multiple of 35x on FY27E earnings).

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412