Buy Container Corporation Ltd For Target Rs.950 by Motilal Oswal Financial Services Ltd

Weak EXIM realization hurts earnings; lower depreciation supports APAT

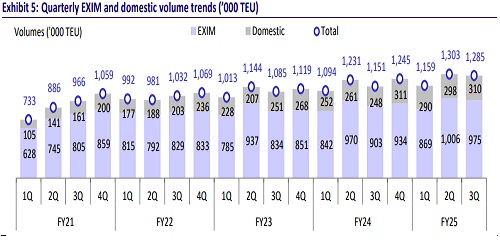

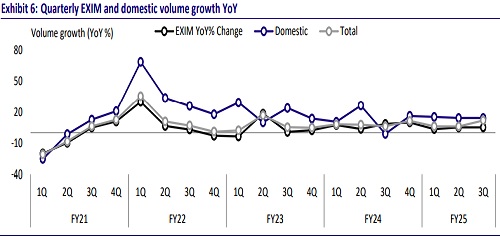

* Container Corporation of India (CCRI)’s revenues were flat YoY at INR22b during 3QFY25 (10% below our estimate). Total volumes grew 12% YoY to 1.3m TEUs, with EXIM/Domestic volumes at 0.97m/0.3m TEUs, respectively (+8%/+25% YoY).

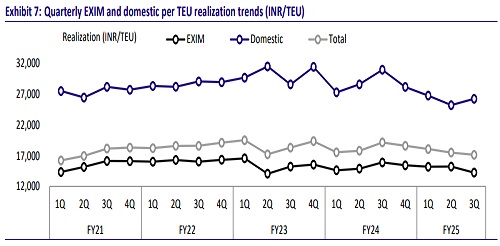

* Blended realization declined ~11% YoY to INR17,138/TEU. EXIM/Domestic realization stood at INR14,245/INR26,254 per TEU, respectively (-10%/-15% YoY). EBITDA margins came in at 20.8% (vs our estimate of 23.2%). EBITDA declined ~10% YoY and was 20% below our estimate.

* Lower depreciation offset the miss in operational performance, which led to an APAT of INR 3.4b (in-line with our estimate). During 3QFY25, the company reassessed the useful life of its wagons based on railway standards, technical advice, experience, and manufacturer certification, extending it from 15 to 30 years. As a result, depreciation for the quarter and nine-month period was INR125m and INR367m, respectively, reflecting a reduction of INR258m and INR792m. This change increased PBT by the same amount.

* During 9MFY25, revenue was INR65.8b (+4% YoY), EBITDA was INR14.7b (+2% YoY), EBITDA margin came in at 22.3%, and APAT was INR9.9b (+6% YoY). The land license fee for 9MFY25 stood at INR2.6b (1.7b in 1HFY25). LLF for FY25 is expected to be INR3.5b (vs. INR3.7b in FY24).

* During 9MFY25, CCRI expanded its logistics network, enhanced double-stack operations, and leveraged the Dedicated Freight Corridor (DFC) for efficiency gains. The company remains focused on integrated logistics solutions, boosting rail freight movement, and infrastructure expansion. Management has revised FY25 capex guidance upwards primarily for new terminals, fleet expansion, and improved multimodal connectivity to strengthen its growth prospects.

* 3QFY25 was impacted by lower realizations and weaker volumes. Given the softened volume growth outlook, we revised our FY25/26/27 EBITDA estimates lower by 7%/6%/5%, respectively. With delays in DFC, the volume growth improvement would be more gradual than earlier estimated. We reiterate BUY with a revised TP of INR950 (based on 18x EV/EBITDA on Sep’26).

Highlights from the management commentary

* The LLF for 9MFY25 stood at INR2.6b. LLF for FY25 is expected to be INR3.5b. It is expected to increase 7% annually. The company is looking to surrender some of the underutilized terminals, which would help maintain LLF for FY26 at similar levels to those in FY25.

* The double-stack rake movement grew 11.3% YoY, with 4,608 double-stack rakes operated during 9MFY25. In Dec’24, CCRI commenced double-stack train operations at Nava Sheva, further enhancing efficiency. Additionally, operations at Gangavaram Port have begun, supporting volume growth.

* CCRI has increased its capex budget by 40% to INR8.6b for FY25, up from the previous estimate of INR6.1b. Out of this, INR4.4b has already been spent in 9MFY25.

* By 2028, the company aims to significantly expand its infrastructure. The plan includes 80 terminals, 500 rakes, and a container fleet of 70,000 units. To support this expansion, capex spending has been revised upwards.

* CCRI is experiencing strong demand in both EXIM and domestic segments. It is targeting a handling volume of 5m TEUs in FY26.

Valuation and view

* During 9MFY25, CCRI strengthened its logistics network, advanced double-stack operations, and utilized DFC to enhance efficiency. The company continues to prioritize integrated logistics solutions, rail freight expansion, and infrastructure growth. Management has increased capex guidance, focusing on new terminals, fleet expansion, and multimodal connectivity to reinforce its market leadership and future growth.

* With DFC’s commissioning and a continuous ramp-up in the number of doublestacked trains, we expect blended volumes to post a 12% CAGR during FY24-27. We expect EBITDA margin to be 22-23% over FY24-27. We reiterate BUY with a revised TP of INR950 (based on 18x EV/EBITDA on Sep’26). Standalone quarterly snapshot

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412