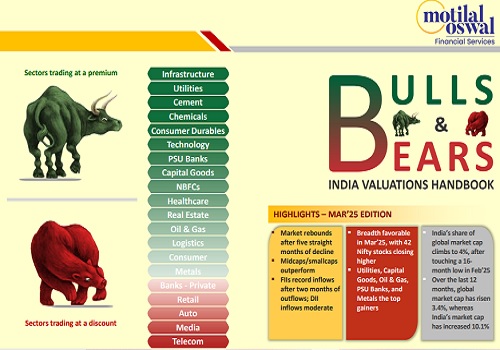

NBFC`s Sector Update : Loan growth strong; rising CoF an impediment to NIM expansion - Motilal Oswal Financial Services Ltd

Asset quality robust but credit costs relatively higher in MFI and personal loans

* AUM growth strong across product segments: We expect ~6% YoY growth in AUM for our coverage HFC universe, including both affordable and other HFCs. Vehicle financers are projected to report ~26% YoY AUM growth. Gold lenders (including non-gold products) are likely to record ~19% YoY growth. NBFC-MFIs are forecasted to post ~29% YoY growth, while diversified lenders are expected to deliver ~28% YoY growth in AUM. For our coverage universe, we estimate a loan growth of ~20% YoY/~5% QoQ in 4QFY24. While the strong loan growth was broad-based, select micro-financers and small-ticket personal loan (STPL) lenders continued to calibrate their growth.

* CoB continues to rise and impedes NIM expansion: Higher risk weights on bank term loans to NBFCs and an increase in MCLR of banks resulted in rising CoB during the quarter. The continued rise in CoB has prevented the NIM expansion, which was previously envisaged for fixed-rate lending like Vehicle Finance. At the sectoral level, we expect NIM to remain stable for vehicle financiers and anticipate NIM compression for HFCs and MFIs.

* Investments in expanding physical branch distribution network and technology will keep operating cost ratios stable: We expect operating cost ratios to remain stable sequentially with an improvement bias. NBFCs and HFCs have been investing in upgrading their technology and analytics infrastructure, as well as in expanding their physical branch distribution network.

* Asset quality robust but credit costs relatively higher in MFI and personal loans: Typical of the fourth quarter of a fiscal year, we expect a sequential improvement in asset quality across all lenders except for select MFI players. MFI and personal loans are two product segments where we expect credit costs to be relatively higher than their normalized levels.

* PAT growth of ~25% YoY for the coverage universe; sector on a strong footing and will benefit from any interest rate cuts: We estimate ~23%/23%/25% YoY growth in NII/PPoP/PAT in 4QFY24 for our NBFC – Lending Financials coverage universe. Structurally, we believe that fixed-rate lenders such as Vehicle Financiers, Micro Financiers and even Micro-LAP lenders will benefit from any interest rate cuts whenever they occur. Our top picks in the sector are SHTF, PNBHF, and Fusion MFI.

Demand improves in mortgages; NIM compression to sustain

* Disbursement momentum improved for both large HFCs and affordable housing financiers (AHFCs). Demand remained strong in the mid-ticket and luxury housing segments, while showing signs of improvement in the affordable segment.

* We anticipate credit costs for LICHF to be at ~55bp (vs. ~60bp in 3QFY24) as we do not expect any further deterioration in asset quality. Margin could contract ~10bp QoQ due to a moderation in yields and a rise in CoF.

* We forecast both Aavas and HomeFirst to report a strong QoQ improvement in disbursements, leading to a healthy AUM growth. While we expect NIM to remain stable for Aavas (aided by an increase in PLR effective Mar’24), we anticipate it to moderate for HomeFirst because of the ongoing rise in its CoB. Asset quality is projected to improve across buckets, with credit costs likely to remain benign.

* We estimate PNBHF to deliver a ~14% YoY growth in retail loans. We estimate ~10bp QoQ NIM compression. Asset quality will continue to improve in both retail and corporate loan portfolios.

Vehicle finance – NIM to remain stable or exhibit minor compression

* MMFS has reported disbursements of ~INR153b in 3QFY24 (up 11% YoY), but growth in business assets was slightly ahead of our estimates at ~24% YoY. We expect credit costs for MMFS to be at ~0.5% in 4QFY24 (vs. negligible credit costs in 4QFY24). We estimate disbursements to remain healthy for CIFC/ SHTF, which should translate into ~35%/22% YoY growth in AUM.

* We estimate NIM to either remain stable or exhibit a minor compression due to a sustained rise in the CoB. MMFS has already reported a strong improvement in its asset quality (some of which could have been aided by write-offs made at the end of the quarter). Even for CIFC/SHFL, we expect a minor improvement in asset quality of vehicle finance (VF), with a sequential moderation in credit costs.

Gold finance – higher gold prices and gold lending ban on a peer can aid stronger growth

* We expect gold loan financiers to deliver stronger gold loan growth in 4QFY24. While higher gold prices will be a big contributor to gold loan growth, we also estimate that there will be a modest tonnage growth in the quarter.

* We expect ~5%/3% sequential growth in the gold loan portfolio of MUTH/MGFL. Gold Loans NIM should exhibit QoQ compression because of the rise in CoF.

Microfinance – mixed outlook; AUM growth healthy but slippages continue

* Disbursements have remained healthy for NBFC-MFIs, leading to healthy GLP growth for all three NBFC-MFIs – CREDAG, Fusion, and Spandana – in our coverage universe. We expect CREDAG/Fusion/Spandana to report a ~26%/ 24%/39% YoY growth in FY24.

* While we estimate a ~30bp and ~15bp QoQ NIM compression for CREDAG and Spandana, respectively, we estimate a margin expansion of ~10bp for Fusion, driven by its stable weighted average CoB.

* Flows into forward asset quality buckets continued this quarter as well. Seasonal improvement in asset quality (typical of 4Q of the fiscal year) might not be there for NBFC-MFIs such as Fusion or Spandana. We estimate credit costs of ~2.4%/ ~3%/3% for CREDAG/Fusion/Spandana in 4QFY24.

Diversified financiers: Going strong barring some calibration in personal loans

* LTFH has reported a strong 31% YoY/7% QoQ growth in Retail Loans. Since the wholesale segment (such as real estate and infrastructure) will continue to moderate, the consolidated loan book could grow ~4% QoQ in 4QFY24. We estimate credit costs to moderate for LTFH, leading to a sequential improvement in profitability.

* We expect BAF to report ~35% YoY/7% QoQ growth in its AUM. We estimate a ~20bp QoQ contraction in NIM for BAF with credit costs at ~1.65% (stable QoQ).

* Poonawalla reported ~54% YoY growth in standalone AUM, driven by ~11% QoQ growth in disbursements. We estimate this to translate into ~15% QoQ PAT growth for the company.

* For IIFL Finance, we estimate a consolidated AUM growth of 23% YoY. This factors in a ~5% QoQ decline in its gold loan book, primarily because of the RBI ban on the company’s incremental lending in gold loans. We estimate a 4QFY24 PAT of INR4.8b (PQ: INR4.9b).

For More Motilal Oswal Securities Ltd Disclaimer http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412