Morning Update – 10th June 2025 by SBI Securities

Markets likely to open higher on positive global market cues

Indian equity markets extended gains from last week with Nifty 50 and Sensex gaining 0.4% and 0.3% respectively at close, although the intraday activity was rangebound after giving a gap-up opening. Broader markets outperformed the benchmarks with BSE Mid and Smallcap gaining marginally above 1% each. Sectorally, except for Realty, all the other sectors ended positive on BSE with Power, Oil & Gas and IT indices gaining the most. On the liquidity front, both FIIs and DIIs net bought in the cash market to the tune of Rs 1,993 cr and Rs 3,504 cr respectively yesterday.

US markets closed flat overnight with S&P 500/Nasdaq gaining 0.1%/0.3% respectively as progress over the much watched out US-China trade negotiations was limited. The Chinese exports to US contracted for second consecutive month in May, recording a steepest fall of 34% since Feb'20. Asian markets are mostly up indicating a positive start for our market today.

Key Actionable

* Capri Global Capital: The company opened its QIP to raise 2,000 cr at an issue price set at Rs 146.5 per share, a 19% discount to the last closing. The total issue size contains a green shoe option of Rs 500 cr. The proceeds are to be used for the expansion of business operations by augmenting our capital base and repayment, in full or in part, of certain outstanding borrowings – Neutral to Marginally Negative in short term

* Tata Power: The company's solar manufacturing arm, TP Solar has crossed 4 GW solar module manufacturing at its Tamil Nadu plant. The plant has cumulatively produced 4049 MW of solar modules and 1441 MW of solar cells up to May 31, 2025. TP Solar is targeting 3.7 GW of solar cell output and 3.725 GW of module production in FY26 – Positive in medium to long term

* Wipro: The company strengthened its Middle East presence with new regional headquarters in Riyadh – Neutral to Positive in short term

* HCL Technologies: The company launched a second delivery center in Thiruvananthapuram, Kerala. The centre will deliver projects across AI, GenAI, Cloud and emerging technologies to HCLTech’s clients across industry verticals – Neutral to Positive in short term

* Mahindra and Mahindra Finance: The company approved an allotment of 15.4 cr shares on a rights basis at an issue price of Rs 194 per share. The issue price includes a premium of Rs Rs 192 per share – Neutral to Positive in short term

* Jana Small Finance Bank: The lender filed an application with the RBI seeking approval for a voluntary transition from a small finance bank to universal bank – Neutral to Positive in short term

* Nykaa: The company completed the second tranche remaining investment of Rs 5 cr into Earth Rhythm Private – Neutral to Positive in short term

* Infibeam Avenues: The company approved a letter of offer in relation to the rights issue filed with exchanges for in-principal approvals – Neutral to Positive in short term

* TIL: The company announced the formation of a dedicated strategic business unit called 'TIL Defence' to consolidate its expanding defence portfolio and accelerate indigenous production of critical military systems – Neutral to Positive in short term

* IRB Infra developers: The company reported an aggregate YoY revenue growth of 9% at Rs 581 cr in May’24 – Neutral to Positive in short term

* ITD Cementation: The company secured a contract worth Rs 893 cr for the construction of berth and breakwater for the development of Greenfield Captive Jetty(s) in Odisha – Positive in short term

* Jindal Saw: The company announced a significant capital expenditure plan in the Middle East, with projects slated for execution over a 12 to 36-month timeline. The company will invest $105 million to set up a 3-lakh tonne per annum seamless pipe plant in Abu Dhabi, which will be 100% owned by Jindal Saw. Additionally, it is entering into two joint ventures in Saudi Arabia $10 million JV with Buhur Investment for HSAW pipes and $3 million JV with RAX United for ductile iron pipes, with 51% ownership in both ventures – Positive in medium to long term

* Zee Entertainment: The company signed an agreement with content start-up Bullet to launch India’s first micro-drama application – Neutral to Positive in short term

* Nibe: The company secured a technology transfer licence from the Defence Research and Development Organisation for modular bridging system – Positive in medium to long term

* Protean eGov Technologies: The company received an order worth Rs 100 cr from Bima Sugam India –Positive in short term

* Apollo Pipes: The company acquired an additional stake of 1.01% via secondary purchase in arm Kisan Mouldings – Neutral to Positive in short term

* Jupiter Wagons: The company’s arm Jupiter Electric Mobility unveiled its first showroom in Bengaluru – Neutral to Positive in short term

Insider Trades

* Deccan Gold Mines: Promoter Rama Mines Mauritius sold 5 lakh shares.

* Usha Martin: Promoter Peterhouse Investments India sold 2 lakh shares.

* Geojit Financial Services: Promoter BNP Paribas sold 13.11 lakh shares.

* Suprajit Engineering: Promoter Supriyajith Family Trust bought 5.6 lakh shares and promoter Akhilesh Rai bought 11,081 shares.

* MTAR Technologies: Promoter P Kalpana Reddy sold 20,000 shares.

Trading Tweaks

* Ex- Dividend: Indian Bank, Tata Investment Corp, Asian Paints, Johnson Controls and Hitachi.

* Ex-stock Split: Vesuvius India (Rs 10 to Rs 1)

Fund Flows – Cash Market (09th June)

* FII (Rs cr): +1,992.9

* DII (Rs cr): +3,503.8

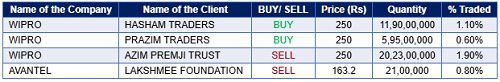

Bulk Deals – NSE

Block Deals – NSE

Block Deals – BSE

Bulk Deals – BSE

Above views are of the author and not of the website kindly read disclaimer

More News

Quote on Pre-Market Comment 15th December 2025 by Aakash Shah, Technical Research Analyst, C...