2024-05-28 10:10:29 am | Source: PR Agency

Mid Market Comment by Mr Shrey Jain, Founder & CEO SAS Online - India's Deep Discount Broker

Below the Quote on Mid Market Comment by Mr Shrey Jain, Founder & CEO SAS Online - India's Deep Discount Broker

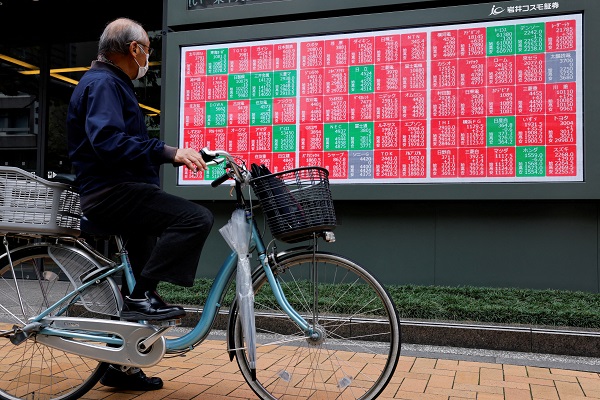

Yesterday, Nifty tested the 23,100 level but failed to maintain its gains and ended flat. Today, we expect Nifty to consolidate around the 23,000 level, as both the 23,000 Call and Put options have substantial open interest. Specifically, the 23,000 Call strike has significant open interest of approximately 64 lakh shares, while the 23,000 Put strike holds around 71 lakh shares in open interest.

For Bank Nifty, the 49,000 Put strike has notable open interest, which is expected to provide support, whereas the 49,500 level is likely to act as a resistance. The volatility index continues to rise ahead of the election results, reaching 23.61. Until June 3rd, we can expect the market to exhibit rollercoaster-like fluctuations.

For Bank Nifty, the 49,000 Put strike has notable open interest, which is expected to provide support, whereas the 49,500 level is likely to act as a resistance. The volatility index continues to rise ahead of the election results, reaching 23.61. Until June 3rd, we can expect the market to exhibit rollercoaster-like fluctuations.

Above views are of the author and not of the website kindly read disclaimer

Disclaimer:

The content of this article is for informational purposes only and should not be considered financial or

investment advice. Investments in financial markets are subject to market risks, and past performance is

not indicative of future results. Readers are strongly advised to consult a licensed financial expert or

advisor for tailored advice before making any investment decisions. The data and information presented

in this article may not be accurate, comprehensive, or up-to-date. Readers should not rely solely on the

content of this article for any current or future financial references.

To Read Complete Disclaimer Click Here

Latest News

The Index can short below 25600 for the potential ta...

Buy Inox Wind Ltd for the Target Rs. 181 by Systemat...

Buy Bank of Maharashtra Ltd for the Target Rs. 80 by...

Global business challenged by rapid emergence of a n...

Alliance Insurance Brokers Appoints Aatur Thakkar as...

Biz2X appoints Narendra Singh Chandel as Vice Presid...

Former UTI Pension Fund CEO Balram Bhagat joins The ...

SVC Bank Enters Landmark 120th Year: Blending a Cent...

NITI Aayog releases export preparedness index of Ind...

India's GDP likely to grow at 7.5-7.8 pc in FY26

More News

Quote on Market Wrap 03rd December 2025 from Mr. Ajit Mishra - SVP, Research, Religare Broki...

Pre-Market Comment by Hardik Matalia, Derivative Analyst, Choice Broking

Quote on Pre-market comment for Tuesday December 30 by Amruta Shinde, Technical & Derivative analyst, Choice Broking

Quote on Market Expiry 21st August 2025 by Chandan Taparia Head Derivatives & Technicals, Wealth Management, Motilal Oswal Fin...