Metal Prices Expected to Fluctuate on the LME between $9000 and $10200 Motilal Oswal Financial Services Ltd

According to a report by Motilal Oswal Financial Services, base metals have been caught in between supply surplus forecasts for most metals, weakening PMI figures, and constant updates on negotiations between US-China, keeping market participants on edge and uncertain about the future path.

The US has been imposing tariffs continuously on its trade partners, while keeping rates high for Chinese imports—with tariffs on certain goods ranging up to 245%. However, China has been at the forefront of protecting its country’s interests and is fighting back against the constant ‘singling out’ by the US. After making progress with the UK, the Trump administration also took notable de-escalation measures with China to ease the economic hardship that both countries are beginning to experience.

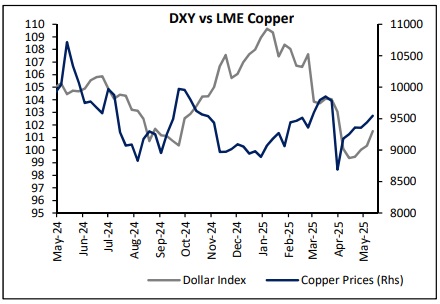

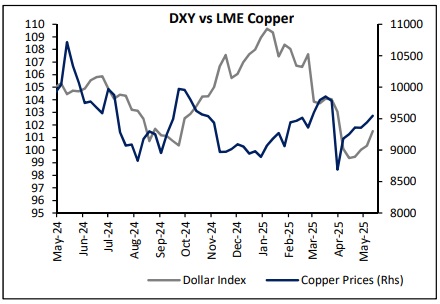

Copper has been witnessing high volatility—briefly touching levels above $10,000 in March, then collapsing to around $8,000 within a week, and rebounding to $9,500. Following the news of Trump signing an executive order directing the Department of Commerce to investigate whether copper imports threaten national security, potentially leading to a 25% tariff on these imports, a price disparity between LME and COMEX prices emerged. This created arbitrage opportunities, prompting speculative shipments and frontloading of planned deliveries to avoid potential tariffs.

Supply Forecasts

The recent ICSG estimates, global copper market is anticipated to witness a considerable surplus over the next two years. The Group expects a global copper surplus of 289,000 tonnes in 2025—more than double the 138,000 tonnes recorded last year, and significantly higher than previous estimates of 194,000 tonnes. The growing surplus is attributed to increased mine supply and smelting capacity.

Uncertainties around international trade policy are expected to impact the global economic outlook and reduce copper demand. Refined copper consumption is now projected to grow only 2.4% this year (down from earlier projections of 2.7% and 2.8% in 2024), and to further slow to 1.8% in 2026—largely driven by a drop in Chinese usage, from 2% this year to just 0.8% next year.

Central Bank Actions

China has signalled the arrival of its monetary easing cycle, aligning with the US-China meeting. The People's Bank of China has reduced the seven-day reverse repurchase rate from 1.5% to 1.4%, and lowered the reserve requirement ratio by 50 basis points to 9%, effective 15th May. This move is expected to release approximately 1 trillion Yuan ($139 billion) of long-term liquidity—the most aggressive easing since the early COVID period.

Additionally, the PBOC introduced measures to stimulate consumption and support the technology sector, including an RMB billion loan program for consumption and senior care, and a 300 billion Yuan increase in the existing tech lending fund. The real estate sector has also benefited from a reduction in the housing provident fund loan rate.

US-China Negotiations

Following prolonged tensions, the first in-person meeting between US and Chinese officials was held in Geneva, Switzerland. Both parties described the discussions as constructive. A joint statement confirmed substantial tariff reductions: China will lower tariffs on US goods from 125% to 10%, and the US will reduce tariffs on Chinese goods from 145% to 30% — both for a 90-day period. The US tariffs will also include a 10% base + 20% fentanyl levy.

Conclusion

While these negotiations mark a positive shift in US-China trade relations and provide temporary relief to base metal prices caution remains necessary. The strengthening of the dollar, driven by optimism around the tariff deal, could present headwinds for metal prices. Though the newly announced tariff rates are less severe than expected, they still represent a significant obstacle to global trade, potentially dampening demand for raw materials. Copper prices are expected to fluctuate between $9,000 and $10,200 on the LME, with persistent volatility anticipated. A cautious, well-informed approach is advised for market participants.

Above views are of the author and not of the website kindly read disclaimer

Tag News

Aviation Sector Update : Air traffic rises MoM in Jan?26; IndiGo share dips YoY By Motilal ...