Silver`s 2025 Rally Signals Structural Shift as Physical Scarcity Drives Prices: Motilal Oswal Financial Services Ltd

The silver market underwent a decisive structural shift in 2025, moving beyond a conventional bull cycle to reflect deep stresses between paper pricing mechanisms and physical availability, according to the Commodities Insight report “Silver Unchained!!!” released by Motilal Oswal Financial Services Ltd.

Silver prices surged to record levels during the year, crossing $75 on COMEX and rising above Rs.2.3 lakh in the domestic market, marking gains of over 160 percent. The report states that this rally is not driven by short-term speculation, but by prolonged physical supply deficits, tightening inventories, policy-led supply constraints, and sustained industrial and investment demand.

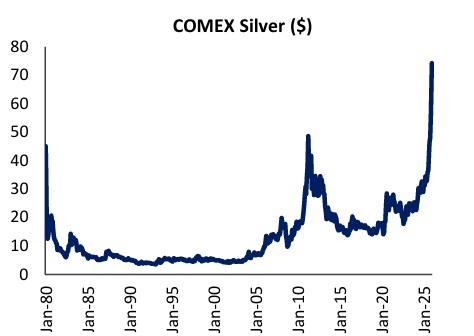

Long-term COMEX Silver Price Trend:

A long-term price chart in the report shows COMEX silver prices accelerating sharply into 2025, marking one of the most significant price inflection points in decades. The move coincides with mounting physical tightness and declining exchange inventories, reinforcing the view that the rally is structurally driven rather than cyclical.

Commenting on the broader structural shift, Navneet Damani, Head of Research – Commodities at Motilal Oswal Financial Services Ltd., said:

“The silver market in 2025 has moved beyond a conventional bull cycle and entered a structural phase, driven by prolonged physical supply deficits, inventory depletion, and policy-led supply constraints. The widening disconnect between paper pricing and physical availability highlights deeper stress in global price discovery mechanisms.”

A key driver behind this transformation has been China’s evolving role in the global silver supply chain. As one of the largest refiners and net importers of silver, China witnessed steady drawdowns in physical inventories throughout 2025, pushing stocks to decade-low levels. Proposed export licensing requirements starting January 1, 2026 further signal tighter control over outbound flows, restricting the availability of physical metal in global markets at a time when other inventory hubs are already under pressure.

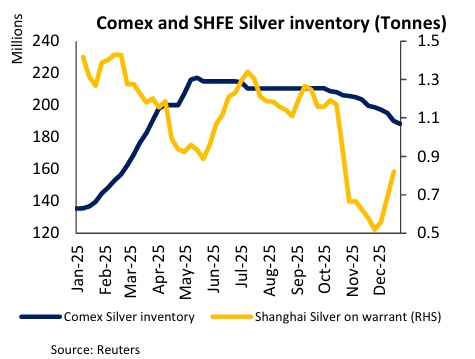

COMEX vs Shanghai (SHFE) Silver Inventories

An inventory comparison chart tracking COMEX registered stocks alongside Shanghai silver inventories highlights sustained drawdowns across both hubs through 2025. The parallel decline underscores a global shortage of deliverable metal rather than a regional imbalance.

As inventories tightened, traditional arbitrage mechanisms between global markets weakened.

Shanghai–COMEX Silver Price Spread

A dedicated chart in the report shows the persistent premium of Shanghai spot silver prices over COMEX futures, frequently ranging between $5 and $8. The report notes that this premium reflects the absence of sufficient physical supply to enforce price convergence, rather than temporary pricing inefficiencies.

Highlighting the mechanics of the market stress, Manav Modi, Commodities Analyst – Motilal Oswal Financial Services Ltd., said: “Persistent inventory drawdowns across key global hubs, weakening arbitrage between Shanghai and COMEX, and repeated delivery pressures have exposed the limited availability of deliverable silver. The sustained premium in physical markets reflects genuine supply tightness rather than temporary pricing inefficiencies.”

Stress within paper markets intensified in late 2025, when COMEX experienced a “vault drain crisis,” with over 60 percent of registered silver inventory claimed for delivery within just four trading days. This episode exposed the widening gap between outstanding futures positions and available physical metal for settlement.

Summarising the shift, Mr. Navneet Damani Head of Research – Commodities and Mr. Manav Modi Commodities Analyst, Motilal Oswal Financial Services Ltd., said “Silver’s 2025 rally is being shaped by real metal scarcity rather than speculative positioning. Physical deficits, policy-driven supply restrictions, and concentrated inventories are increasingly dictating prices, signalling a durable shift in how the silver market is priced and traded.”

The report notes that 2025 marked the fifth consecutive year of physical deficit in the silver market, with mine supply unable to match combined industrial and investment demand. In this environment, Motilal Oswal Financial Services Ltd. continues to maintain a buy-on-dips approach with a staggered investment strategy. While the initial target of $75 on COMEX has been achieved, the firm reiterates its target of $77 on COMEX, equivalent to Rs.2,46,000 on the domestic market, with further revisions dependent on evolving market conditions.

Above views are of the author and not of the website kindly read disclaimer