New Year 2026 - Top Picks by Motilal Oswal Financial Services Ltd

2026 Outlook

As we enter 2026, Indian equity markets are trading close to all-time highs, with the Nifty ending CY25 with gains of nearly 10% on a year-to-date basis. Broader markets displayed mixed trends, with midcaps showing relative resilience, while small-caps witnessed sharper bouts of volatility. After two years of a sharp rally, Nifty Midcap100 managed a modest ~5% return in 2025, while the Nifty Smallcap100 declined by ~6%. Following a year of consolidation marked by global uncertainties and earnings moderation, we expect 2026 to be a year of recovery and steady growth. Improvement in corporate earnings, supportive domestic policies and a revival in private sector investments are likely to drive market performance through the year. Additionally, any resolution of the tariff stalemate with the US could act as an important external catalyst for markets.

Key events in CY26 in CY2

Domestic Factors: Union Budget, government spending, RBI policy, FII trends.

Global factors: US-India Trade Agreement, US interest rates, geopolitical issues, etc.

Earnings & Valuation: Corporate earnings growth trend and valuations in broader market.

Valuation and Outlook:

Nifty climbed to record high of 26,325 in Dec’25, led by strong domestic flows and steady economic growth. From a valuation standpoint, the Nifty’s 1 year forward P/E stands at 21.5x, around 4% above its long-period average (LPA) of 20.8x. In comparison, broader market valuations remain elevated. The Nifty Midcap100 and Smallcap100 are trading at P/E multiples of 29x and 25x, representing premiums of ~26% and ~50% over their respective LPAs.

This suggests that large-cap valuations are relatively reasonable after recent consolidation, while midcap and small-cap stocks warrant a more selective approach. India’s long-term structural growth story remains intact, supported by favourable demographics, rising digital adoption, increasing financialisation of household savings and continued reform momentum. We believe the government’s ongoing policy initiatives will help reset the trajectory of corporate earnings over the medium term. We expect Nifty earnings growth to bounce to 9% in FY26E (from 1% in FY25) and further improve to ~15% in FY27E and FY28E

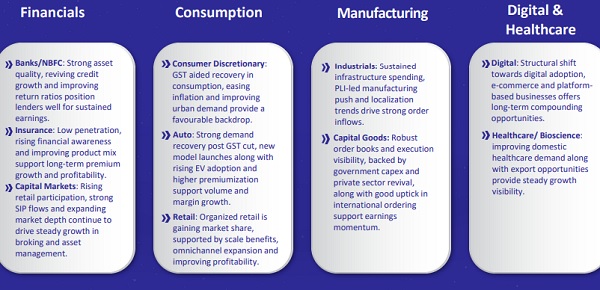

2026: Key Themes

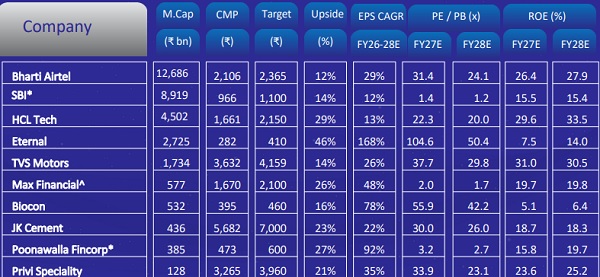

Top Picks – Valuation Summary

Top Picks - Rationale

Bharti Airtel

Bharti continues to deliver strong execution across mobility and digital infrastructure, supported by premiumization, ARPU expansion, broadband growth and Nxtra’s data centre scale-up, enhancing long-term cash flow visibility. Management’s focus on moderated capex and operating efficiency underpins healthy free cash flow generation and balance sheet strength, even as investments continue in network and digital platforms. We have a positive view, backed by consistent operational outperformance and multi-year earnings visibility from 5G rollout, broadband expansion and digital infrastructure, with consolidated revenue/EBITDA CAGR of 15%/18% over FY25–28

State Bank of India

SBI continues to exhibit resilience and market leadership, backed by its diversified customer franchise, strong balance sheet and improving asset quality, with GNPA/NNPA at low levels and healthy momentum across retail, SME and corporate lending. Credit growth remains robust at ~13% YoY, with management guiding for 12–14% loan growth and NIMs above 3%, supported by structural efficiency initiatives such as Project Saral and a strong corporate pipeline of ~INR7t. With improving return ratios and confidence in the durability of core earnings, we expect FY27E RoA/RoE of ~1.1%/15.5%, underpinned by resilient operations and sustained long-term growth prospects.

HCL Tech

HCL Tech’s growth continues to be driven by IT services and ER&D, with early traction in AI-led solutions (now ~3% of revenue); platforms such as AI Force and AI Factory are enhancing productivity and enabling non-linear growth. We expect HCLT to deliver a CAGR of 5.3%/7.2% in USD revenue/INR PAT over FY25-27, supported by large-deal rampups, AI adoption, and healthy client mining. HCLT remains the fastest-growing large-cap IT services firm with strong FCF generation and an all-weather portfolio.

Eternal

Eternal is witnessing strong revenue momentum as it shifts to an inventory-led model, driving sharp growth in net revenues and improving gross margins through full-value recognition and higher inventory ownership. Quick commerce (Blinkit) continues to scale rapidly, supported by store expansion and operational execution, while franchise and e-commerce segments are steadily increasing their share of overall revenues, enhancing diversification. Margin profile is gradually improving, with contribution and EBITDA margins inching up, reflecting early operating leverage despite continued investments in growth and marketing

TVS Motor

TVS Motor continues to outperform the industry, with strong festive-season retail growth, sustained demand momentum aided by GST rate cuts, and sharp improvement in domestic market share across 2W and EV segments. Export performance remains robust with broad-based growth across Africa and LATAM, while operating leverage and mix improvements are supporting gradual margin expansion. A healthy product launch pipeline underpins upgraded FY27 estimates, with revenue/EBITDA/PAT expected to grow at a CAGR of 21%/25%/29% over FY25–28E, supporting sustained return ratios

Max Financial Services

Max Financial maintains a better-than-industry APE growth trajectory. VNB margin witnessed a strong expansion owing to strong growth and a rise in the contribution of protection, non-par, and annuity businesses. The proprietary channel continues to drive growth across offline and online channels, while the bancassurance channel posted strong growth in non-Axis partnerships. The persistency trends improved across long-term cohorts. We expect VNB margins to improve to 25%/26%/26.5% over FY26–FY28, driven by stronger persistency across longterm cohorts, reinforcing the quality of growth

Biocon

Biocon acquired biosimilar business of Viatris to emerge as a leading global integrated company in the biologics segment. The commercial footprint of Viatris complemented Biocon product development/manufacturing capabilities. Biocon remains in good stead for a broad-based scale-up across biologics, generics and CDMO, driving strong earnings revival over FY26-28. Business prospects remain encouraging on the back of a) product launches (namely insulin aspart) in biologics segment and subsequent market share gain, b) scale-up of generics business, and c) growth/operating leverage in Syngene business

JK Cement

JK Cement continues to exhibit operational resilience despite near-term pricing pressures, supported by strong volume traction in central and south markets, effective cost control, and gradual premiumisation. Capacity additions, including the Jaisalmer integrated project and the Buxar grinding unit, are progressing as planned, providing visibility on sustained volume growth, efficiency gains and rising green energy adoption towards ~75% by FY30. We expect robust earnings compounding over FY25–28E, underpinned by growth visibility, timely capacity expansion and margin improvement potential, which supports our positive investment view.

Poonawalla Fincorp

Under new leadership, Poonawalla Fincorp aims to deliver its stated ambition of digitally enabled, multi-product retail platform with disciplined underwriting and strong risk management. New engines like Prime PL, gold loans, CV, consumer durables, and education loans are scaling rapidly, supporting ~50% AUM CAGR over FY25–28E. Deep investments in AI/ML across underwriting, collections, and governance are driving structural improvements. This digital transformation is expected to yield significant cost efficiencies with cost-to-income projected to fall from 51% (FY25) to ~42% by FY28E, supporting ROA expansion toward the 3–3.5% target. PFL is strengthening its granular, retail-centric portfolio while steadily increasing the share of secured products, supporting a sustained reduction in credit costs. We estimate PAT CAGR of 92% over FY26–28E, with ROA/ROE of 2.6%/20% by FY28E.

Privi Speciality Chemicals

Privi Speciality Chemicals, India’s largest aroma chemical exporter, is set to benefit from the global aroma chemicals market growing to USD 9.2bn by 2030. Planned capacity expansion from 48k MT to 66k MT by Mar’28 supports sustained growth. To strengthen its green chemistry portfolio, PRIVI plans to merge with Privi Fine Sciences, adding high-margin bio-based products like furfural and cyclopentanone. With capacity planned at 18k MT by FY27 and 36k MT by FY29, Privi enhances its sustainable innovation edge. We expect 27%/34% revenue/EBITDA CAGR over FY25–28, driven by core capacity expansion, new high-demand speciality products, and stronger partnerships with global customers such as Givaudan.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

More News

Bank Nifty support is at 52750 then 52500 zones while resistance at 53500 then 54000 zones ...