MCX Silver July is expected to correct further towards Rs 94,000 level as long as it trades below Rs 96,400 level - ICICI Direct

Bullion Outlook

• Gold is expected to correct further towards $3140 level on strong dollar and rise in US treasury yields. Further, demand for safe haven may continue to fade on growing optimism over trade deal between U.S. and its major trading partners. On top of it ease in geopolitical tension will push investors away from Bullion. Additionally, in light of easing trade tension, traders have dialed back expectation for rate cuts from US Federal Reserve this year. Market expects first cut of at least 25bps at central banks September meeting. Meanwhile, all yes will be on U.S. producer price index and retail sales data to see how Trump tariff policy affected inflation and consumption

• Spot gold is likely to slip further towards $3140 level as long as it stays below $3230 level. MCX Gold June is expected to slip towards Rs 91,500 level as long as it stays below Rs 93,200 level

• MCX Silver July is expected to correct further towards Rs 94,000 level as long as it trades below Rs 96,400 level.

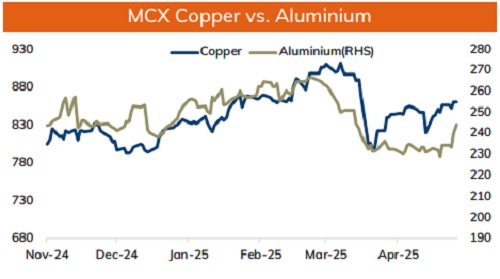

Base Metal Outlook

• Copper prices are expected to trade with positive bias on optimistic global market sentiments, persistent decline in LME inventories and expectation of improved economic data from U.S and Europe. Further, signs of improved demand from China and US-China trade truce will continue to support prices. Meanwhile, sharp upside would be capped on strong dollar

• MCX Copper May is expected to rise towards Rs 865 level as long as it stays above Rs 852 level. A break above ?865 level prices may rise further towards Rs 870 level

• MCX Aluminum May is expected to correct towards Rs 240 level as long as it stays below Rs 245 level. MCX Zinc May is likely to move south towards Rs 257 level as long as it stays below Rs 263 level.

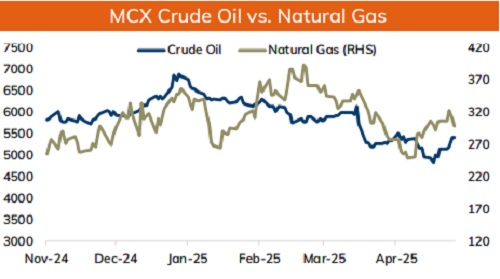

Energy Outlook

• NYMEX Crude oil is likely to correct further towards $61 on strong dollar. Further, surprise jump in weekly crude oil inventories last week has raised concerns about oversupply. Moreover, prices may dip on reports that Iran has signaled openness to nuclear deal with U.S, raising expectations that sanctions on Iranian oil exports would be eased by U.S. Additionally, all eyes will be on developments on Russia-Ukraine talks in Turkey. Meanwhile, investors will remain vigilant ahead of slew of economic data from Europe and US to gauge economic health

• MCX Crude oil June is likely to slip towards Rs 5250 level as long as it stays below ?5500 level. A break below Rs 5250 level prices may dip further towards Rs 5150.

• MCX Natural gas May is expected to slip further towards ?288 level as long as it stays below Rs 308 level.

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631