MCX Natural gas June is expected to move in the band of Rs 310 and Rs 330 level - ICICI Direct

Bullion Outlook

• Spot Gold is expected to face hurdle near $3350 and move lower towards $3275 on easing trade tension between US and China. Further, better than expected US job data would push the odds of early rate cut by the Fed. Meanwhile, investors will focus on key inflation numbers this week before the Fed meeting to get further clarity on the timing of rate cut. lingering geopolitical tension will bring safe haven appeal to the precious metal and limit its downside.

• Spot gold is hovering near the 20-day EMA at $3310, a move below would weaken it towards $33275. On the upside $3350 would act as immediate hurdle. MCX Gold Aug is expected to dip towards Rs 96,200 as long as it trades under Rs 98,000 level.

• Spot silver is expected to trade higher towards $36.50, as long as it holds the support of $33.50. MCX Silver July is expected to rise towards Rs 106,200 level, as long as it holds above Rs 103,500 level.

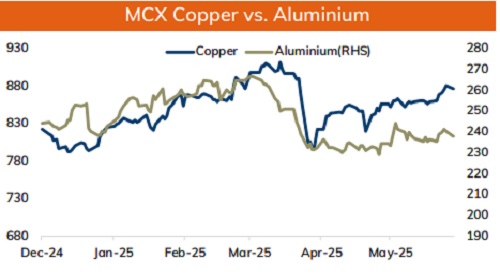

Base Metal Outlook

• Copper prices are expected to find its ground and trade higher on tighter supplies and growing optimism over US-China trade talk. A production set back in Chile this week and operation issues in Democratic Republic of Congo has sunk the supplies. In addition to that depleting LME inventory levels would support the red metal to trade higher. Meanwhile, sluggish demand growth in China may hurt it upside. In China deflation in the industrial demand persisted for more than 3 and half years, which might restrict it upside.

• MCX Copper June is expected to rise back towards Rs 880 level as long as it holds the support near $870 level. On the contrary, a move below Rs 870, would bring further correction in price.

• MCX Aluminum June is expected to find the floor near Rs 236 and rebound towards Rs 241 level. MCX Zinc June is likely to move south towards Rs 250 level as long as it stays below Rs 256 level.

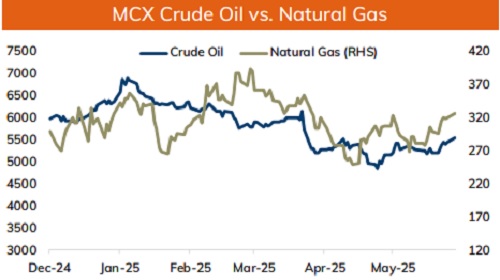

Energy Outlook

• Crude oil is likely to extend its gains and rally towards $65 mark amid supply concerns and geopolitical tension between Russia and Ukraine. Further hopes of trade deal between US and China could provide support to oil prices. Moreover, drop in US oil rigs to its lowest since October 2021 would likely to support prices to hold its gains. Meanwhile, rising supply from OPEC+ would restrict any major upside.

• On the data front a strong call base at $65 would act as major hurdle for now. As long as it resists prices are likely to consolidate in the band of $62 and $65 per barrel. MCX Crude oil June is likely to face stiff resistance near Rs 5600 level and move in the band of ?5400 and ?5600 level.

• MCX Natural gas June is expected to move in the band of Rs 310 and Rs 330 level. Only a move above Rs 330 it would turn bullish and rise towards Rs 340.

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631