MCX Zinc March is likely to slip towards Rs.265, as long as it stays under Rs.270 - ICICI Direct

Metal’s Outlook

Bullion Outlook

* Spot Gold is expected to find support near $2830 per ounce and rebound towards $2900 amid rising fears over global trade war. Tariffs of Mexico and Canada will go into effect on Tuesday which would escalate trade war scenario and bring safe haven appeal. Meanwhile, easing US inflation numbers has increased the chances of two rate cuts this year, which could provide some support to the precious metal. On the other hand, expectation of improved manufacturing activity in US could check its upside

* Gold price is hovering below the 20 day EMA at $2880, which could act as key hurdle for now. On the downside $2830 would be seen as next support. An unwinding in net long position indicates profit booking. MCX Gold April is expected to consolidate in the band of Rs.83,800, and ?85,000 level. Only below Rs.83,800 it would turn weaker towards Rs.83,000.

* MCX Silver May is expected to face resistance near Rs.95,200 and move lower towards Rs.93,200.

Base Metal Outlook

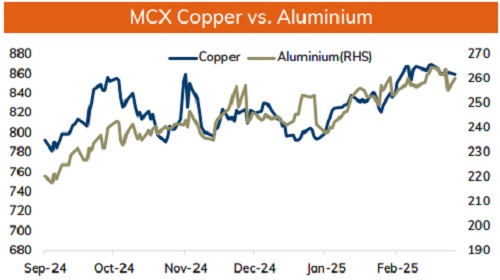

* Copper prices are expected to remain volatile amid tariff threats. Prices may find support on forecast of improved manufacturing activity in US. Further, improvement in manufacturing activity in China would also support metal prices to regain its strength. Meanwhile, global trade war concerns and ample stocks in China would restrict any major up move in the base metals. MCX Copper March is expected to consolidate in between ?856 and ?870. Only a move below ?856, it would turn weaker towards ?850.

* MCX Aluminum March is expected to consolidate in between Rs.262 level and Rs.257 level. Expectation of improved manufacturing activity in US and China would provide support to the base metals.

* MCX Zinc March is likely to slip towards Rs.265, as long as it stays under Rs.270.

Energy Outlook

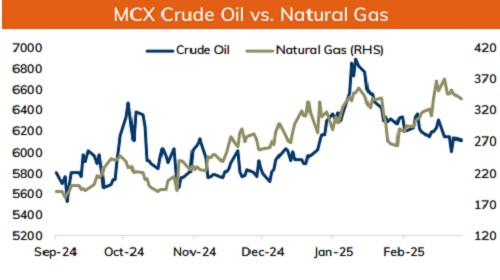

* NYMEX Crude oil is likely to hold support near $69 and move higher towards $71.50 amid lingering peace talk on Russia and Ukraine. Uncertainty over the deal between US and Ukraine has lowered the chance of peace deal. Meanwhile, trade war fear and slow down in US economy would restrict the upside in oil price. Meanwhile, sanctions on Iran and supply concerns form Venezuela would limit the downside in oil prices.

* On the data front, latest CFTC data reported further decline in net longs which indicates weaker bias. In option chain, OI has increased near $68 which could act as major support for now. But, a strong call base near 72 would act as immediate hurdle. MCX Crude oil March is likely to move in the band of Rs.6000 and Rs.6200.

* MCX Natural gas March is expected to move lower towards Rs.325, as long as it trades under ?348. Forecast of warmer US weather would reduce heating demand. Further, improved US production also likely to weigh.

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631