MCX Natural gas July is expected to move higher towards Rs 327 as long as it trades above Rs 305 mark - ICICI Direct

Metal’s Outlook

Bullion Outlook

• Spot Gold is expected to trade lower amid trade deal hopes and improved risk appetite. Growing bets of a trade deal between US and China would ease the safe haven demand in the bullions. Additionally, reduced geopolitical risk in the Middle East could curb investment demand as the ceasefire between Israel and Iran continues to hold. Recent CFTC data indicates a minor liquidation in the net longs last week.

• Spot gold is expected to move lower towards $3240, as long as it trades under $3330. On daily charts, it has moved below the 50-day Ema support at $3280. Furthermore, addition of OI in ATM and OTM call strike indicates price to face stiff resistance near $3300. On the downside, 3200 strike put hold maximum OI which might act as strong support. MCX Gold Aug is expected to face hurdle near ?96,500 and move lower towards ?94,050.

• MCX Silver July is expected to move lower towards Rs 103,400, as long as it trades under Rs 106,800.

Base Metal Outlook

• Copper prices are likely to find support and move higher amid softer dollar and tighter physical market. Easing geopolitical tension in the Middle East has improved risk sentiments and it’s likely to support prices. Additionally, a potential trade deal between US and China would improve risk appetite and support prices. Further, depleting inventory levels in LME and Widening LME copper backwardation clearly indicates tightness on the market. Meanwhile, weaker set of manufacturing PMI from China would restrict any major upside in the red metal.

• MCX Copper July is expected to move higher towards Rs 896, as long as it trades above Rs 885 level. Only above Rs 896 it would open the doors towards Rs 915.

• MCX Aluminum July is expected to rise towards Rs 250 level, as long as it holds above Rs 246. A move above Rs 250 it would rally towards Rs 252. MCX Zinc July is likely to move higher towards Rs 262 level as long as it holds above Rs 257

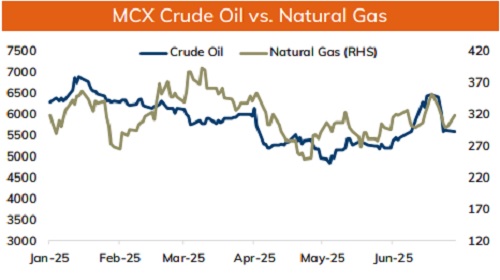

Energy Outlook

• Crude oil is likely to move lower on easing Middle east tension and growing prospects of more OPEC+ supply. Ceasefire between Israel and Iran would improve oil supply from the Middle East countries Further, growing prospects of another output hike in August by OPEC+ nations would improve supply outlook. Meanwhile, a drop in US oil rigs to its lowest since October 2021 may limit the downside. Additionally, improved risk sentiments due to the trade deal optimism could provide support to prices.

• On the data front, fresh addition of OI in OTM call 68 strike indicates prices to face stiff resistance. On the downside 20-day EMA at $64 would act as key support. A break below $64 would weaken it towards $62. MCX Crude oil July is likely to move lower towards Rs 5400 as long as it trades under Rs 5750 level.

• MCX Natural gas July is expected to move higher towards Rs 327 as long as it trades above Rs 305 mark.

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631