Gold steadied near $3,980 after falling below $4,000 earlier - HDFC Securities Ltd

GLOBAL MARKET ROUND UP

Gold steadied near $3,980 an ounce after slipping below $4,000 in the prior session, as investors took profits following a record run. The metal had surged to an all-time high of $4,059.31 on Wednesday but showed signs of being overbought.

Silver extended its retreat after hitting $51.24 — a level unseen since 1980 — though it's still up 70% this year, far outpacing gold. The rally in precious metals reflects growing caution over frothy equity markets, U.S. fiscal strain, and concerns over Fed independence.

Oil steadied after its sharpest weekly drop, buoyed by hopes of easing Middle East tensions and improving supply prospects. Signs of diplomatic progress could strip remaining war premiums from prices, as the market braces for a potential surplus by year-end. Meanwhile, OPEC+ approved a 137,000 barrel-per-day output hike for November, aiming to regain lost market share.

Copper slipped after nearing record highs, as attention shifted to supply disruptions. The metal retreated following a 1.9% surge on Thursday, sparked by China’s return from a weeklong break. Prices briefly hit $11,000, close to May 2024’s all-time peak of $11,104.50. Meanwhile, Chile’s Codelco posted its weakest monthly output in decades, grappling with setbacks from a July collapse at its El Teniente mine and ongoing production woes.

Asian stocks slipped as investors grew wary of overheated tech valuations following this year’s strong rally. The S&P 500 fell to around 6,735, and US 10-year yields rose three basis points. Meanwhile, the dollar eased slightly after a four-day climb, though it remains on track for its best weekly performance since mid-November 2024. Investors are focused on the recent strength of the dollar.

Gold

* Trading Range: 121000 to 124000

• Intraday Trading Strategy: Buy Gold Dec Fut at 119600 SL 119200 Target 120200

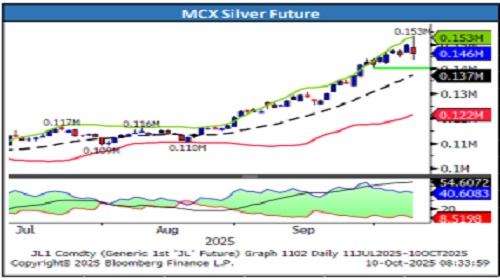

Silver

* Trading Range: 144200 to 149500

* Intraday Trading Strategy: Sell Silver Dec Fut below 144000 SL 145200 Target 142100

Crude Oil

* Trading Range: 5350 to 5590

* Intraday Trading Strategy: Sell Crude Oil Oct Fut between 5480-5510 SL 5540 Target 5390

Natural Gas

* Trading Range: 276 to 310

* Intraday Trading Strategy: Sell Natural Gas Oct Fut at 290 SL 297 Target 277

Copper

* Trading Range: 980 to 1020

* Intraday Trading Strategy: Sell Copper Oct Fut below 1000 SL 1015 Target 980

Zinc

* Trading Range: 275 to 278

* Intraday Trading Strategy: Buy Zinc Oct Fut at 280-279 SL 277 Target 285

Please refer disclaimer at https://www.hdfcsec.com/article/disclaimer-1795

SEBI Registration number is INZ00017133