Commodity Morning Insights 16th October 2025 by Axis Securities Ltd

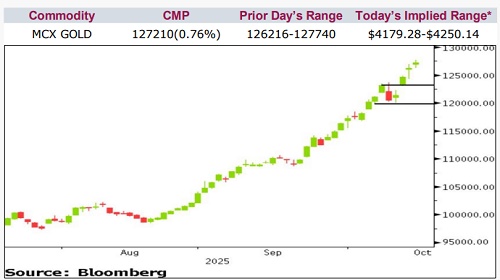

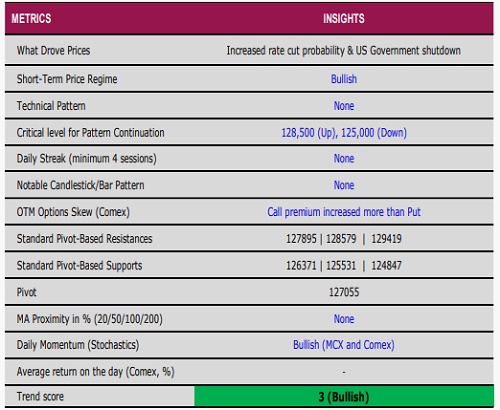

Comex Gold extended its winning streak for the fourth consecutive session, scaling above the $4,200 mark for the first time and closing over 1% higher. Mounting concerns over the U.S. government shutdown, rising expectations of rate cuts, and renewed U.S.-China trade tensions prompted investors to shift towards safe-haven assets, boosting bullion’s appeal

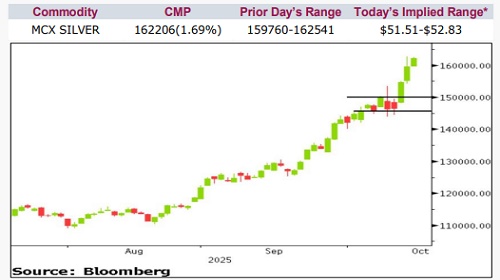

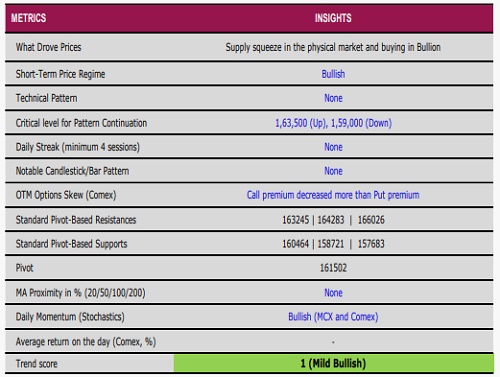

Comex Silver surged over 3% in the previous session, breaching the $53 level for the first time in history. A tightening physical market, particularly in London and India, added to the bullish momentum. The near-term outlook remains constructive as long as the $50 support zone holds firm

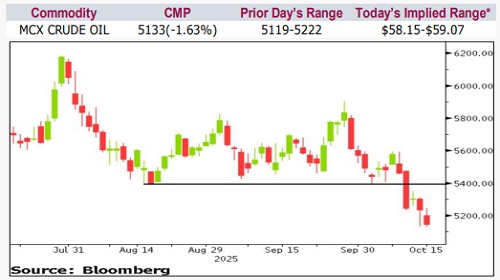

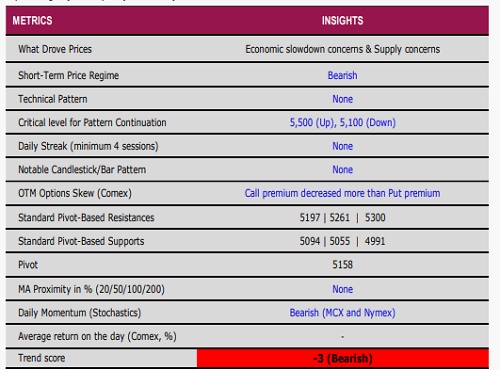

Nymex Crude Oil ended almost flat, recovering from multi-week lows after U.S. President Donald Trump announced that Indian Prime Minister Narendra Modi had agreed to suspend Russian oil imports. The statement helped ease fears of an impending supply glut, which had been amplified by the IEA’s projection of a surplus of up to 4 Mn barrels per day by 2026

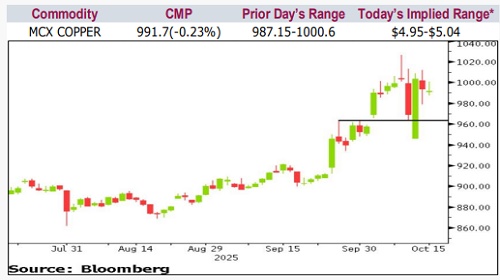

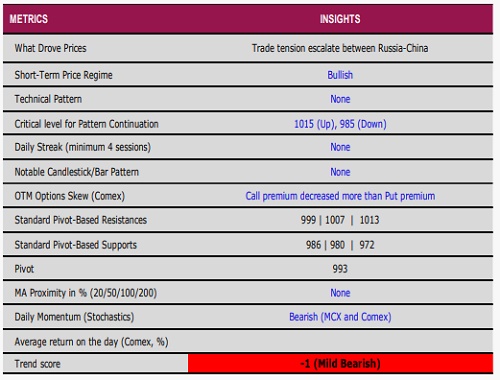

Comex Copper eased by more than 0.5%, extending its decline from the previous day amid escalating U.S.-China trade tensions that clouded the global demand outlook. Despite the short-term weakness, the broader

trend remains underpinned by supply constraints and steady industrial demand. Chilean miner Codelco has cautioned that its El Teniente operation will run below capacity in the coming months, potentially tightening global copper availability

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633