2025-12-12 11:58:14 am | Source: Axis Securities Ltd

Commodities Daily Insights 12th December 2025 by Axis Securities Ltd

- Comex Gold extended its winning streak in the last session, surging past the major near-term resistance at the $4,240 level. The metal gained more than 1% after the Fed delivered the expected 25 bps rate cut, while Chair Powell’s remarks were interpreted as modestly dovish. This prompted traders to increase the odds of further easing, even as the policy statement and dot plot kept the pace of further cuts conditional. Meanwhile, the Fed also announced plans to purchase about $40 Bn of short-dated Treasury bills to ease money market strains, a measure that should cap upward pressure on short yields and support precious metals

- Silver also extended its winning streak, climbing to a new 52-week high after decisively breaking above the $64 level. The 25 bps rate cut, supply squeeze, stimulus news from China and increased ETF inflow boosted the appeal for the white metal. We expect silver to trade with a positive bias as long as it holds above the $60 level

- Nymex Crude Oil dropped nearly 2%, giving back the previous session's gains as oversupply concerns outweighed geopolitical factors, including the U.S. seizure of a sanctioned oil tanker off Venezuela. Although the International Energy Agency trimmed its supply surplus forecast for the first time since May, it still expects supply to exceed demand by 3.8 Mn barrels a day in 2026

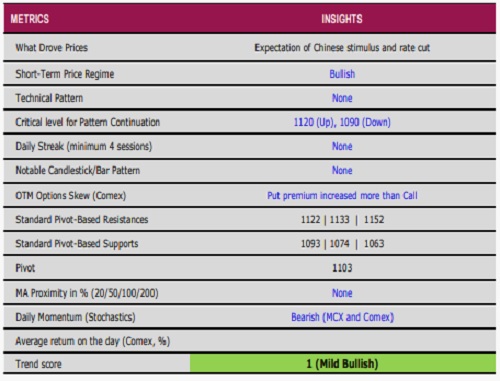

- Comex Copper rose to a multi-week high, gaining close to 1.5% as prices rallied sharply to record highs following the Federal Reserve’s widely expected 25 bps rate cut. Copper futures on the London Metal Exchange advanced 2% to $11,785 a metric ton, after reaching $11,800.5 a ton earlier in the session. A lower interest-rate environment typically supports economic activity and boosts demand for industrial metals. Prices are also buoyed by fears of supply shortages due to a series of mine disruptions and heavy stockpiling in the U.S. amid concerns that the Trump administration could impose tariffs on refined metal imports next year

- Natural Gas Futures tumbled almost 10% as forecasts show warmer-than-normal conditions through 26th December, curbing heating demand. Production in the Lower 48 climbed to 109.7 bcfd so far in December, edging above November’s record and boosting storage to about 3% above seasonal norms. Still, last week’s 177 bcf storage withdrawal was unusually large, reflecting the brief spell of extreme cold.

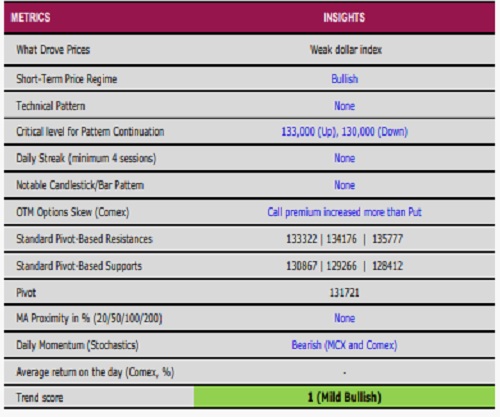

Gold

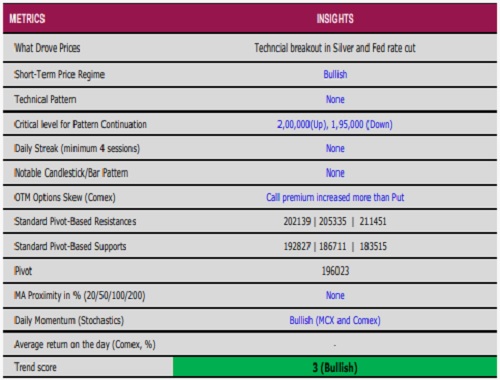

Silver

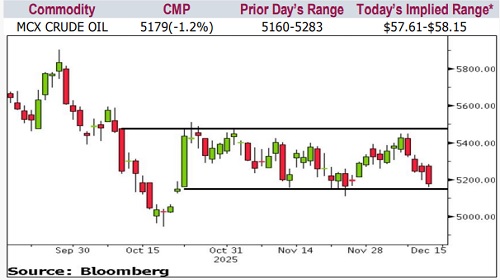

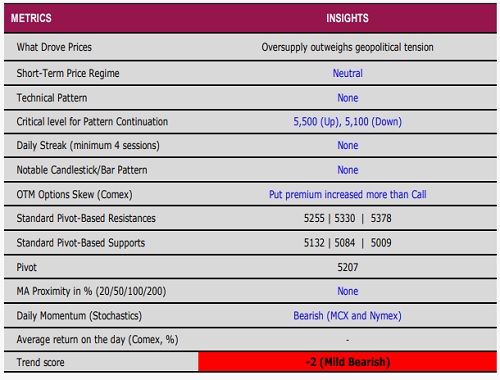

Crude Oil

Copper

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633

Disclaimer:

The content of this article is for informational purposes only and should not be considered financial or

investment advice. Investments in financial markets are subject to market risks, and past performance is

not indicative of future results. Readers are strongly advised to consult a licensed financial expert or

advisor for tailored advice before making any investment decisions. The data and information presented

in this article may not be accurate, comprehensive, or up-to-date. Readers should not rely solely on the

content of this article for any current or future financial references.

To Read Complete Disclaimer Click Here

Latest News

Government signs Rs 5,083 crore deals to acquire he...

India`s steel sector aims to reach 300 million tonne...

Gujarat`s `Miracle Boy`boosts dairy yields with reco...

India can play key role as world`s manufacturing par...

`Farmers step onto global stage`: CM Himanta Biswa S...

India`s cleantech hiring surges 56 pc in last 2 years

Silver Update as 03rd March 2026 by Amit Gupta, Kedi...

Adani Group`s $100 billion plan for renewable-powere...

UIDAI completes Aadhaar biometric updates for 1.2 cr...

Canada bets big on India`s growth by crucial $2.6 bi...