MCX Natural gas Feb is expected to slip further towards 265 level as long as it stays below 280 level - ICICI Direct

Bullion Outlook

* Spot gold is likely to face stiff resistance near $2790 level on strong dollar and rise in US treasury yields ahead of US Federal Reserve first monetary policy this year, where central bank is likely to keep its benchmark overnight interest rate in the 4.25%-4.50% range. More focus will be on statements to get clarity on future rate trajectory. Fed chair Powell is likely to strike cautious tone and keep Feds options open so that it provides policymakers time to assess impact of US President Donald Trump administration polices. Meanwhile, uncertainties surrounding US President Donald Trump proposed tariffs will increase demand for safe haven

* Spot gold is likely to face stiff resistance near $2790 level and slip back towards $2740 level. MCX Gold February is expected to slip back towards Rs.79,700 level as long as it stays below Rs.80,500 level

* Spot Silver is likely to face stiff resistance near $30.80 level and slip back towards $29.80. MCX Silver March is expected to slip back towards Rs.89,800 level as long as it trades below Rs.92,500 level

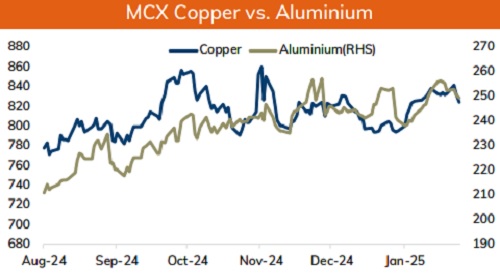

Base Metal Outlook

* Copper prices are expected to trade with negative bias on strong dollar and rise in LME inventories along with decline in cancel warrants. Further, escalating tariffs threat from US President Donald Trump will increase the risk of raising costs for manufacturers dampening demand. Additionally, fresh tariffs warning from US President Donald Trump could disrupt global commodity trade and ignite trade war, hurting global economic growth. Traders will also remain cautious ahead of the February 1 deadline for the first round of tariffs targeting China, Mexico, and Canada.

* MCX Copper February is expected to slip towards Rs.818 level as long as it stays below Rs.835 level. A break below Rs.818 level copper prices may slip further towards Rs.815 level

* MCX Aluminum Feb is expected to face stiff resistance near Rs.250 level and slip further towards Rs.245 level. MCX Zinc Feb is likely to slip towards Rs.262 level as long as it stays below Rs.268 level

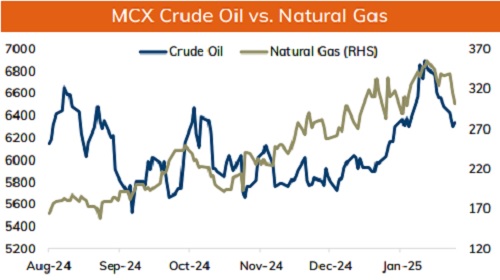

Energy Outlook

* NYMEX Crude oil is expected to trade with negative bias and slip further towards $72.50 level on strong dollar, forecast for warmer than normal temperatures and projection of rise in US crude oil inventories. Further, disappointing economic data from China fueled concerns that weakness in economy will keep its energy demand depressed. Moreover, US President Donald Trump fresh tariffs threat has raised concerns over trade war, hurting global economic growth and denting demand for oil. Additionally, all eyes will be on monetary policy outcome of major central banks, like Federal Reserve and the European Central Bank, as decision weighs on economic growth and oil demand expectations

* NYMEX Crude oil is likely to slip towards $72.50 level as long as its stays below $74.50 level. MCX Crude oil Feb is likely to slip towards Rs.6200 level as long as it stays below Rs.6450 level.

* MCX Natural gas Feb is expected to slip further towards 265 level as long as it stays below 280 level.

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631