MCX Natural gas Dec is expected to rise towards Rs460 level as long as it stays above Rs436 level - ICICI Direct

Metal’s Outlook

Bullion Outlook

* Spot Gold is likely to hold its gains and trade with the positive bias towards $4250 level on weak dollar and softening of US treasury yields. Further, prices may rally amid growing probability of December rate cut. As per CME Fed-Watch tool traders are now pricing almost 89% chance of a rate cut in December, up from 84% a week ago. Moreover, prices may get support on safe haven buying and strong central bank demand. Additionally, concern over Fed independence resurfaced after White House National Economic Council Director Kevin Hassett emerged as the frontrunner to serve as the next Fed chair. Furthermore, weakness in the labor market would also provide support to prices.

* MCX Gold Feb is expected to rise towards Rs131,500 level as long as it stays above Rs129,500 level.

* MCX Silver March is expected to rise towards Rs185,000 level as long as it stays above Rs178,400 level. A move above Rs185,000, would open the doors towards Rs186,800.

Base Metal Outlook

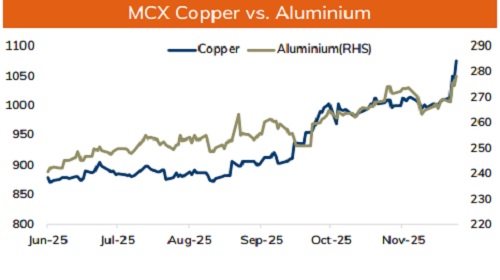

* Copper prices are expected to hold its gains and move higher on concerns over supply shortage. A drop in Chilean production and expectation of drop in production from Kamoa-Kakula complex in the Democratic Republic of Congo would hurt global supplies. Moreover, depleting inventory levels in LME, which hit its lowest since July has heightened supply concern. Further, producers have also announced plans to charge record premiums to supply customers in Europe and Asia next year, with buyers in effect compensating them for the additional profits they could make selling to the US.

* MCX Copper Dec is expected to hold support near Rs1060 move higher towards Rs1090 level. Only break below Rs1060 level it may fall towards Rs1050-Rs1045 level.

* MCX Aluminum Dec is expected to rise towards Rs280 level as long as it stays above Rs274 level. MCX Zinc Dec is likely to move in the wide range of Rs305 level and Rs310 level. Only above Rs310 it would open the doors towards Rs314.

Energy Outlook

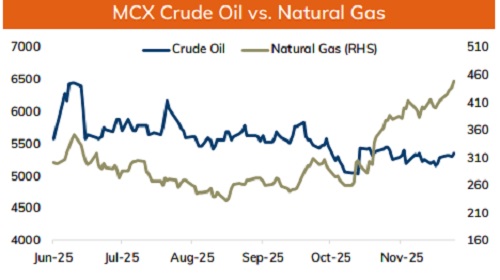

* Crude oil is likely to hold support near $58 per barrel and move higher towards $60 on escalating geopolitical risks. The potential for a further delay in the Russia-Ukraine peace deal was exacerbated by recent attacks on Russian oil infrastructure. Additionally, stalled negotiations, could jeopardize oil supplies from Russia. Furthermore, tensions between US and Venezuela present another risk to global supplies. Prices are likely to receive additional support from improved risk sentiments, driven by growing prospects of a US Federal Reserve interest rate cut next week.

* MCX Crude oil Dec is likely to hold support near Rs5240 level and move higher towards Rs5400 level. Only a move above Rs5400 it would turn bullish towards Rs5500.

* MCX Natural gas Dec is expected to rise towards Rs460 level as long as it stays above Rs436 level. Colder US weather forecast would boost heating demand.

Please refer disclaimer at https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631

More News

Buy Jeera Mar @ 22200 SL 21900 TGT 22500-22700. NCDEX - Kedia Advisory