MCX Gold Feb is expected to slip towards Rs 141,500 level as long as it stays below Rs 144,000 level - ICICI Direct

Metal’s Outlook

Bullion Outlook

* Spot Gold is likely to trade with the negative bias and slip further towards $4550 level on strong dollar and rise in US treasury yields. Further, better than expected economic data from US cemented expectations that US Federal Reserve will keep rates on hold for the next several months. Moreover, improving labor data and hawkish comments from Fed officials have pushed back expectations for next rate cut to June. Additionally, demand for safe haven may ease as US President Donald Trump said he has no plans to fire Fed Chair Powell and signs of easing tension between US and Iran. Meanwhile, strong central bank buying would support prices. Poland’s central bank governor Adam said wants to raise its reserves to 700 tons which is currently 550 tons

* MCX Gold Feb is expected to slip towards Rs 141,500 level as long as it stays below Rs 144,000 level.

* MCX Silver March is expected to slip towards Rs 277,000 level as long as it stays below Rs 293,000 level.

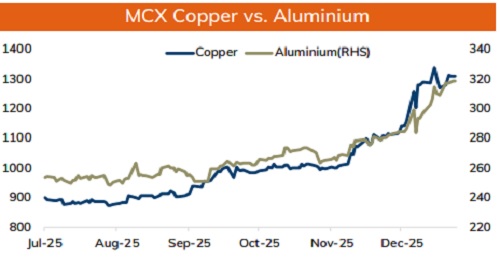

Base Metal Outlook

* Copper prices are expected to trade with a negative bias amid strong dollar and as US President Donald Trump refrained from imposing new tariff on critical minerals. Instead, said he would negotiate agreements with foreign nations to ensure adequate supplies of critical minerals. Further, prices may slip on weak demand from China. The Yangshan copper premium, a gauge of Chinese consumers' appetite for imported copper, declined to $38 a ton, down from above $50 by the end of 2025. Meanwhile, sharp downside may be cushioned on supply concerns amid series of mine disruption and recurring protest. Additionally, better than expected economic data from US would provide some cushion to prices

* MCX Copper Jan is expected to slip towards Rs 1280 level as long as it stays below Rs 1325 level. A break below Rs 1280 level may open doors for Rs 1270-Rs 1265 level

* MCX Aluminum Jan is expected to slide towards Rs 314 level as long as it stays below Rs 321 level. MCX Zinc Jan is likely to face stiff resistance near Rs 320 level and slip towards Rs 314 level

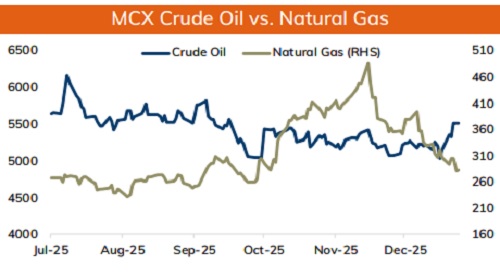

Energy Outlook

* NYMEX Crude oil is likely to trade with negative bias and slip towards $58 level on supply glut. Further, risk premium may lessen as concerns over potential military action against Iran and oil supply disruptions eased after U.S President Donald trump said he had been told that killings during Iran’s crackdown on protests were easing. Additionally, positive call between Trump and Venezuela’s acting President raised the expectation of stability and more oil leaving Venezuela. Furthermore, rise in US crude oil and fuel stockpiles signals weak demand. Moreover, strong dollar may weigh on oil prices

* MCX Crude oil Feb is likely to slip further towards Rs 5250-Rs 5200 level as long as it stays below Rs 5480 level.

* MCX Natural gas Jan is expected to slip further towards Rs 270 level as long as it stays below Rs 300 level

Please refer disclaimer at https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631