MCX Gold Feb is expected to rise towards Rs.131,500 level as long as it stays above Rs.129,500 level - ICICI Direct

Metal’s Outlook

Bullion Outlook

* Spot Gold is likely to hold its gain and trade with the positive bias towards $4250 level on weak dollar and strong investment demand. Further, prices may rally amid growing probability of December rate cut. As per CME Fed-Watch tool traders are now pricing almost 86% chance of a rate cut in December and two mare rate cuts in the coming year. Additionally, concern over Fed independence resurfaced after White House National Economic Council Director Kevin Hassett emerged as the front-runner to serve as the next Fed chair. Furthermore, prices would get support on addition of fresh net longs in the latest CFTC report to 204.7k from 176.6k.

* MCX Gold Feb is expected to rise towards Rs.131,500 level as long as it stays above Rs.129,500 level.

* MCX Silver March is expected to rise towards Rs.185,000 level as long as it stays above Rs.179,000 level. A move above Rs.185,000, would open the doors towards Rs.186,800.

Base Metal Outlook

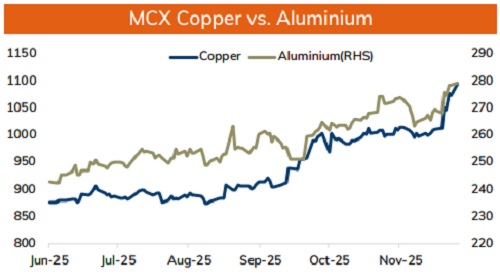

* Copper prices are expected to hold their gains and move higher amid concerns over supply shortage. These worries are heightened by depleting inventory levels in the LME, which have hit their lowest point since July. Furthermore, investors will remain cautious over growing speculation on higher import tariffs on refined copper by US in the coming year 2026. Meanwhile investors will eye on trade balance numbers from China and new loan numbers to get further clarity in price trend.

* MCX Copper Dec is expected to hold support near Rs.1070 and move higher towards Rs.1100 level. Only break below Rs.1070 level it may fall towards Rs.1060-Rs.1050 level.

* MCX Aluminum Dec is expected to rise towards Rs.284 level as long as it stays above Rs.275 level. MCX Zinc Dec is likely to move higher towards Rs.314 level as long as it stays above Rs.305 level.

Energy Outlook

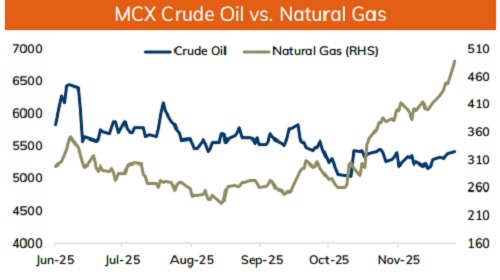

* Crude oil is likely to hold support near $59 per barrel and move higher towards $62 on escalating geopolitical risks. Recent attacks on Russian oil infrastructure may hinder peace talks, raising concerns over the stability of Russian oil supplies. Prices are likely to receive additional support from improved risk sentiments, driven by growing prospects of a US Federal Reserve interest rate cut next week. Meanwhile, investors will eye on key economic numbers from China and US to get more clarity.

* MCX Crude oil Dec is likely to hold support near Rs.5280 level and move higher towards Rs.5580 level.

* MCX Natural gas Dec is expected to hold the support near Rs.455 level and move higher towards Rs.480 level. Colder US weather forecast would boost heating demand.

Please refer disclaimer at https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631