MCX Gold Dec is expected to rise towards Rs.122,000 level as long as it stays above Rs.120,000 level - ICICI Direct

Metal’s Outlook

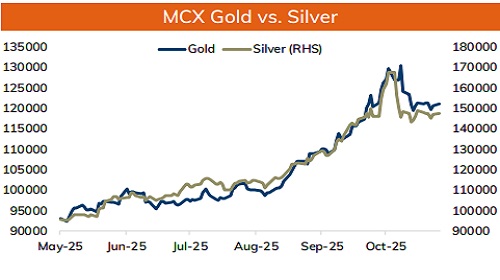

Bullion Outlook

* Spot Gold is likely to rise towards $4080 level amid weakness in dollar and softening of US treasury yields across curve. Further, recent batch of data from US raised concerns over economic slowdown, boosting hopes for additional monetary easing by the Federal Reserve. As per CME FedWatch tool traders are now pricing a 67% chance of a rate cut in December, up from about 63% weak ago. Further, demand for safe haven may increase on ongoing concerns over prolonged U.S. government shutdown and uncertainty over the legality of tariffs. Market fears that longer shutdown may hurt US economy, giving more room for Fed to cut interest rates. Additionally

* MCX Gold Dec is expected to rise towards Rs.122,000 level as long as it stays above Rs.120,000 level

* MCX Silver Dec is expected to rally towards RS.150,000 level as long as it stays above Rs.146,000 level.

Base Metal Outlook

* Copper prices are expected to trade with a negative bias amid risk aversion in the global markets and disappointing economic data from US and China. Further, worries over demand in top metal consumer China will hurt prices. Yangshan copper premium, a gauge of China's appetite for importing copper dropped to $35 a ton from $58 in late September. Additionally, weak trade data from China would weigh on prices, with October exports unexpectedly falling 1.1% and import growth slowing sharply to 1%. Official data showed China’s copper imports dropped in October. Copper imports slid to 438,000 metric tons in October from 485,000 tons a month earlier, a 9.7% drop. Meanwhile, sharp fall may be cushioned on fears that Beijing would target copper refining industry in its push to curb overcapacity

* MCX Copper Nov is expected to slip towards Rs.994 level as long as it stays below Rs.1010 level.

* MCX Aluminum Nov is expected to rise towards Rs.274 level as long as it stays above Rs.270.50 level. MCX Zinc Nov is likely to move north towards Rs.305 level as long as it stays above Rs.300.50 level

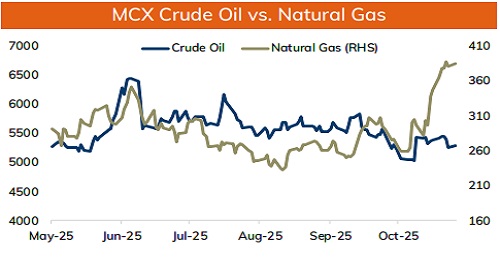

Energy Outlook

* Crude oil is likely to trade with negative bias and slip back towards $59.50 level on concerns over supply glut and risk aversion in the global markets. Moreover, investors fear that longer the US government shutdown is maintained, more likely the US economy will suffer denting demand for crude oil. Additionally, U.S. Federal Aviation Administration ordered airlines to cut thousands of flights because of the shortage of air traffic controllers, hurting fuel demand. Meanwhile, sharp fall in prices would be cushioned on weak dollar and sanctions on Russia and Iranian oil are disrupting supplies to largest importers. Moreover, as per customs data China’s crude imports in October rose 2.3% from September and were up 8.2% from a year earlier at 48.36 million tons

* MCX Crude oil Nov is likely to slip towards RS.5220 level as long as it stays below RS.5420 level.

* MCX Natural gas Nov is expected to rise towards RS.400 level as long as it stays above RS.378 level.

Please refer disclaimer at https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631