MCX Crude oil Jan is likely to consolidate in the band of Rs.5100 and Rs.5250 level - ICICI Direct

Metal’s Outlook

Bullion Outlook

* Spot gold is expected to move higher today, primarily driven by a surge in safe-haven demand due to fresh geopolitical tensions and a weaker US dollar. Fresh geopolitical conflict has increased market instability, pushing investors towards gold as a safe-haven asset to protect their wealth. In a massive escalation of tensions, the United States conducted a large-scale military operation in Venezuela on January 3, 2026, capturing President Nicolás Maduro. Prices would also get support from increasing prospects of further monetary policy easing from the US Fed. As per the CME Fed-watch tool March rate cut probability gone above 50%. Further, Spot gold is expected to move towards $4425, as long as it holds above $4330 mark.

* MCX Gold Feb is likely to move in a wider range of Rs.134,500 and Rs.137,200 with bullish bias. A move above Rs.137,200, it would rise towards Rs.139,000.

* MCX Silver March is expected to hold support at Rs.234,000 and rise towards Rs.246,000. A move above Rs.246,000 would extend its gains towards Rs.250,000

Base Metal Outlook

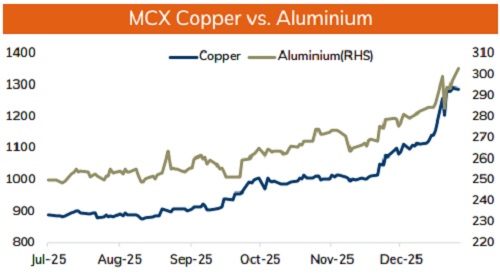

* Copper prices are expected to hold its ground and move higher, driven by a convergence of structural supply deficits and unprecedented demand from new-age industries. Production remains constrained by a major outage at Freeport's Grasberg mine in Indonesia and disruptions at Chile's El Teniente. Further, better than expected manufacturing activity from China would also bring optimism in prices. Rising copper premiums and planned output reduction for 2026 by China's leading copper smelters would support prices to move higher.

* MCX Copper January is expected to hold support near Rs.1275 and move higher towards Rs.1325 level. Only move below Rs.1275 level it may fall towards Rs.1250 level.

* MCX Aluminum January is expected to hold support near Rs.297 and move towards Rs.305 level. Only a move below Rs.297 it would slip towards Rs.289-290 zone. MCX Zinc is likely to remain the band of Rs.303 and Rs.312. Only a move below Rs.303 it would turn bearish towards Rs.300.

Energy Outlook.

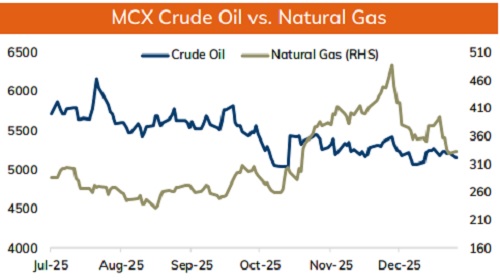

* NYMEX crude oil is expected to face hurdle near $58 per barrel and move lower towards $56 on sign of supply improvement and higher inventory levels in US. Meanwhile, prices will remain volatile due to the ongoing geopolitical tensions. The US operation in Venezuela on the weekend introduced significant short-term uncertainty to the market, which can sometimes lead to price spikes. However, the prevailing view is that while the situation is a major geopolitical event, it is unlikely to lead to a sustained price increase due to existing market fundamentals.

* MCX Crude oil Jan is likely to consolidate in the band of Rs.5100 and Rs.5250 level. Only move below Rs.5100 it would slip towards Rs.5000.

* MCX Natural gas Jan is expected to face hurdle near Rs.340 and move lower towards Rs.310 level. Forecast of warmer than expected weather in US could hurt its demand outlook.

Please refer disclaimer at https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631