MCX Copper February has breached the multiple resistance at Rs. 862 and rallied towards Rs.870 - ICICI Direct

Bullion Outlook

* Gold is expected to hold above $2835 and move higher towards $2890 on safe haven demand as most investors turned cautious due to Trump’s trade policies. Recent announcement from Trump administration to hike tariffs on Aluminium and steel imports by 25% has heightened tension. Further, increasing investment demand in China would also support the bullions to scale new highs. Meanwhile, a stronger dollar and diminishing prospects of 2 rate cuts in this year amid fiscal policy uncertainty would restrict any major upside in the yellow metal.

* MCX Gold April is expected to hold the support at Rs.84,200 level and move higher towards Rs.85,800 level. Only a move below Rs.84,200 level prices may slip towards Rs.83,500 level.

* MCX Silver March is expected to hold the key support at Rs.94,000 and move higher towards Rs.96,600. Only above Rs.96,600 level it would turn bullish and open the doors towards Rs.98,000.

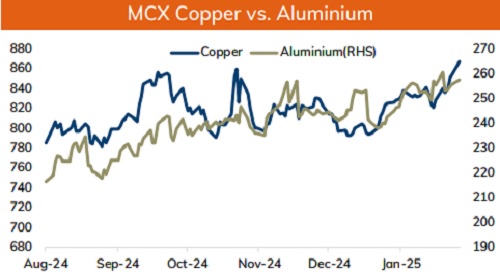

Base Metal Outlook

* Copper prices are likely to extend its rally on tightness in supply from Chile. Further, improved demand from China after New year holiday would also support prices. Depleting inventory levels in China would force the players to replenish their stocks. Further, rise in CPI numbers in China indicates demand improvement. However, tariff concerns from US would cap sharp upside in prices.

* MCX Copper February has breached the multiple resistance at Rs. 862 and rallied towards Rs.870. So as long as it holds above Rs.862 it would push prices towards Rs.875 level. Above Rs.875, we may see levels of Rs.880.

* MCX Aluminum Feb is expected to rise towards Rs.260 level as long as it trades above Rs.254 level. The Trump administration has proposed a 25% tariff hike on Aluminum imports. MCX Zinc Feb is likely to hold Rs.269 level and move higher towards Rs.274 level.

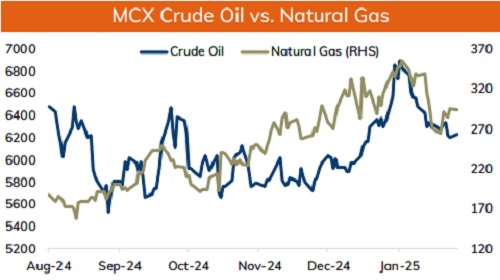

Energy Outlook

* NYMEX Crude oil is expected to hold its ground near $70 mark and rebound towards $73 on supply concerns. Sanction on an international network for facilitating Iranian crude supplies could offer short term support to oil prices. Meanwhile, concerns over new trade war between US and China would increase demand uncertainty.

* On the data front, strong put base near the 70 put strike would act as major support. Where as 20 day EMA at $73 would act as immediate hurdle. Unwinding of OI in OTM call strikes indicates price recovery in oil prices. MCX Crude oil Feb is likely to hold the support at Rs.6150 and move higher towards Rs.6330.

* MCX Natural gas Feb is expected to hold its ground and move towards Rs.302 as long as it holds above Rs.288. Depleting gas inventory and forecast of colder weather in US would help prices to trade firm. Further, tightness in several markets would support bullish bets on gas prices.

https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631