MCX Copper Dec is expected to slip towards Rs1013 level as long as it stays below Rs1028 level - ICICI Direct

Metal’s Outlook

Bullion Outlook

* Spot Gold is likely to trade with the positive bias and rise towards $4210 level on weak dollar and softening of US treasury yields across curve. Further, prices may rally as investors are leaning more towards comments from Fed officials for guidance on interest rate cuts as some of the economic data are out of date due to 43-day government shutdown and are offering little insight on economic state. A number of speakers have boosted expectations for December rate cut. As per CME FedWatch tool traders are now pricing almost 87% chance of a rate cut in December, up 83% a day ago and from 39% a week ago. Moreover, prices may rally on strong central bank demand for gold and as the concern over Fed independence resurfaced after White House National Economic Council Director Kevin Hassett emerged as the front-runner to serve as the next Fed chair. MCX Gold Feb is expected to rise towards Rs 128,800 level as long as it stays above Rs 126,500 level.

* MCX Silver March is expected to rise towards Rs 167,500-Rs 168,500 level as long as it stays above Rs 163,500 level

Base Metal Outlook

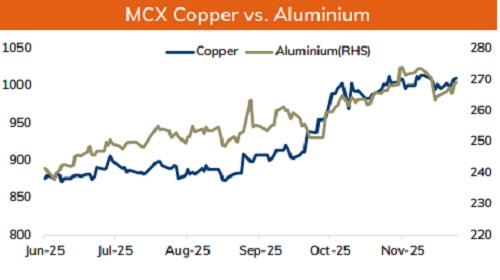

* Copper prices are expected to trade with a negative bias on concerns over weak demand from China and rising inventories at LME registered warehouses. Slew of disappointing economic data from US and China has raised concerns over economic health of the countries and demand outlook. Moreover, prices may slip on renewed worries about the China’s property sector. Vanke sought to delay an onshore bond repayment for the first time, rekindling worries about a spillover effect. Meanwhile, Paul White, the Secretary-General of the International Copper Study Group said Copper output growth is forecasted slow to 0.9% in 2026

* MCX Copper Dec is expected to slip towards Rs1013 level as long as it stays below Rs1028 level. A break below Rs1013 level may open doors for Rs1008-Rs1005 level

* MCX Aluminum Dec is expected to slip towards Rs 268 level as long as it stays below Rs 273 level. MCX Zinc Nov is likely to face stiff resistance near Rs 301.5 level and slip towards Rs 296 level

Energy Outlook

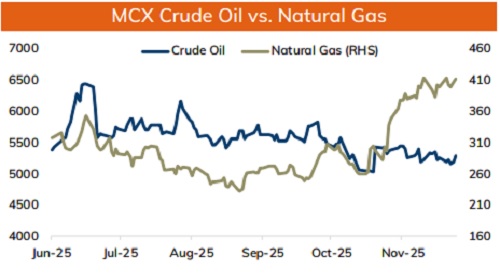

* Crude oil is likely to trade with negative bias and dip towards $58 level on rising crude oil inventories, prospects of oversupply and signs of positive progress in peace talk between Ukraine and Russia. Russian President Putin said Trump’s proposals for ending the Ukraine war could underpin future agreements and signaled readiness for talks. Investors are of opinion that a peace deal may increase the chances of lifting sanctions on Russian crude exports adding more supply. Meanwhile, sharp downside may be cushioned on weak dollar and optimistic global market sentiments. Additionally, OPEC+ is likely to leave output levels unchanged at its meeting on Sunday

* MCX Crude oil Dec is likely to slip back towards Rs 5220-Rs 5180 level as long as it stays below Rs 5380 level.

* MCX Natural gas Dec is expected to rise towards Rs 420 level as long as it stays above Rs 400 level.

Please refer disclaimer at https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631

.jpg)