MCX Copper Dec is expected to hold support near Rs.1100 and move higher towards Rs.1120 level - ICICI Direct

Metal’s Outlook

Bullion Outlook

* Spot Gold is likely to trade higher amid weakness in the US dollar and safe haven buying. Prices would get support on growing bets that the US President would appoint a dovish fed chair in early 2026, which could turn out to be negative for the dollar and support the bullions to hold its gains. Further, concerns over US labor market and growing expectation of more rate cuts in the coming year will also boost the yellow metal to make new highs. As per the CME Fed-watch tool January rate cut has gone up to 24.4% from 20.6% a day ago. Furthermore, strong central bank buying and investment inflows would again strengthen the bullions.

* MCX Gold Feb is expected to rise towards Rs.133,000 level as long as it stays above Rs.131,000 level. A move above Rs.133,000, it would rise towards Rs.134,500.

* MCX Silver March is expected to rise towards Rs.199,500- Rs.200,000 zone as long as it stays above Rs.194,500 level. A move above Rs.200,000, would open the doors towards Rs.202,500.

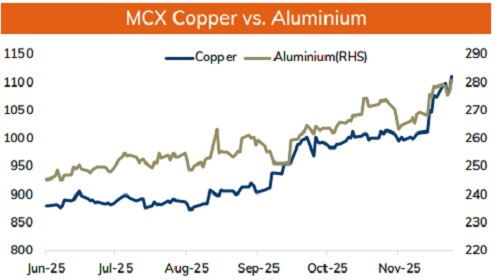

Base Metal Outlook

* Copper prices are expected to hold its ground and move higher on supply concerns and growing prospects of fresh round of stimulus from China. Furthermore, improved risk sentiments after the US Fed rate cut and upgraded its growth forecast for the US economy and expectation of loose monetary policy would bring optimism in the metal space. Prices would also get support on concerns over a supply shortage and strong US demand along with depleting inventory levels in LME would help the metal to regain its strength. On the other hand, sluggish demand growth from China could check any major up move in the metal.

* MCX Copper Dec is expected to hold support near Rs.1100 and move higher towards Rs.1120 level. Only break below Rs.1100 level it may fall towards Rs.1090-Rs.1088 level.

* MCX Aluminum Dec is expected to rise towards Rs.285 level as long as it stays above Rs.275 level. Only a move below Rs.275, it would slip towards Rs.270. MCX Zinc Nov is likely to move higher towards Rs.325 level as long as it stays above Rs.314 level.

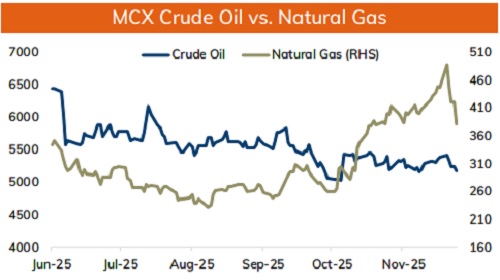

Energy Outlook

* Crude oil is expected to remain under pressure and move lower towards $57 per barrel on forecast of global supply glut. Crude oil crack spread has hit 2-month lows signaling weaker demand from the oil refiners. Also, prices would remain under pressure after Saudi Arabian state producer Aramco is likely to lower crude oil prices for Asian buyers for January delivery. Meanwhile, rising geopolitical tension in Venezuela and Ukraine would limit the downside in prices. In addition to that, improved risk sentiments after US Fed rate cut would and hopes of stimulus from China would limit its downside

* MCX Crude oil Dec is likely to face hurdle near Rs.5300 and move lower towards Rs.5100 level. Only a move above Rs.5300 it will turn bullish.

* MCX Natural gas Dec is expected to weaken further towards Rs.370 level as long as it trades under Rs.400 level. Forecast of warmer US weather would reduce heating demand.

Please refer disclaimer at https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631

.jpg)