MCX Aluminum Feb is expected to slip towards Rs302 level as long as its stays below Rs312 level - ICICI Direct

Metal’s Outlook

Bullion Outlook

* Spot Gold is likely to trade with negative bias amid firm dollar. Further, recent batch of economic data from US painted mixed picture for Federal Reserve interest rate cut, as US job data signaled stabilizing labor market while, CPI data showed inflation increased less than expected. Meanwhile, sharp fall in prices may be cushioned on safe haven demand following escalating geopolitical tension in Middle East and Eastern Europe. Further, gold demand from China would stay strong ahead of Lunar New Year. Additionally, investors will remain cautious ahead of Fed’s meeting minutes, advance estimate of US GDP, and PCE inflation data for more guidance on the policy outlook

* MCX Gold April is expected to slip back towards Rs 152,000-?150,000 level as long as it stays below Rs 156,500 level.

* MCX Silver March is expected to slip towards Rs 228,000-Rs 225,000 level as long as it stays below Rs 251,000 level.

Base Metal Outlook

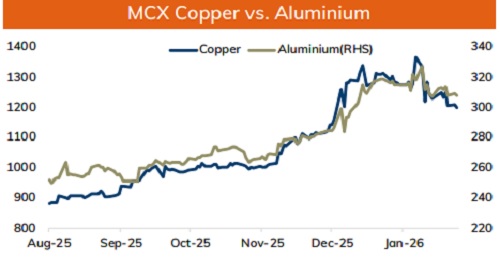

* Copper prices are expected to trade with negative bias amid firm dollar and weak global market sentiments. Further, prices may dip on signs of weak demand in China ahead of Lunar New Year holidays. Additionally, persistent rise in inventories at LME registered warehouses would hurt prices. Furthermore, Yangshan copper premium, which reflects Chinese appetite for imported copper, was at $33 a ton, still too low to indicate strong demand. Additionally, investors will remain cautious ahead of economic data from major countries to gauge economic health and demand outlook

* MCX Copper Feb is expected to slip towards Rs1180 level as long as it stays below Rs1230 level. A break below Rs1180 level prices may be pushed towards Rs1267-Rs1155 level

* MCX Aluminum Feb is expected to slip towards Rs302 level as long as its stays below Rs312 level. MCX Zinc Feb is likely to face stiff resistance near Rs324 level and slip further towards Rs317 level

Energy Outlook

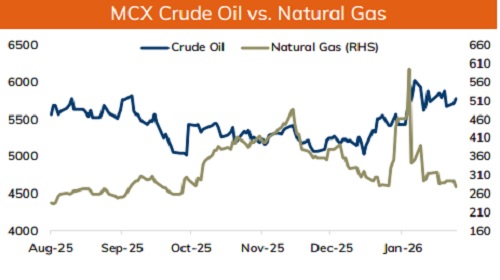

* NYMEX Crude oil is likely to trade with positive bias as geopolitical tension in Middle East and Eastern Europe raised fears of supply disruption. Further, Iran launched a maritime drill in the Strait of Hormuz, a vital oil transit route. All eyes will be on second round of meeting between US and Iran over nuclear deal. On top of it, US-led negotiations between Russia and Ukraine will also be in focused, but investors remain skeptical about any near-term diplomatic breakthrough. Meanwhile, sharp upside may be capped on strong dollar and risk aversion in the global markets. Further, OPEC+ is considering resuming output hikes in April

* NYMEX Crude oil is likely to rise towards $64.50 level as long as it stays above $62 level. MCX Crude oil March is likely to rise towards ?5950-?6000 level as long as it stays above Rs 5700 level.

* MCX Natural gas Feb is expected to rise towards Rs 300-?315 level as long as it stays above Rs 265 level.

Please refer disclaimer at https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631