Commodity Weekly Insights 05th January 2026 by Axis Securities

The Week That Was

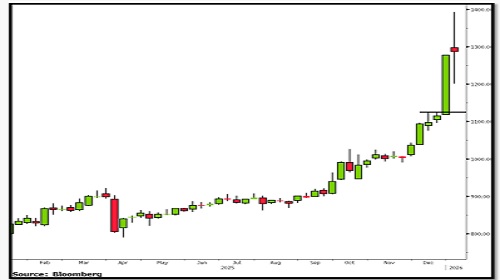

* Spot gold ended last week on a negative note, declining more than 4% amid profit-booking. Despite the weekly correction, the metal delivered a strong performance last year, gaining nearly 65%, with the rally accelerating from late April after the US administration introduced sweeping global tariffs. Gold’s advance has been supported by persistent geopolitical uncertainty, expectations of lower US borrowing costs, sustained central bank purchases, and renewed inflows into gold-backed exchange-traded funds. Geopolitical risks remained elevated as the US intensified enforcement against Venezuela’s oil trade, while renewed Russia-Ukraine strikes over the New Year period targeted Black Sea ports and key energy infrastructure.

* Spot silver also witnessed sharp selling, falling more than 8% over the week, though it remained the biggest gainer in December with a 27% rise. After touching an all-time high of $83.8 on Monday, the metal has still surged nearly 148% over the past year following the rollout of broad US trade tariffs. The rally has been reinforced by ongoing geopolitical instability, expectations of easier US monetary policy, persistent supply constraints, low inventories, and rising industrial as well as investment demand.

* Comex copper ended the week lower by 2.5%, though it remains the best-performing metal so far this year, posting gains of around 8%. Copper supply has come under pressure following halted operations at Freeport-McMoRan’s Grasberg mine in Indonesia, which accounts for nearly 3% of global supply, after a fatal incident. This has amplified supply concerns from Chile and Peru, where workers’ protests continue to disrupt production. The uncertainty has been compounded by renewed tariff threats on copper products from US President Donald Trump, prompting increased flows of copper into US warehouses from major trading hubs in London and Shanghai.

* WTI crude oil erased most of its weekly gains and ended marginally higher by 0.5%, as markets priced in expectations of a record global supply surplus. Both the International Energy Agency (IEA) and the US government forecast global production to exceed consumption, rising from a four-year high surplus in 2025 to a record level in 2026. The IEA recently projected that the global crude surplus could widen to 3.8 Mn barrels per day in 2026, up from over 2 Mn bpd in 2025. Persistent geopolitical risks involving Venezuela, Nigeria, and Russia are limiting downside pressure on prices, while expectations that OPEC+ will pause further production increases at its upcoming meeting continue to provide support.

MCX Gold

Technical Outlook:

MCX Gold ended the week lower by nearly 3% after witnessing sharp rejection from record highs. Last Monday, prices posted a strong bearish candle, marking the biggest single-day fall after hitting an all-time high. Since then, prices have failed to breach the high of that bearish candle, confirming a sell-on-rise structure in the near term. Going forward, the bias remains bearish, and any decisive breakdown below Rs 1,34,300 could accelerate selling pressure, dragging prices towards Rs 1,30,000, followed by Rs 1,28,000 in the coming sessions. On the upside, Rs 1,40,500 remains a strong resistance, and only a sustained move above this level would negate the current negative setup

Recommendation:

We recommend selling MCX Gold below Rs 1,34,300, with a stoploss above Rs 1,37,000 and targets of Rs 1,30,000 and Rs 1,28,000.

Current Market Price (CMP): Rs 1,35,752

MCX Silver

Technical Outlook:

MCX Silver traded with high volatility and ended the week lower by around 1.5%, though it managed to recover part of its early losses. On the weekly chart, the RSI has started turning down from the overbought zone, indicating weakening momentum and a possible near-term corrective phase. A breakdown below Rs 2,22,500 is likely to invite fresh selling, with prices expected to slide towards Rs 2,05,000, followed by Rs 2,00,000 on the downside. On the upside, Rs 2,54,200 stands as a key resistance, and any recovery is likely to face selling pressure near this zone.

Recommendation

We recommend selling MCX Silver below Rs 2,22,500, with a stop loss above Rs 2,30,000 and targets of Rs 2,05,000 and Rs 2,00,000.

Current Market Price (CMP): Rs 2,36,650

MCX Crude Oil

Technical Outlook:

MCX Crude Oil ended the week marginally lower and continues to consolidate within a symmetrical triangle pattern, reflecting indecision and range-bound trade. Prices are expected to remain confined within this structure until a clear directional breakout emerges. The commodity is currently trading in a tight range of Rs 4,900–5,300. A breakout above Rs 5,300 could trigger fresh upside momentum, opening the door towards the Rs 5,600 and Rs 5,800 levels. Conversely, a breakdown below Rs 4,900 would result in a breach of the key support channel, exposing prices to a sharper decline towards Rs 4,600, followed by Rs 4,400.

Recommendation:

We recommend buying MCX Crude Oil above Rs 5,300, with a stop-loss below Rs 5,100 and targets of Rs 5,600 and Rs 5,800.

Current Market Price (CMP): Rs 5,161

MCX Copper

Technical Outlook:

MCX Copper witnessed extreme volatility last week, recording a high of Rs 1,393 and a low of Rs 1,201, before ending the week marginally lower by 0.7%. The price action suggests continued instability, with volatility likely to remain elevated in the near term. A breakdown below the Rs 1,200 mark could intensify selling pressure, dragging prices towards the Rs 1,150 and Rs 1,130 levels. On the upside, the all-time high of Rs 1,393 remains a strong resistance. Additionally, the daily RSI is hovering near 70 but forming lower lows, indicating negative divergence and signalling emerging weakness in price momentum.

Recommendation:

We recommend selling MCX Copper below Rs 1,200, with a stop-loss above Rs 1,230 and targets of Rs 1,150 and Rs 1,130.

Current Market Price (CMP): Rs 1,289

For More Axis Securities Disclaimer https://simplehai.axisdirect.in/disclaimer-home

SEBI Registration number is INZ000161633

.jpg)