Life Insurance Industry Reports Muted Performance; New Business Premiums Dips 3.1% y-o-y in June 2025 by CareEdge Ratings

Overview

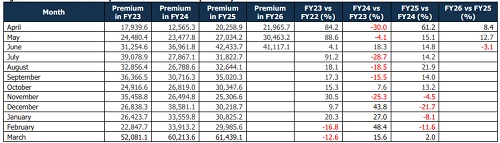

In June 2025, the Indian life insurance industry reported new business premiums of Rs 41,117.1 crore, a year-on-year (y-o-y) decline of 3.1%, compared to the 12.7% growth recorded in May 2025 and notably lower than the 14.8% growth seen in June 2024. The decline can largely be attributed to the ongoing impact of the revised surrender value regulations, lower credit life sales, and group single premiums.

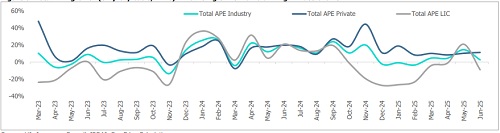

The Annual Premium Equivalent (APE) rose by 2.5% in June 2025, a slower growth rate compared to the 20.0% increase in the same period last year. In APE terms, the industry grew at an 11.0% compounded annual growth rate (CAGR) between June 2023 and June 2025. During this period, private insurers grew at 15.4%, outpacing LIC’s growth of 4.8%.

Figure 1: Movement in Monthly New Business Premium (Rs crore)

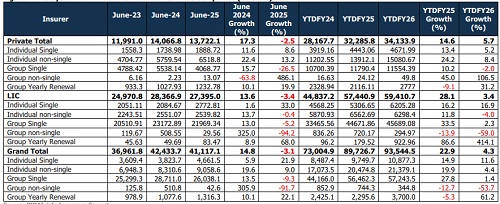

Figure 2: First-year Premium Growth of Life Insurance Companies (Rs crore)

In June 2025, the new business premiums of private players declined by 2.5%, while LIC, which registered a contraction of 3.4%, experienced a similar decline. The overall industry contraction was driven by group single premiums and weakness across the segments. Although there was a drop in the group single policies sold by LIC, the impact was partially offset by a higher average premium per policy. Growth continues to be influenced by structural changes in policy design, particularly adjustments to sum assured and commission structures following the implementation of the revised surrender value guidelines, effective October 1, 2024. At the same time, market volatility has dampened demand for ULIP products, affecting overall sales momentum.

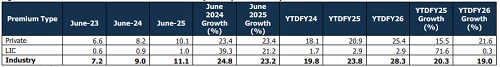

Figure 3: Movement in Premium Type of Life Insurance Companies (Rs crore)

In June 2025, non-single premiums registered a y-o-y growth of 5.2%, significantly lower than the 22.9% growth seen in June 2024. On the other hand, single premiums declined by 5.6%, a significant slowdown compared to the 12.5% growth recorded in the same month last year. Despite the contraction, single premiums continue to be nearly three times larger than non-single premiums in absolute terms. Within the segmental mix, private insurers maintain a stronger presence in the non-single (individual) premium category, whereas LIC retains its dominance in the single premium space, particularly driven by group business.

Figure 4: Movement in Premium Type of Life Insurance Companies (Rs crore)

In June 2025, group premiums declined by 9.6%, compared to a 14.8% growth in June 2024. Individual premiums, however, grew by 13.1%, a slower pace than the 14.9% gain the previous year. The decline in group premiums can be attributed to lower credit life sales and the ongoing impact of revised surrender value regulations. The private sector continued to lead the individual segment, while LIC retained its dominance in the group segment.

Figure 5: Movement in Individual Non-Single Policies of Life Insurance Companies (in lakhs)

In June 2025, individual non-single policy sales decreased by 8.0%, compared to the 11.9% growth recorded in the same period last year. Private players saw a 5.0% increase, while LIC experienced a significant decline of 14.5%, contrasting with an 11.9% increase in June 2024. The significant decline in the number of policies sold can be attributed to the implementation of new surrender value norms, which took effect in October 2024. Private players appear to have adjusted more swiftly to the regulatory changes by increasing the average ticket size of individual non-single policies. Insurers have also shifted their focus toward highervalue policies, which has partially cushioned the impact on overall premium collections. However, this evolving policy mix is expected to weigh on margins going forward.

Figure 6: Movement of Sum Assured of life insurance companies. (Rs lakh crore)

Figure 7: Movement in APE of life insurance companies (Rs crore)

Figure 8: Total APE growth (on y-o-y basis, in %) – Non-Single Premiums driving Private Growth

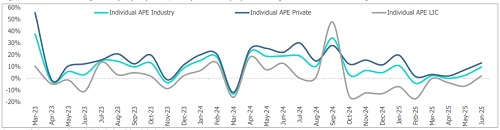

Figure 9: Individual APE growth (on y-o-y basis, in %) – Private players coming to terms with the changes

Figure 10: Group APE growth (on y-o-y basis, in %)

CareEdge Ratings View

According to Saurabh Bhalerao, Associate Director, CareEdge Ratings, “The first quarter is typically a slow period for the life insurance sector, as it follows the fiscal year-end when most retail customers have already purchased policies in a last-minute rush. In Q1FY26, the q-o-q growth has increased by 4.3% compared to 22.9% growth in the same quarter a year ago, mainly because of muted consumer demand and the impact of revised surrender value guidelines, which were effective October 1, 2024. June also saw a 14.5% y-o-y fall in volume of policies sold. Both LIC and private insurers reported a contraction in group single policies, which fell by 36.4% y-o-y to Rs 26,038.1 crore. However, despite this, LIC and private players reported a premium growth in individual single and non-single premiums, indicating that they have a strong distribution channel and moved to higher value policies amid changes in surrender value regulations.”

According to Sanjay Agarwal, Senior Director, CareEdge Ratings, “The growth of ULIPs has been muted due to market volatility. Meanwhile, individual and yearly group business has driven growth for the month. There is likely to be an increased emphasis on the agency channel, spurred by banks' focus on deposit gathering. Furthermore, the proposed Insurance Amendment Act aims to enhance market penetration by encouraging new companies to enter the market. A gradual recovery is expected in FY26, driven in part by private insurers expanding their reach through deeper geographical penetration, in conjunction with the launch of the Bima Trinity. CareEdge expects the life insurance industry to continue to grow at 10%-12% over a three-to-five-year horizon, driven by product innovation along with supportive regulations, rapid digitalisation, effective distribution, and improving customer services.”

Above views are of the author and not of the website kindly read disclaimer