Israel-Iran tensions likely to widen India`s CAD by 0.3% of GDP: ICRA

ICRA in its recent report has said that if the heightened tension in the West Asia pushes average crude prices by $10 per barrel, it will typically push up India's net oil imports by nearly $13-14 billion during the year, enlarging the India's current account deficit (CAD) by 0.3 per cent of GDP. It stated ‘If the average crude oil price rises to $80-90/bbl in FY26, then the CAD is likely to widen to 1.5-1.6% of GDP from our current estimate of 1.2-1.3% of GDP. This would also exert pressure on the USD/INR pair during the fiscal.’

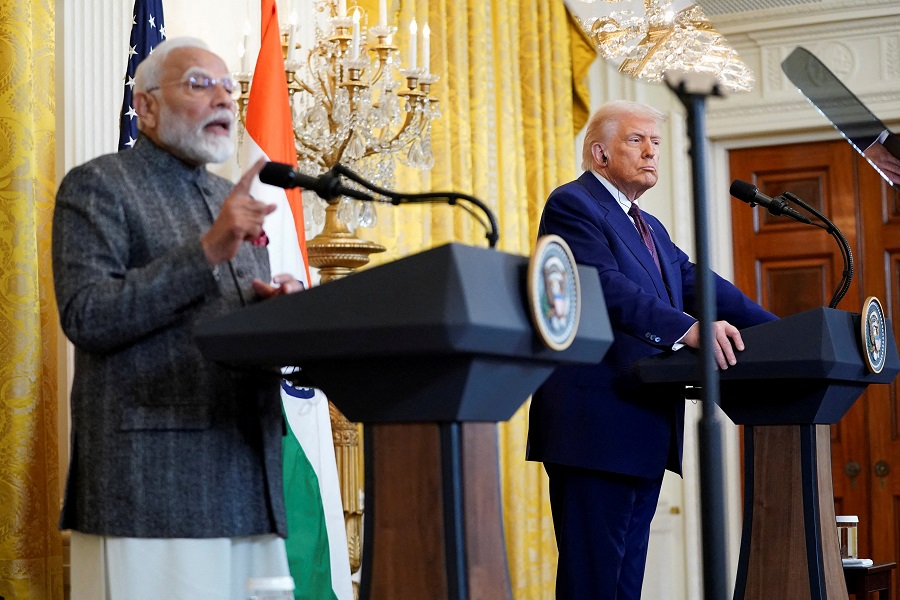

The report said the conflict between Iran and Israel, which began on June 13, 2025, pushed crude prices from $64-65/bbl to $74-75/bbl. Now, after the US strike on Iran's nuclear sites, Iran has announced that it will close the Strait of Hormuz, which can disrupt the global crude supply. It mentioned ‘Iran straddles the (Strait of Hormuz), which remains one of the key energy choke points, through which almost 20 per cent of global liquids and liquified natural gas (LNG) is traded.’

Moreover, it expects change in crude oil prices is likely to translate faster into the WPI than the CPI amid different weightage mix in both these indices; for every 10 per cent increase in crude oil prices, the WPI inflation will rise by 80-100 bps, compared to 20-30 bps in CPI inflation, provided the transmission into RSPs of petrol and diesel takes place. India imports crude from Iraq, Saudi Arabia, Kuwait and the UAE, which is routed through the Strait of Hormuz (SoH), and it accounts for approx. 45-50 per cent of the total crude oil imports to India.

Additionally, it stated that any sustained disruption in supplies from Iran, and/or spread of the conflict to other large producers in this area and/or any disturbance in the trade route through SoH could drive energy prices higher. On the natural gas side, nearly 54 per cent of natural gas imports for India pass through SoH, and a major share of the term LNG originates from Qatar and the UAE. And any disruption in the SoH may result in supply uncertainties from Qatar and the UAE, which may result in higher dependence on the spot LNG market.