IPO Note : Canara Robeco Asset Management Company Ltd by Geojit Financial Services Ltd

A Profitable, Expanding Asset Manager with Retail Focus...

Canara Robeco Asset Management Company Ltd. (CRAMC), established in 1993, is India’s second-oldest mutual fund house and operates as a joint venture between Canara Bank (51%) and Japan’s ORIX Corporation (49%). As of June 30, 2025, the company managed 26 mutual fund schemes—comprising 12 equity, 10 debt, and 4 hybrid funds—with a quarterly average AUM (QAAUM) of Rs.1,110.52bn. Backed by a robust distribution network of over 52,000 partners and Canara Bank’s extensive branch presence, CRAMC has established a strong legacy of consistent fund performance, operational excellence, and deep retail penetration.

* India’s mutual fund (MF) industry reached Rs.67.4tn in FY25, registering an 18.4% AUM CAGR over FY19–25. It is projected to grow at ~16–18% CAGR during FY25–30E, supported by rising retail participation, digital penetration, and increasing financial awareness. (Source: AMFI, Crisil Intelligence).

* According to CRISIL, MF equity AUM is projected to grow at a 20–21% CAGR over FY25–30E. With ~91.17% of its quarterly average AUM (QAAUM) allocated to equity-oriented schemes, Canara Robeco Mutual Fund is well-positioned to capitalize on this segment-driven expansion.

* Canara Robeco’s QAAUM grew from Rs.624.85bn in FY23 to Rs.1.11tn by June 2025, reflecting a strong 29% CAGR, well above the industry’s average growth rate.

* CRAMC’s revenue from operations increased at a 40% CAGR over FY23–FY25, nearly doubling to Rs.403.7cr, supported by growing AUM and stable fee yields.

* CRAMC’s 86.9% retail AUM and 99% retail folio share (~5mn accounts) highlight a highly granular investor base, supporting long-term fund stability through SIPs and strong penetration in B-30 cities.

* PAT stood at Rs.190.7cr in FY25, growing at a 55% CAGR over FY23–25, with margins expanding from 38.6% to ~47%, reflecting strong earnings growth and operational efficiency.

* The 3 yr Avg. return ratios RoE and RoCE are healthy at ~33% and ~40% over FY23-25, reflecting strong profitability and effective capital deployment.

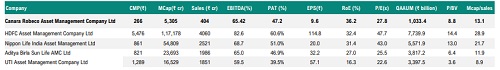

* At the upper price band of Rs.266, CRAMC is available at a P/E of 21.7x (FY26E annualised), which appears reasonable compared to its peers. Backed by a diversified product portfolio, strong brand equity, wide market presence, solid financials, and favourable industry tailwinds, we assign a SUBSCRIBE rating for investors with a long-term investment horizon.

Purpose of IPO

The issue is primarily an Offer for Sale (OFS) of up to 49,854,357 equity shares totalling Rs.1,326.1cr. Offer for sale from promoters comprises sale of 2,59,24,266 equity shares by Canara Bank and up to 2,39,30,091 equity shares by ORIX Corporation Europe N.V The objective of the issue is to achieve the benefits of listing the equity shares on the stock exchanges.

Key Risks

* ~91% of QAAUM is from equity-oriented schemes.

* High competition from industry peers.

* 73.45% of MAAUM (Monthly Avg AUM) depends on third-party distributors.

Peer Valuation

For More Geojit Financial Services Ltd Disclaimer https://www.geojit.com/disclaimer

SEBI Registration Number: INH200000345