India Strategy : Nifty-500 review - Broad-based growth amid challenges by Motilal Oswal Financial Services Ltd

Nifty-500 review: Broad-based growth amid challenges

SMIDs outperform sharply

* Nifty-500 delivered a healthy double-digit earnings growth in 2QFY26, the highest in five quarters, despite geopolitical headwinds and weak consumption trends.

* Aggregate earnings of the Nifty-500 Universe grew 15% YoY. Ex-Financials, the reported aggregate earnings jumped 20% YoY. Ex-Metals and O&G, the aggregate earnings grew 9% YoY.

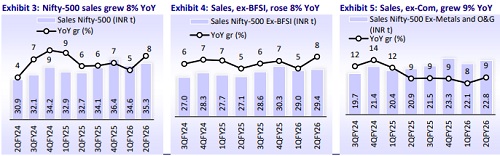

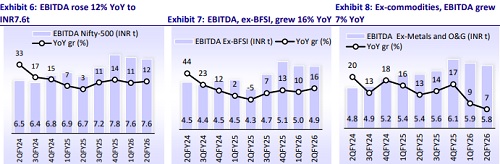

* Aggregate sales/EBITDA/adj. PAT of Nifty-500 companies grew 8%/12%/15% YoY to ~INR35t/INR8t/INR4t in 2QFY26.

* Corporate earnings in 2QFY26 were resonably driven by broad-based growth, with significant contributions from key sectors such as O&G (+59% YoY growth), NBFC (21% YoY), Metals (+18% YoY), Cement (+211% YoY), Capital Goods (30% YoY), Telecom (loss-to-profit), Retail (32% YoY), and Real Estate (22% YoY).

* Chemicals (+35% YoY) and Consumer Durables (+45% YoY) recorded strong growth on a soft base. Meanwhile, Technology (+8% YoY), Healthcare (+9% YoY), PSBs (+3% YoY), Consumer (+5% YoY), and Utilities (flat YoY) witnessed muted earnings growth. In contrast, Automobile (-16% YoY), Pvt. Banks (-3% YoY), and Media (-10% YoY) hurt overall earnings growth.

* Mid-caps and small-caps notably outperform: The 2Q earnings performance of the Nifty-500 was fueled by mid- and small-cap companies. Aggregate earnings of the Midcap-150 companies grew 27% YoY, while Smallcap-250 companies recorded a 37% YoY growth. In comparison, earnings growth for the large-caps (Nifty-100 const.) stood at 10% YoY. Weak performance by Private Banks and the Automobile sectors resulted in the relative underperformance of the large-cap universe compared to SMIDs.

* Sectors and companies: Of the 20 key sectors, 17 reported profit growth in 2Q. OMCs dominated, accounting for 33% of the incremental YoY accretion in earnings. The top 10 incremental profit contributors, primarily from O&G, Metals, Financials, and Telecom, together contributed around 64% of the incremental YoY earnings growth. About 230 companies within Nifty-500 reported an earnings growth of over 15% YoY, while 174 companies reported a decline or loss during the quarter.

* The EBITDA margin of Nifty-500 (excl. BFSI) came in at 16.9% (up 120bp YoY, down 30bp QoQ) in 2QFY26. Ex-commodities (i.e., Metals and O&G), the EBITDA margin stood at 18.8% (down 30bp YoY, down 80bp QoQ). 10 out of 16 major sectors (excl. Financials) reported EBITDA margin expansion during the quarter.

* Earnings of the Nifty-500 universe grew 12% YoY for 1HFY26. Ex-Financials, the earnings grew 16% YoY, while ex-Metals and O&G, the earnings rose 8% YoY. The large-/mid-/small-cap earnings increased 9%/23%/19% in 1HFY26.

Key sectoral highlights for 2QFY26

* Oil & Gas: The sector contributed significantly to the aggregate earnings growth during the quarter, with EBITDA/PAT growth of 48%/59% YoY, mainly led by OMCs. Excl. OMCs, the O&G sector’s EBITDA/PAT grew 7%/flat YoY in 2QFY26.

* Metals: The sector reported healthy PAT growth of 18% YoY over a soft base of 2QFY25. Growth was also boosted by a strong performance of Ferrous companies, better-than-expected NSR led the earnings beat despite softer realizations, while EBITDA rose 11% YoY on healthy volume and lower costs. Non-ferrous companies posted earnings growth led by favorable metal prices and steady volumes.

* BFSI reported 7% YoY earnings growth, primarily led by NBFCs (21% YoY), while the Banks posted a muted 2Q performance (flat YoY PAT growth). Several banks have guided for further NIM improvement in 2HFY26, driven by the benefits of the CRR cut, continued deposit repricing, and higher loan growth.

* The cement sector reported its second quarter of strong earnings growth, rising 3.1x YOY after four consecutive quarters of weak earnings. Reported sales and EBITDA of the sector grew 18% and 49% YoY, respectively.

* Capital goods companies reported a healthy quarter, with sales/EBITDA/PAT growth of 15%/17%/30% YoY, supported by better-than-expected order inflows and strong execution. Order inflows were particularly strong in the power T&D, renewables, and defense segments.

* The telecom sector reported a profit of INR32b in 2QFY26 compared to a loss of INR2b in 2QFY25, primarily driven by Bharti Airtel. However, other peers posted muted growth or a decline in earnings for the quarter.

* Technology: IT companies posted positive earnings growth on the already beatendown expectations, with PAT growth of 8% YoY. Most large-cap IT companies reported a healthy performance supported by a seasonally strong quarter and steady deal ramp-ups. However, various management of several companies indicated that demand is subdued, with no clear signs of spending cycle recovery.

* The Consumer sector reported a third quarter of mid-single-digit earnings growth of 5% YoY. The sector reported the 10th quarter of muted revenue growth. Staple companies’ demand was stable; however, the GST transition and an extended monsoon hit the overall performance during the quarter.

* The Automobile sector reported a weak quarter, with aggregate earnings down 16% YoY, dragged down by Tata Motors PV. Excluding TMPV, aggregate earnings for the sector grew 16% YoY. While the overall earnings print remained healthy across the sector, OEM companies fared better than Auto component companies during the quarter.

.

.

For More Research Reports : Click Here

For More Motilal Oswal Securities Ltd Disclaimer

http://www.motilaloswal.com/MOSLdisclaimer/disclaimer.html

SEBI Registration number is INH000000412

More News

Nifty immediate support is at 25700 then 25600 zones while resistance at 26100 then 26277 zo...