India Strategy : Currency market contagion singes equities by Emkay Global Financial Services Ltd

US tariffs are finally starting to compound into stress across asset classes. The rupee has been under continuous pressure since the initial tariff announcement in Apr-25, and this weakness is now reflecting in domestic liquidity. Such stress, aggravated by worries around fiscal deficit, has led to a prolonged bear market in bonds. The equity market is finally feeling the pinch, as both FPIs (worried about the currency) and local investors (spooked by the liquidity stress) head for the door. The RBI’s efforts to bring stability have met with mixed success – we think only a final India-US trade deal will deliver a lasting solution. We continue to see extreme market volatility in the short term – near-term relief from the RBI/Fed measures could be quickly overwhelmed by CAD pressures. The best way to ride this out is to stick with large caps, with private lenders, pharma, and IT as the preferred defensive sectors. We think this is a passing phase of 2-3 months, and remain constructive on Indian equities, with Consumer Discretionary our most favored sector.

Currency market stress… The rupee has been on a continuous slide since the first Trump tariff announcement in Apr-25. The drop has continued in Q4CY25 despite support from the RBI, likely due to further widening of the current account deficit. We think the rupee is suffering on two fronts. First, exports have weakened in Q4CY25 due to front-ending earlier in the year before tariffs kicked in. On the other hand, consumption recovery in the festival season would have pushed up import demand and put further stress on the external account. Elevated gold imports are accentuating the problem.

…preying on a vulnerable bond market The bond market has been vulnerable going into 2HFY26 on two counts. First, consolidated fiscal deficit is under pressure from GST cuts, low nominal GDP growth, and aggressive welfare spending by state governments. Secondly, acceleration in loan growth has led to loan-deposit ratios rising which, in turn, is affecting overall demand for bonds. The bond market is in a negative spiral, with buyers suffering MTM loss and reluctant to increase exposure, fearing further portfolio damage. The short end of the curve is healthier (Exhibit 5), though volatile liquidity is now starting to bite.

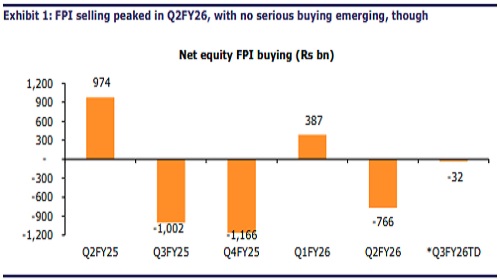

Equity flows hit on all fronts Stress in financial markets is now spilling into equities. FPI flows are staying away (Exhibit 1) due to currency fears, not to mention the relative attraction of other markets (like the US and China) on growth and valuations. We think domestic flows, especially on the retail front, have been affected by the domestic liquidity problem (Exhibit 2) since the last couple of weeks. The vulnerability is reinforced by the relatively high valuations for Indian equities, with the Nifty trading at 20.3x 1YF, 4% above the LTA (Exhibit 13). Notably though, granular valuation metrics have cooled down – the share of stocks trading at +1sd above LTA has fallen from 43% in Oct-25 to 33% as on 8-Dec-25.

Some relief next week, though efficacy doubtful There could be some relief for the next 8-10 days. The Fed cut is an incremental positive, especially with the Chairman warning about the US economy slowdown raising hopes of further easing. Moreover, the RBI measures announced on 4-Dec start to kick in from 11-Dec, with Rs1.45trillion of durable liquidity added to this system in three tranches (Exhibit 9). This should support bond markets across maturities. However, continued stress on the external account could swiftly negate such gains. We believe that the only durable solution to this negative cycle would be signing of the India-US trade deal, with substantial reduction in tariffs for Indian exports to the US (currently at 50% tariffs for many categories). Till this happens, financial markets in India remain vulnerable to periodic sell-downs, and equities will not be immune to contagion.

Stay defensive in the short term For the next 2-3 months, we recommend investors increase their defensive exposure. Technology, Pharmaceuticals, and Private Banks remain the best ways to do this, given that their historic beta are the lowest (Exhibit 15). We would also trim exposure to smalland mid-caps, given the inherent high beta and expensive valuations. We think this is a passing phase, with a high likelihood of the trade deal concluding within 3-6M. The good news is that the domestic economy is gaining strength and the earnings cycle has turned in the last 1-2M. From a long-term perspective, we remain constructive on Indian equities, with consumer discretionary our most preferred sector

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354