RBI MPC Preview by Emkay Global Financial Services Ltd

The consensus view of “no rate cut” in October seems driven more by the RBI’s June and August policy guidance than by the current macro realities. However, we believe there are enough reasons for the RBI to depart from its recent guidance, deliver a further 25bps easing in October, and adopt an open-ended policy approach/guidance for more easing ahead. Notwithstanding the “done for now” RBI guidance and possibility of our rate-cut call misfiring in the October policy, we re-emphasize that what the June MPC meeting taught us was that macro resets evidently need front-loaded policy action than a back-loaded one.

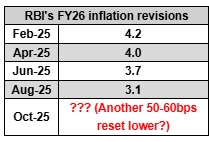

#1. Why wait when inflation is seeing a sharp lower reset?

* The RBI has been consistently revising down its FY26 inflation since April, after the quarterly prints undershot. Since June, RBI’s inflation resets have been dramatic, and forecast revisions are likely to continue in the October policy (RBI’s current CPI forecast: 3.1%). Ex-GST impact, we estimate FY26 headline CPI/core inflation at 2.6%/4.3% and, assuming 70% GST pass-through, headline/core is likely to track 2.1%/3.6%, with FY27E now tracking close to 4%.

* The near-term visibility on inflation (RBI’s primary mandate) opens space for more easing, especially as the real policy rate based on average FY26 inflation could exceed 3%.

In such a context, focusing on one-year-ahead expected inflation (RBI’s 1QFY27 forecast in Aug: 4.9%) appears increasingly misplaced in an evolving world – particularly as the global landscape continues to shift toward a disinflationary bias in Asia.

# 2. Why wait when near-term GDP prints could be noisy?

* The recent upside surprise in 1Q GDP growth had deflator noise, frontloaded US exports, and government spending. The 7%+ print could continue in 2Q, amid statistical adjustments (2Q deflator sub 1%), though 2H would see slower growth as the tariff impact starts to take form. Even as the RBI may revise up FY26 GDP growth, the underlying growth levers are still weak, income hits are likely to spread from the urban to semi-urban segments, and more policy impetus is needed from both, fiscal and monetary (See “Playing the consumption card right”).

* FY26 nominal GDP is likely to print at sub-8%, with all macro and market variables—fiscal deficit/GDP, sovereign debt/GDP, credit growth or corporate earnings, FPI, etc—needed to be re-calibrated accordingly. Any slippage on nominal growth would imply much higher compression of fiscal deficits for achieving similar improvement in the debt/GDP dynamics.

#3. Why wait to save the Rupee when it can act as an automatic stabilizer?

* Some argue that more rate cuts could weigh further on narrowing interest-rate differentials with the US and reduced risk premia, and pressure the already-weak Rupee. However, India’s relative loss of export competitiveness vs EM Asia, amid higher tariffs and especially now with services coming in the trade war ambit, would, in principle, warrant some adjustment via a weaker currency vs peers. Such depreciation would act as a natural stabilizer for a weaker CAD, rather than being misread as a rate-easing deterrent.

* Risk to our view: Assigning 30% probability that the MPC skips this policy till Dec-25 as it awaits greater clarity on both, the external and domestic uncertainties, for assessing the tariff-hike hit and the GST-cuts impact along with pass-through of past cuts.

For More Emkay Global Financial Services Ltd Disclaimer http://www.emkayglobal.com/Uploads/disclaimer.pdf & SEBI Registration number is INH000000354

More News

Government rationalises certain international letter post services from Jan 1