India Poised for Recovery Amid Global Rally and Fund Rotation: PL Asset Management

PL Asset Management, the asset management division of PL Capital Group (Prabhudas Lilladher), in their recent report ‘PMS Strategy Updates and Insights’, cited that Global markets witnessed a broad-based rally in September, buoyed by the U.S. Federal Reserve’s easing cycle and renewed Chinese stimulus. While the S&P 500 gained 3.1%, Nasdaq surged 5.1%, and Hong Kong’s Hang Seng jumped 7.1%, Indian equities posted modest gains as domestic markets lagged their global peers amid tariff pressures and foreign institutional outflows. Yet, beneath the surface, improving breadth, sectoral rotation and stable macros suggest India may be entering an early recovery phase.

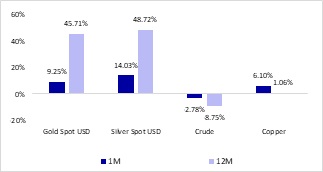

The report further cited that, the Nifty 50 rose 0.75%, while the Nifty Midcap 150 and Smallcap 250 gained 1.39% and 1.13%, respectively. Performance was led by cyclical sectors such as public sector banks, automobiles, and metals. Meanwhile, IT and FMCG stocks underperformed following the U.S. government’s decision to sharply hike H-1B visa fees to $100,000, raising concerns over potential earnings downgrades. Globally, safe-haven assets extended their winning streak. Gold rallied 9.3% and silver surged 14%, marking their seventh consecutive weekly gain as central banks and ETFs stepped up buying amid a weakening dollar and de-dollarization trends. Crude oil prices softened, with Brent dipping below $70 per barrel, providing some relief to import-dependent economies like India. Copper also saw a strong uptick of 6.1%, supported by China’s industrial revival measures.

Domestic Macro Fundamentals Remain Resilient Despite External Headwinds

India’s macroeconomic backdrop remained stable through the month. Consumer inflation edged up slightly to 2.07%, while the Reserve Bank of India maintained the repo rate at 5.5%, balancing growth with price stability. The rupee weakened marginally by 0.76% to 88.84 against the U.S. dollar, reflecting global risk-off sentiment and equity outflows. However, industrial and consumption indicators signaled underlying strength. The Index of Industrial Production rose 3.5% in July and the core sector expanded 6.3% in August, suggesting sustained momentum in manufacturing and infrastructure.

A significant policy milestone came with the rollout of GST 2.0, effective September 22, which simplified tax slabs to 5% and 18%. The reform is expected to provide a festive boost to consumption across FMCG, auto, and discretionary categories, reinforcing domestic demand at a crucial juncture. The government’s continued focus on fiscal discipline and structural reforms is helping anchor investor confidence even as external uncertainties persist.Meanwhile, Systematic Investment Plan (SIP) inflows remained robust at ?28,000 crore, underscoring the steady participation of retail investors. With valuations now neutral and the earnings downgrade cycle nearing its end, PL Asset Management anticipates a base formation for upgrades in the coming quarters.

Market Indicators Turn Constructive; Signs of Early Recovery Emerge

Despite modest index-level moves, market internals have begun to improve. PL Asset Management’s analysis shows a notable strengthening in breadth — the proportion of stocks hitting new 12-month highs has doubled from recent lows, and six-month breadth readings have climbed above 55%. This broad-based participation signals growing investor conviction and improving risk appetite in Indian equities.

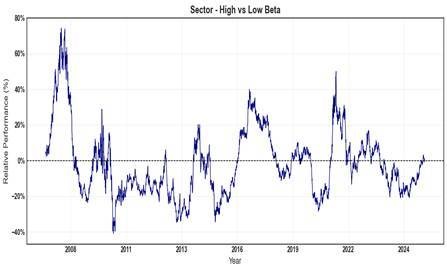

High Beta resurgence reflects renewed risk appetite and a preference for cyclical sectors over non-cyclicals.

A clear factor rotation is underway. Value and high-beta stocks have outperformed, reflecting the market’s shift toward cyclicality and growth-oriented sectors. Conversely, quality and low-volatility factors, which dominated during the earlier risk-averse phase, are now mean-reverting. This transition underscores a renewed willingness among investors to embrace risk, positioning the market for potential upside as sentiment normalizes.

Mr. Siddharth Vora, Head - Quant Investment Strategies & Fund Manager, PL Asset Management said: “We believe Indian markets are entering a healthy normalization phase. Our indicators suggest that the risk appetite cycle is turning, supported by resilient domestic liquidity, stable macros, and early signs of earnings revival. While short-term volatility may persist due to global factors, the medium-term setup looks increasingly constructive.”

Cyclicals Outperform as Defensives Lose Steam

Sector-wise, cyclicals such as autos, public sector enterprises, defense, and metals have been the standout performers. This rotation away from defensives like pharma, IT, and consumer staples reflects investors’ growing confidence in the domestic recovery narrative. Strong GDP growth prints, accommodative fiscal and monetary policies, and benign inflation are providing the stability needed for risk assets to flourish.

AQUA Portfolio Outperforms with Tactical Sector Rotation

Within its flagship AQUA strategy, PL Asset Management reported an impressive 3.4% gain in September, outperforming the BSE 500 TRI’s 1.2% rise. The fund’s outperformance was driven by prudent positioning in cyclical sectors and a tactical increase in portfolio beta from below 1 to around 1.2. Allocations to IT and healthcare were trimmed, while exposure to higher beta themes — particularly financials (32%), materials (24%), and industrials (11%) — was raised. Auto ancillaries accounted for 9% of the portfolio, with a transitory cash position of 8.5%.

Since inception in June 2023, the AQUA strategy has delivered 22.66% returns versus 17.7% for its benchmark, demonstrating consistent alpha generation across market cycles. The portfolio also maintains a balanced market-cap mix, with 39.7% in midcaps, 37.2% in large caps, and 14.5% in small caps — a structure designed to capture emerging opportunities while managing volatility. Rolling three-month alpha metrics and rising portfolio beta indicate that the fund is positioned to capitalize on a risk recovery phase. Reduced average market-cap exposure further highlights a constructive stance aimed at leveraging the ongoing cyclical upturn.

Outlook: Range-Bound Yet Resilient with Positive Bias

Looking ahead, PL Asset Management expects markets to remain range-bound but resilient, with a positive bias driven by the upcoming Q2 FY26 earnings season and festive consumption tailwinds. External headwinds such as global tariff shifts, volatile crude prices, and currency movements may continue to cause short-term fluctuations. However, a combination of domestic liquidity, policy continuity, and improving earnings visibility positions India favorably among emerging markets.Over the medium term, PL Asset Management foresees a stronger growth cycle supported by GST-led consumption revival, potential rate and tax adjustments, and a turnaround in corporate earnings. With valuations now balanced and liquidity ample, the risk-reward profile for Indian equities appears increasingly attractive.

Above views are of the author and not of the website kindly read disclaimer

Tag News

Fund Folio : Equity AUM rises for the 12th successive year; net inflows moderate in CY25 by ...