India Economics : Weekly round-up of macro-economic events By JM Financial Ltd

THIS WEEK'S HIGHLIGHTS

In the week gone by, the RBI’s MPC chose to defer policy easing considering the comfortable inflation trajectory. The policy tone was balanced with a dovish tilt, building in deceleration in 2H, which aided bond yields.

The southwest monsoon is expected to be in surplus to the extent of 8% above the long period average on pan-India basis. Bihar and Jharkhand ended with 15-20% deficits. Overall, the strong monsoon is set to support agriculture and rural incomes, and help moderate food inflation.

Source: Bloomberg, JM Financial, As on 3rd Oct’25

The Central government announced a 30-day productivity bonus for ~3.5mn employees ahead of the festive season. The maximum payout can be ~INR 6,900/employee depending on basic pay and allowances. Unexpected payouts like these generally tend to boost consumption in the economy.

As per the RBI’s latest survey, confidence in credit demand is growing while the proportion of bankers anticipating easier loan terms has been on the rise. Separately, consumer confidence across rural and urban areas has been cautiously positive for both present as well as near-term economic outlook.

Source: Bloomberg, JM Financial, As on 3rd Oct’25

New project announcements in India declined 18% to INR 5.2trln in Sep-Q, mainly led by infrastructure projects while manufacturing and energy projects fell 15% and 12% respectively. Moreover, capacity utilisation in the manufacturing space has moderated to 74.1% in 1Q vs. 77.7% in the previous quarter.

As per SEBI’s latest survey, only 9.5% of Indian households (32.1mn) invests in the securities market, lower than 11% in China and ~62% in the US. The survey also highlighted that 79% of Gen-Z households remain risk averse.

S&P global has assessed that the probability of a US recession stands at 30% or higher, citing elevated interest rates and slowing consumer demand.

Domestic Macroeconomic Indicators/Events

* RBI MPC Review | MPC in wait-and-watch mode; rate cut deferred till December:

The MPC’s decision to maintain status quo was unanimous. The policy stance remained unchanged at “neutral”, while two of the members were in favour of an “accommodative” stance. Inflation expectations have been lowered by 110bps in the last two meetings while GDP is expected to decelerate in 2H of FY26. RBI’s growth-inflation projections seem realistic and the policy tone was balanced with a dovish tilt, which reflected in the partial unwinding in bond yields. The additional measures announced appear to be enabling provisions for a pick-up in credit growth, with substantial increase in limits (2.5-5 times) for loan against shares and IPO funding. The benign inflation trajectory has opened up policy space for easing, but the RBI chose to wait and watch till the next MPC meet in December.

* India-EFTA trade pact to make Swiss goods cheaper:

India’s trade agreement with the European Free Trade Association (EFTA) comes into effect on 1st Oct’25 and offers binding commitment of USD 100bn investment and 1mn direct jobs in the next 15 years. This deal will reduce import tariffs, making Swiss wines, chocolates, apparel, and luxury watches more affordable in India. In return, Indian exports like tea, coffee, textiles, marine products, leather, gems, and engineering goods will gain wider access to EFTA markets. The Trade and Economic Partnership Agreement (TEPA) covers tariff concessions on over 92% of tariff lines, representing nearly 99.6% of India’s exports. Sensitive sectors such as dairy, processed food, and medical devices have been protected from steep duty cuts. Over the next 5–10 years, India will gradually phase out duties on a range of goods, strengthening bilateral trade ties.

* India's monsoon set to end on a High, with 8% rain surplus:

The 2025 southwest monsoon is set to end on a high, with an overall 8% surplus against the long-period average of 87 cm, making it one of the best in recent years. Rainfall was 10–15% above normal in central and southern states, boosting reservoir storage to nearly 85% of capacity. The surplus is expected to lift kharif crop output, with paddy sowing already crossing 41mn hectares and pulses acreage up 7% YoY. However, eastern states like Bihar and Jharkhand ended with 15–20% deficits, while northwest India saw patchy rains. Overall, the strong monsoon is set to support agriculture and rural incomes, and help moderate food inflation.

* Central government declares 30 days' bonus for employees ahead of festivals:

The Central government has announced a 30-day productivitylinked bonus for about ~ 3.5mn employees ahead of the festive season. Each eligible employee is expected to receive a payout of nearly INR 7,000, depending on basic pay and allowances. We estimate that this move will put INR 17.5bn into workers’ hands, giving a boost to household spending. The bonus covers Group C and non-gazetted Group B staff, including railway, postal and defence civilian employees. We believe that the payout will not only lift morale but also spur consumption and retail sales during the festive period.

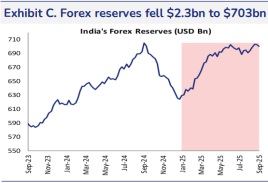

* Global economy undergoing structural shift; Sitharaman says India remains resilient:

Finance Minister Nirmala Sitharaman said the global economy is undergoing a structural transformation driven by technological disruptions, supply chain realignments, and energy transition. Rising geopolitical uncertainties and inflationary pressures are reshaping trade and investment flows. Despite these headwinds, she noted that India is better positioned to withstand shocks owing to its strong domestic demand, digital push, and policy reforms. Sitharaman highlighted that India’s macro fundamentals, including healthy forex reserves and fiscal discipline, provide a cushion against volatility. This resilience, she added, enhances India’s role as a growth driver in an uncertain global environment.

* India's central government fiscal snapshot:

April–Aug’25: As of Aug’25, India's central government reported a fiscal deficit of INR 5.98trln, accounting for 38.1% of the INR 15.69trln target for the fiscal year 2025–26. Total receipts during this period stood at INR 12.82 trln, while total expenditure reached INR 18.8 trln. Notably, capital expenditure increased to INR 4.3trln from INR 3trln in the previous year, reflecting a focus on infrastructure investment (38.5 % of FY26BE vs 27% last year). Revenue receipts saw a decline, with net tax receipts falling to INR 8.1trln from INR 8.7trln, although non-tax revenue rose to INR 4.4trln from INR 3.3trln. These figures indicate a strategic emphasis on capital spending amid a slight dip in tax collections. Media reports indicate that the central government has been exploring ways to enhance its capex allocation without stretching its fiscal deficit target of 4.4% of GDP for FY26. Looking at the current financial performance it seems a tall task.

* India's industrial output grows 4.0% in Aug’25:

India's industrial production, as measured by the Index of Industrial Production (IIP), increased by 4.0% YoY in Aug’25, marking an improvement from the 3.5% growth recorded in July. The mining sector led the growth with a 6.0% rise, while manufacturing and electricity generation grew by 3.8% and 4.1%, respectively. Despite this positive trend, the cumulative IIP growth for the April– August period stands at 2.8%, down from 4.3% in the same period last year. This indicates a moderation in industrial activity, with the mining sector showing resilience amidst overall economic challenges.

* RBI bank lending survey shows rising optimism on loan demand:

In the 33rd round of the Reserve Bank of India’s Bank Lending Survey (BLS), 38.9% of bankers’ net responses were positive, up from 37.5% in the previous quarter. Expectations for loan demand are strengthening, with net positive responses projected at 42.6% for Dec’25, 44.6% for Mar’26, and remaining steady at 44.6% for Jun’26. However, sentiment on loan terms and conditions remains subdued, with only 9.3% of net responses indicating improvement for Sep’25. Looking ahead, 18.5% of bankers anticipate easier loan terms in Dec’25, rising to 20.4% in Mar’26 and 24.1% in Jun’26. Overall, the survey points to growing confidence in credit demand, while credit conditions are expected to ease gradually over the next three quarters.

* Urban and rural consumer confidence edges up in Sep’25:

Urban consumer confidence showed a modest improvement in Sep’25, with the RBI’s Urban Consumer Confidence Survey reporting a rise in the current situation index (CSI) to 96.9 and the future expectations index (FEI) to 125. The survey covered 6,068 respondents across 19 major cities. In rural areas, confidence also strengthened, with the CSI increasing to 100.9 and the FEI reaching 127.9, based on responses from 8,848 participants. Rural optimism rose broadly, except for perceptions of current price levels. Overall, both urban and rural consumers displayed cautiously positive sentiment on both present and near-term economic outlook.

* RBI OBICUS survey shows mixed trends in manufacturing sector:

The latest RBI OBICUS survey reported a seasonal dip in manufacturing capacity utilisation to 74.1% in Apr–Jun’25, down from 77.7% in the previous quarter. On a seasonally adjusted basis, capacity utilisation improved slightly by 30 bps to 75.8%. New orders moderated, growing 7.3% YoY compared to 7.4% in Mar’25. Meanwhile, the average backlog of orders rose 9.0% and pending orders grew 7.2% YoY. Overall, the survey indicates stable capacity use alongside steady, albeit moderate, demand conditions in the manufacturing sector.

* Government collects INR 1.9trln GST in Sep’25: The Central government reported Goods and Services Tax (GST) collections of INR 1.9trln for Sep’25, reflecting steady growth in economic activity. Monthly collections remain above the INR 1.8trln mark for the fourth consecutive month. The increase was driven by strong performance in the services and manufacturing sectors, along with improved compliance. September’s revenue also contributes to higher fiscal resources for government spending and infrastructure projects. Markets view the collections as a positive indicator of domestic demand and robust tax compliance.

* Price of 19-kg commercial LPG cylinder hiked by INR 15.50: The price of a 19-kg commercial LPG cylinder has been increased by INR 15.50, effective immediately. The hike comes amid rising global energy costs and higher input expenses for distributors. This increase will impact restaurants, small businesses, and other commercial users, slightly raising their operating costs. This could contribute to higher inflation in the services and food sectors. Overall, it may put moderate upward pressure on consumer prices in the coming months as LPG has a weightage of 0.65% in the WPI basket.

* New project announcements dip to INR 5.2trln in Sep’25 quarter:

New project announcements in India fell to INR 5.2trln in the Sep’25 quarter, down 18% from INR 6.35trln in the Jun’25 quarter. Infrastructure projects led the decline, with announcements dropping 20% to INR 2.1trln, while manufacturing and energy projects fell 15% and 12%, respectively. The slowdown reflects cautious investor sentiment amid global economic uncertainties and rising input costs. Analysts warn the dip could delay capacity expansions and capital expenditure in the near term. Despite the moderation, long-term investment prospects remain supported by government incentives and policy reforms.

* SEBI survey finds low household participation in securities market:

A nationwide SEBI survey revealed that only 9.5% of Indian households, or about 32.1mn, invest in securities, despite 63% being aware of at least one market product. In contrast, approximately 62% of American households owned stocks in 2025 while in China this number is lower at 11%. Urban participation in India is higher at 15%, compared to 6% in rural areas, with Delhi (20.7%) and Gujarat (15.4%) leading. The survey found that nearly 80% of households prioritise capital preservation over higher returns, and 79% of Gen-Z households remain risk-averse, though they prefer short video-based learning. Key barriers identified include product complexity, limited financial knowledge, and trust issues. The survey collected responses from over 90,000 households across the country.

* India’s manufacturing growth moderates in Sep’25:

India’s manufacturing sector saw a slowdown in Sep’25, with the Manufacturing PMI falling to 57.7 from 59.3 in Aug’25, the weakest since May, though still indicating expansion above the 50-point mark. Output, new orders, and input purchases continued to rise but at a slower pace, while job creation dipped to a 1-year low. Export demand showed improvement, driven by stronger orders from Asia, Europe, the Americas, and the Middle East. Firms raised output prices sharply due to higher costs for raw materials, labour, and transport, supported by sustained demand. Despite cost pressure, business confidence surged to a 7-month high, bolstered by recent GST cuts and stable market conditions.

* Maharashtra approves Global Capacity Centre 2025 Policy to attract investments:

The Maharashtra government has approved the Global Capacity Centre (GCC) 2025 Policy to attract investments worth over INR 1trln in the next 5 years. The policy aims to create 0.3mn-0.5mn highskill jobs by encouraging multinational corporations to set up operations in IT, financial services, and engineering design. Incentives include infrastructure support, faster clearances, and fiscal benefits to position Maharashtra as a global hub. The state targets capturing at least 15–20% of India’s total GCC market, currently valued at USD 46bn. Officials said the move will help Mumbai and Pune compete with global hubs like Singapore, Dublin, and Poland.

Global Market Movers

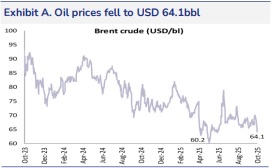

* US government shutdown raises economic concerns:

The US government has officially shutdown as Congress failed to pass the funding bill. A shutdown will furlough around 800,000 federal employees and suspend many non-essential government services. It is anticipated that each week of closure could cost the US economy roughly USD 6bn–8bn in lost output. Sectors like transportation, healthcare, and national parks would see disruptions, and key economic data releases could be delayed. Even a short-term shutdown could weigh on consumer confidence, retail spending, and financial market stability.

* S&P Global pegs US recession risk at 30% or more:

S&P Global has assessed that the probability of a US recession stands at 30% or higher, citing elevated interest rates and slowing consumer demand. The agency noted that persistent inflation pressure and tighter credit conditions continue to weigh on growth prospects. While the labour market remains relatively strong, wage gains are moderating, signaling potential cooling ahead. Analysts also flagged global uncertainties and weak external demand as downside risks. S&P said any policy missteps could further increase the likelihood of a downturn.

* EU to propose doubling tariff rate on steel imports to 50%:

The European Union is preparing to propose a sharp increase in import tariffs on steel, raising the rate from the current 25% to 50%. The move is aimed at protecting domestic producers from a surge in cheaper imports, particularly from Asian markets. Officials argue that the step is necessary to safeguard jobs and maintain competitiveness in the bloc’s steel industry. However, trade partners are likely to contest the measure at the WTO, citing risks of protectionism. Analysts warn the hike could push up input costs for EU manufacturers dependent on imported steel.

* Supreme Court bails out US Fed by allowing Governor Lisa Cook to keep her job:

The US Supreme Court has ruled in favour of Federal Reserve Governor Lisa Cook, allowing her to continue in office despite legal challenges to her appointment. The case had raised uncertainty over the central bank’s leadership at a time of delicate economic balancing. By upholding her position, the court averted potential disruptions to the Fed’s policy-making process. The decision is seen as a relief for financial markets, which value stability in the central bank’s board. Analysts say it reinforces institutional continuity as the Fed navigates growth and inflation concerns.

* Soybean prices bounce back on hopes of renewed US-China trade talks:

Soybean prices rebounded sharply after US President Donald Trump said he would urge Chinese President Xi Jinping to resume purchases when they meet later this month. The statement revived hopes of easing trade tensions that had hurt American farmers. Futures in Chicago rose over 2% immediately after the remarks, signaling improved market sentiment. China, once the largest buyer of US soybeans, had cut imports during the trade dispute. Traders expect talks could pave the way for stronger agricultural exports if commitments materialise.

* Japan’s 10-year bonds slip amid auction woes and election concerns:

Japan’s 10-year government bonds edged lower following the second poorly received auction of the week, highlighting market jitters over the ruling party’s upcoming leadership election. The benchmark yield rose 0.5 basis points to 1.65%, while bond futures reversed earlier gains. Investors are increasingly wary of potential Bank of Japan rate hikes, adding pressure to the bond market. Weak auction demand reflects uncertainty about fiscal and monetary policies under new leadership. Analysts say the trend signals heightened volatility in Japanese government securities in the near term.

* China's Manufacturing PMI shows modest improvement in Sep’25:

China's official Manufacturing Purchasing Managers' Index (PMI) rose to 49.8 in Sep’25, up from 49.4 in August, indicating a slight easing of contraction in the manufacturing sector. Despite the improvement, the PMI remains below the neutral 50-point threshold, signaling that the sector is still contracting. The sub-index for production increased to 51.9, the highest in 6 months, suggesting a modest uptick in manufacturing activity. However, the new orders sub-index remained below 50, reflecting ongoing weak domestic demand. The data highlights the challenges faced by China's manufacturing sector amid global trade tensions and domestic economic pressures.

Please refer disclaimer at https://www.jmfl.com/disclaimer

SEBI Registration Number is INM000010361