Index fell 5th week on tariffs, Fed, FII sell-off, rupee, earnings - ICICI Direct

Nifty : 24565

Technical Outlook

Day that was…

* Index extended loses over fifth consecutive week tracking tariff development, U.S. Fed Policy, FII's sell-off, depreciating rupee and muted earning season. Consequently, Nifty performed in tandem with global peers and settled the volatile week at 24565, down 1%. Sectorally, Realty, Metal extended losses while FMCG relatively outperformed the benchmark. Nifty midcap and small cap indices continued to inch downward over second consecutive week, down in the range of 2-3%.

Technical Outlook:

* The weekly price action formed a bear candle carrying lower highlow, indicating selling pressure at higher levels

* Going ahead, any development related to tariff negotiation’s outcome would dictate the further course of action. In the process, strong support is placed at 24200 being 200 days EMA coincided with 38.2% retracement of entire up move seen off April lows. Any positive outcome on the tariff negotiation front would help Nifty to recover past couple of weeks lost ground to head towards psychological mark of 25000 in coming weeks. Traders should note that, since Covid lows, index has not closed on a negative note for more than 5 consecutive weeks and subsequently witnessed a technical pullback. In current scenario, past five weeks corrective move (-4%) has hauled weekly stochastic oscillator in oversold conditions (placed at 11), indicating impeding pullback. Hence, traders should refrain from creating aggressive short position at current juncture. However, to pause the downward momentum, a decisive close above previous session is a pre-requisite.

* On the broader market front, the midcap index is currently trading below its two months low, indicating pause in upward momentum. Hence, it’s important to keep stock centric approach while focusing on stocks backed by strong earnings

* On the structural front, we are in a secular bull market, wherein intermediate corrections due to Global as well as domestic uncertainties have offered incremental buying opportunity from medium term perspective. Hence, we advise investors not to panic in current tariff led volatility, instead capitalize current corrective phase to build quality portfolio backed by strong earnings in a staggered manner

* Key monitorable to watch out for in current volatile scenario:

a) Development of Bilateral trade deal negotiations.

b) RBI Policy.

c) U.S. Dollar index has pulled back and likely to retest past 2 years breakdown area of 100.50. Failure to sustain above it would result into resumption of down trend.

d) India VIX: after 11 weeks India VIX is likely to close above previous week high. Further, bounce back from cyclical low of 10 suggest rise in volatility going ahead

Nifty Bank : 55617

Technical Outlook

Day that was...

* The Bank Nifty ended the week on a negative note, closing at 55,617 with a weekly loss of 1.61%, while the Nifty Private Bank Index underperformed the benchmark, declining 2.48% to settle at 26,820.

Technical Outlook:

* The weekly price action formed a bear candle carrying lower highlow, indicating selling pressure at higher levels

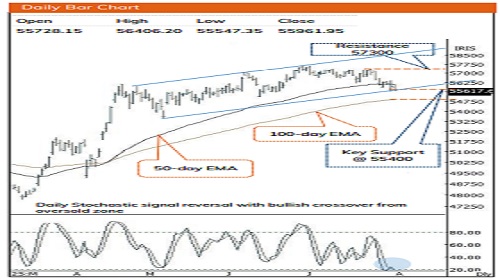

* Key point to highlight is that, Bank Nifty has shown resilience near the lower boundary of its ascending channel, successfully holding support at 55,400, which also aligns with its 100-day EMA since late April 2025, sustaining a higher-high, higher-low structure despite intermittent geopolitical headwinds. Heading into next week, markets will closely monitor the RBI’s upcoming interest rate policy announcement, along with developments in the ongoing India-US trade tariff negotiations. Going ahead we believe as long as the index holds above 55,400, a pullback toward 56,800-57,300 cannot be ruled out. A decisive breakout above this level, would open next leg of up move. Additionally, the daily stochastic oscillator has slipped below 10, entering oversold territory and hinting at a potential reversal.

* Since April, intermediate corrections have remained shallow while the index has consistently held above its 100-day EMA. Moreover, over the past eleven weeks, the index has retraced 50% of the preceding 8.50% up move seen in the prior five weeks. The slower pace of retracement highlights a robust price structure, which augurs well for the next leg of the uptrend. However, any extended correction from current levels could find immediate support near the 54750 zone which is 50% retracement level of its preceding rally and confluence with 100-day EMA base support.

* The PSU Bank Index underperformed the broader market, forming a bearish candle with an upper wick and closed negative. Index continues to trade above the 200-day EMA along with 50% retracement of the preceding rally (from 6065 to 7305), both placed near 6685 offering a meaningful downside cushion, a key support that had held since May. While the Bank Nifty consolidates within 3.5% of its all-time high, PSU Banks continue to lag, trading 16% below their peak, thereby presenting a possible catch-up opportunity. Despite the ongoing weakness, the index maintains a higher-high, higher-low structure as per Dow Theory since its breakout on May 19, with immediate support seen around 6,700, which aligns with the 20- week EMA.

Please refer disclaimer at https://secure.icicidirect.com/Content/StaticData/Disclaimer.html

SEBI Registration number INZ000183631